Car title loans provide businesses with a flexible financing solution using vehicle ownership as collateral. Offering swift access to capital with minimal paperwork and relaxed credit standards, these loans cater to short-term funding needs. Lenders accommodate variable revenue streams through customizable repayment plans, avoiding long-term commitments. This alternative approach empowers entrepreneurs to seize opportunities while maintaining control over their assets.

Car title loans have emerged as a flexible financing option for businesses seeking quick cash without long-term commitments. This alternative lending approach allows entrepreneurs to leverage their vehicle’s equity, providing access to capital for immediate needs or growth opportunities. In this article, we’ll explore the ins and outs of car title loan business use, highlighting its benefits, repayment strategies, and considerations for strategic long-term planning.

- Understanding Car Title Loans for Businesses

- Benefits: Flexible Financing Without Commitments

- Strategies for Repayment and Long-Term Planning

Understanding Car Title Loans for Businesses

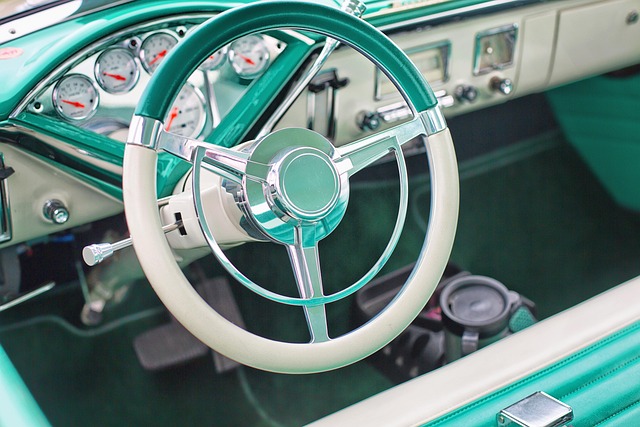

Car title loans are a flexible financing option designed specifically for businesses that need quick access to capital without the constraints of a traditional long-term loan. This alternative funding method allows business owners to use their vehicles, such as trucks, vans, or fleet cars, as collateral to secure a loan. By pledging their vehicles, businesses can gain immediate access to funds, providing them with the flexibility to navigate unexpected expenses, seize market opportunities, or bridge short-term financial gaps.

The title loan process is straightforward and efficient. Businesses complete an application, providing details about their vehicle and financial situation. Once approved, they receive the loan amount, keeping their vehicle as collateral. Loan terms vary depending on the lender and the value of the vehicle but often offer shorter durations compared to traditional business loans. This ensures businesses can repay the loan promptly while maintaining ownership and continued use of their assets, including keeping your vehicle operational for daily business needs.

Benefits: Flexible Financing Without Commitments

Car title loan businesses offer a unique advantage for individuals seeking flexible financing options without long-term commitments. This alternative lending approach provides quick funding, enabling business owners to access capital swiftly to meet immediate financial needs. Unlike traditional loans that often require extensive documentation and strict credit criteria, car title loans focus on the value of your vehicle, making it accessible to a broader range of borrowers.

The benefits extend beyond easy access; this type of loan approval process is typically faster, allowing for rapid decision-making. It provides financial assistance tailored to your requirements, offering peace of mind and the freedom to manage cash flow effectively. With no long-term obligations, business owners can focus on growth opportunities without the burden of fixed repayments, making it an attractive solution for those seeking short-term relief or quick funding.

Strategies for Repayment and Long-Term Planning

One of the key benefits of using a car title loan for business purposes is the flexibility it offers in terms of repayment strategies. Unlike traditional loans, which often require fixed monthly payments over a set period, car title loans allow borrowers to tailor their repayments based on their cash flow. This can be particularly advantageous for businesses with fluctuating revenue streams or those experiencing temporary financial setbacks. Lenders typically offer multiple options, including weekly or bi-weekly payments, allowing entrepreneurs to manage their finances more effectively and avoid the strain of long-term commitments.

Long-term planning is still feasible with car title loans as lenders often provide clear guidelines for repayment and loan duration. Borrowers can choose a repayment period that aligns with their business goals, whether it’s paying off the loan quickly or spreading out payments over an extended period. Additionally, understanding the interest rates and potential penalties associated with early or late repayments is crucial for effective financial management. With these flexible strategies in place, business owners can access much-needed cash advances while maintaining control over their vehicle ownership and financial future.

Car title loans offer a flexible financing solution for businesses seeking short-term cash without long-term commitments. By leveraging their vehicle’s equity, entrepreneurs can access immediate funds, enabling them to seize opportunities and navigate unexpected expenses. While repayment strategies require careful planning, the benefits of car title loan business use can be a game-changer for those in need of swift financial support. Remember, understanding these loans and implementing effective repayment plans are key to making this alternative financing method work successfully for your business.