Greenville car title loans TX offer flexible terms, quick approvals, and personalized repayment plans using vehicle equity as collateral. They provide swift funding for emergencies while maintaining long-term financial stability with transparent interest rate comparisons and a clear title transfer process.

Greenville car title loans TX offer a unique solution for borrowers seeking quick financial support. Understanding the flexibility of these loans is key. This article delves into the various terms and benefits, highlighting how they cater to Texas residents’ needs. By exploring different options, you can navigate the process effectively. Whether it’s a short-term fix or long-term planning, flexible terms ensure affordability and accessibility, making Greenville car title loans a viable choice for managing unexpected expenses or funding aspirations.

- Understanding Greenville Car Title Loans TX Flexibility

- How Do Flexible Terms Benefit Borrowers in TX?

- Navigating Options for Car Title Loans in Greenville, TX

Understanding Greenville Car Title Loans TX Flexibility

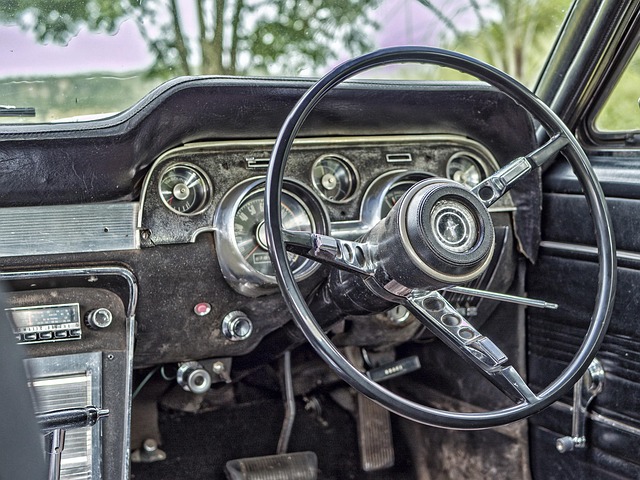

Greenville car title loans TX offer a unique advantage to borrowers by providing flexible terms. This means that individuals can tailor their loan repayment schedule to suit their financial capabilities, making it an attractive option for those seeking quick cash. The flexibility lies in the fact that lenders allow you to use your vehicle’s equity as collateral, ensuring a faster loan approval process with minimal paperwork.

One of the key benefits is the quick approval mechanism. Lenders conduct a simple vehicle inspection to assess the car’s value and determine the loan amount, often leading to same-day approvals. This rapid turnaround time can be a game-changer when you need money urgently. Moreover, flexible repayment plans mean that borrowers can choose monthly installments that align with their income cycles, making it easier to manage debt without the usual stress.

How Do Flexible Terms Benefit Borrowers in TX?

Flexible terms for Greenville car title loans TX offer a much-needed safety net for borrowers facing financial emergencies. In times of sudden expenses or unexpected life events, these loans provide quick funding, allowing individuals to access emergency capital swiftly. This rapid approval process ensures that borrowers don’t have to wait for days or even weeks to receive the support they require.

Moreover, flexibility in terms enables lenders to tailor repayment plans according to individual needs and income levels. Borrowers can choose from various repayment options, making it easier to manage their finances without adding undue stress. This benefit is particularly valuable for those seeking quick approval and a hassle-free borrowing experience, ensuring that they receive the necessary funds without compromising their financial stability in the long term.

Navigating Options for Car Title Loans in Greenville, TX

Navigating the world of Greenville car title loans TX can seem like a daunting task. With various lenders offering different terms and conditions, it’s crucial to understand your options before making a decision. These short-term loans are designed for individuals who need quick access to cash using their vehicle as collateral. One of the key factors to consider is the interest rates, which can vary significantly between lenders. It’s important to compare rates from reputable institutions like those offering Houston title loans, ensuring you get a fair deal.

Additionally, understanding the title transfer process is essential. This involves signing over the ownership rights of your vehicle to the lender for a specified period until the loan is repaid. Repayment terms are flexible and can be tailored to fit individual needs, allowing borrowers to pay back the loan at their own pace. By carefully evaluating interest rates and repayment conditions, residents of Greenville, TX, can access much-needed funds while maintaining control over their assets.

Greenville car title loans TX offer a unique flexibility that benefits borrowers across Texas. By understanding the various terms available and how they work, individuals can make informed decisions about their financial needs. With careful consideration of their options, borrowers can find personalized solutions tailored to their circumstances, ensuring a smoother borrowing experience. Navigating these choices allows folks in Greenville to access much-needed funds efficiently, providing them with a reliable resource for unexpected expenses or personal growth opportunities.