Texas motorcycle title loans offer quick cash access (often within days) secured by a borrower's vehicle title, with flexible repayment terms and minimal hassle. Riders can use these loans for unexpected expenses without selling their motorcycles, but protecting oneself involves verifying lender legitimacy, understanding interest rates, fees, and creating a solid repayment strategy through open communication.

In the vibrant landscape of Texas, exploring safe and legal avenues for financial support is essential, especially for those leaning on two wheels. This article delves into the world of Texas motorcycle title loans, offering a comprehensive guide for borrowers. We’ll explore how these loans function, the eligibility criteria, and critical legal aspects to ensure informed decision-making. By understanding your rights and options, you can navigate this alternative financing path securely.

- Understanding Texas Motorcycle Title Loans

- Eligibility and Requirements for Borrowers

- Protecting Yourself: Legal Considerations and Repayment Strategies

Understanding Texas Motorcycle Title Loans

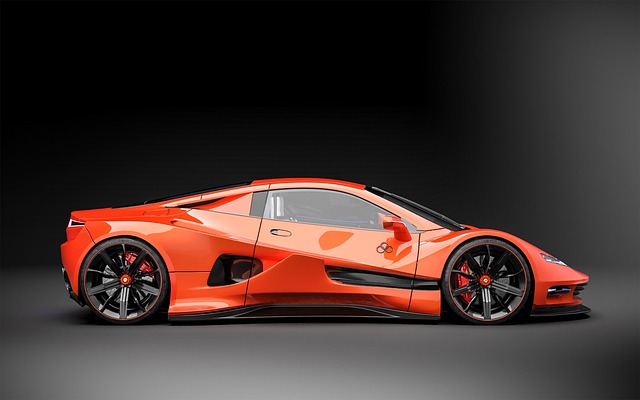

Texas motorcycle title loans are a type of secured lending where individuals can borrow money using their motorcycle’s title as collateral. This unique financial option is designed for motorcyclists who need quick access to cash, offering a convenient and potentially faster alternative to traditional bank loans. With these loans, lenders provide funds based on the value of the borrower’s vehicle, allowing them to retain possession of their motorcycle during the loan period.

The process involves an online application where borrowers submit basic information and details about their motorcycle. After approval, they can receive quick funding directly into their accounts, often within a short turnaround time. One significant advantage is the flexibility in payment plans; borrowers can choose terms that suit their financial comfort level, making it an attractive option for those seeking immediate financial support without the hassle of lengthy application processes.

Eligibility and Requirements for Borrowers

In Texas, motorcycle title loans are a popular option for riders seeking quick financial assistance. To be eligible for such loans, borrowers must possess a valid driver’s license and hold clear ownership rights to their motorcycle. Lenders will evaluate the vehicle’s condition and value, ensuring it meets certain criteria to secure the loan. This process involves a comprehensive inspection and appraisal of the motorcycle, determining its current market worth.

Borrowers should be prepared with documentation, including proof of identity, residency, and income. Lenders may also require a clear title history and may offer flexible payment plans tailored to individual needs. These loans are ideal for those facing unexpected expenses or requiring emergency funds, allowing them to access assets quickly without selling the motorcycle outright.

Protecting Yourself: Legal Considerations and Repayment Strategies

When considering a Texas motorcycle title loan, protecting yourself involves understanding legal considerations and developing a repayment strategy. Firstly, ensure that you are dealing with a reputable lender who adheres to state regulations governing such loans. The Texas Office of Consumer Credit Commissioner oversees these practices, so check their website for licensed lenders. Additionally, review the loan agreement thoroughly before signing; understand the interest rates, fees, and repayment terms to avoid any surprises.

Repayment strategies are crucial for maintaining your financial stability. Consider negotiating flexible payment plans that align with your budget. Many lenders offer these to keep borrowers on track. If facing difficulties, communicate openly with your lender; they might provide extensions or adjustments to help you stay current on payments and keep your vehicle. Remember, timely repayment not only saves you from penalties but also reflects positively on your credit score.

Texas motorcycle title loans can provide a quick financial solution for riders in need, but understanding the process and legal protections is crucial. By ensuring you meet eligibility criteria and are aware of repayment options, you can make an informed decision. Always prioritize your safety by dealing with reputable lenders and familiarizing yourself with state regulations to avoid any legal pitfalls when taking out a loan on your motorcycle.