Urban and rural areas exhibit contrasting title loan urban vs rural usage patterns. Urban dwellers use title loans for quick financial solutions due to high costs and fast lifestyles, while rural residents rely on them as stable, alternative financing options with fewer traditional banking services available. Title loan urban vs rural usage highlights diverse needs and challenges in accessing short-term and emergency funds across different regions.

Title loans, a form of secured lending, have seen varying adoption rates across urban and rural contexts. This article delves into the unique dynamics shaping title loan usage in these environments. While urban areas present distinct financial needs met by traditional lenders, rural communities often rely on alternative solutions due to limited access to mainstream banking services. We explore these contrasts, offering insights into the evolving landscape of title loan urban vs. rural usage and its implications for financial inclusivity.

- Exploring Title Loans: Urban vs Rural Dynamics

- Financial Needs in Urban Areas: Title Loan Perspective

- Rural Communities and Alternative Lending Solutions

Exploring Title Loans: Urban vs Rural Dynamics

In urban settings, title loan usage exhibits distinct dynamics compared to rural areas. Cities, with their bustling metropolises and diverse economies, often attract individuals seeking quick financial solutions. Urban dwellers might turn to title loans for unforeseen expenses, such as medical emergencies or unexpected repairs, leveraging their asset—a vehicle—for immediate funding. The ease of access to multiple lenders and a higher concentration of financial institutions contribute to the prevalence of these short-term loans in urban contexts.

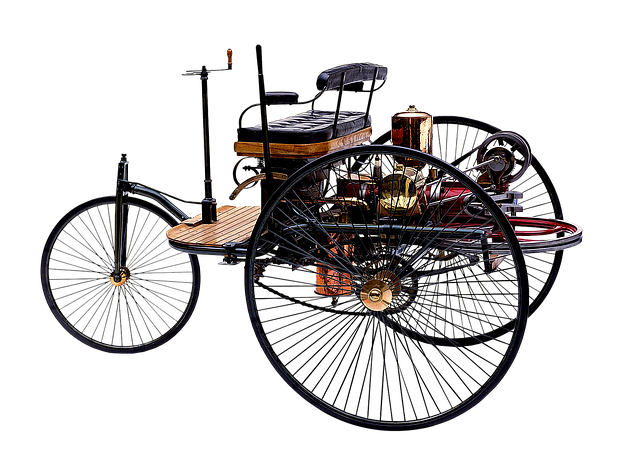

Conversely, rural communities present a different picture. Here, limited economic opportunities and longer distances between service providers can strain personal finances. Rural residents might opt for title pawns as a means to bridge financial gaps, especially when traditional loan options are scarce. With lower population densities, rural areas often have fewer lending outlets, leading to a reliance on alternative financing methods like title loans or pawnshops, which cater to unique local economic conditions and challenges related to loan eligibility and interest rates.

Financial Needs in Urban Areas: Title Loan Perspective

In urban areas, financial needs often present unique challenges due to the high cost of living and fast-paced lifestyle. Residents face various expenses such as housing, transportation, childcare, and education, which can quickly add up. Traditional banking options might not always cater to these immediate needs effectively, leaving many urban dwellers seeking alternative financial assistance. Here, title loans emerge as a viable solution for quick financial transfer, allowing individuals to access funds using their vehicle titles as collateral. This is particularly useful in situations requiring prompt cash flow, such as covering unexpected expenses or bridging income gaps between paychecks.

The convenience and accessibility of title loan processes are especially appealing in urban contexts where time is of the essence. With a streamlined title transfer process, individuals can secure loans within a short timeframe, ensuring they have the financial resources needed to navigate their immediate challenges. This dynamic underscores the growing preference for title loan urban vs. rural usage, as city dwellers recognize the speed and flexibility it offers, potentially transforming their access to financial assistance.

Rural Communities and Alternative Lending Solutions

In rural communities, where access to traditional banking services and credit options might be limited, alternative lending solutions have emerged as a crucial financial resource. One such option gaining traction is the use of motorcycle title loans. This unique form of lending allows individuals with a clear motorcycle title to secure a loan by pledging their vehicle’s value. It offers an accessible way for rural residents to gain quick funding without the stringent requirements often associated with mainstream banking, such as a detailed credit history or extensive documentation.

Unlike urban areas where various financial institutions compete for customers, rural markets may have fewer options, leading many to rely on non-traditional lenders. The appeal of title loan urban vs rural usage differs significantly here. In urban settings, these loans might be used for short-term cash needs, while in rural communities, they can provide a stable financial solution during financial emergencies or for investment opportunities that require immediate capital. This alternative lending sector plays a vital role in ensuring that rural populations have access to much-needed funds and can bridge the gap until more conventional borrowing options become available.

In understanding title loan usage, we’ve observed distinct patterns between urban and rural contexts. Urban areas present unique financial challenges driven by higher living costs and a prevalence of short-term lending options, making title loans a viable solution for immediate cash needs. In contrast, rural communities often rely on alternative lending solutions due to limited access to traditional banking services and a different economic landscape. This exploration highlights the nuanced approach required in addressing varied financial needs across diverse geographical settings. By considering these dynamics, lenders can tailor their services more effectively to serve both urban and rural populations.