Car title loans Port Arthur TX offer a quick cash solution for individuals with poor credit, secured by their vehicle's title. These loans have lower interest rates and flexible terms but carry the risk of repossession if payments are missed. Maintaining open communication with lenders, keeping vehicles well-maintained, and making consistent, disciplined repayments help avoid repossession. After repaying, focus on financial stability through budgeting, saving, investing, and improving credit scores to secure better loan terms in the future.

Looking to repay your car title loan in Port Arthur, TX? It’s crucial to understand your options and make informed decisions. This guide will walk you through the process, offering strategies for wise repayment and financial stability after settling your car title loan in Port Arthur, TX. From understanding the terms to building a solid financial foundation, these insights ensure you’re prepared for this significant step.

- Understanding Car Title Loans Port Arthur TX

- Strategies for Repaying Your Loan Wisely

- Building Financial Stability After Repayment

Understanding Car Title Loans Port Arthur TX

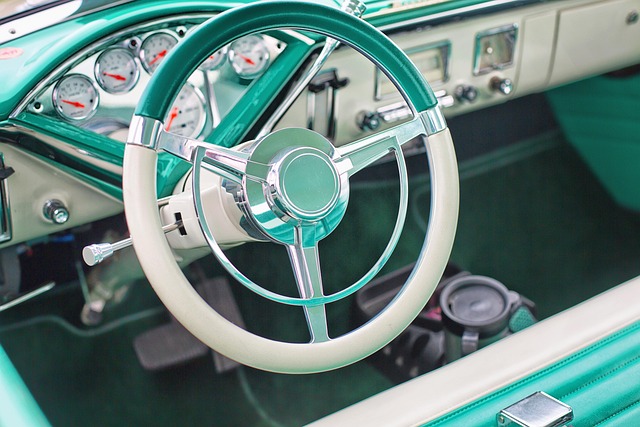

Car title loans Port Arthur TX are a form of secured lending where your vehicle’s title acts as collateral for the loan. This type of loan is designed for individuals who need quick access to cash and may not have the best credit history. The process involves using your car’s registration and title as security, allowing you to borrow money against the value of your vehicle. Once approved, you’ll receive a lump sum, and you’ll be required to make regular payments until the loan is fully repaid.

Understanding how Car title loans Port Arthur TX work is crucial for making informed decisions about your financial solution. The advantage lies in its accessibility; even those with poor credit or no credit history can apply. Additionally, compared to traditional loans, these loans often offer lower interest rates and more flexible repayment terms. However, it’s essential to be mindful of the potential risks, such as repossession if you default on payments, and ensure you fully comprehend the terms and conditions before pledging your vehicle collateral.

Strategies for Repaying Your Loan Wisely

Repaying your Car Title Loan Port Arthur TX shouldn’t have to be a stressful process. One of the best strategies is to maintain regular communication with your lender. Transparency about your financial situation can lead to flexible repayment plans, and some lenders may even offer extended terms or lower interest rates if you demonstrate responsible management of your loan. Additionally, keeping your vehicle in good condition can help. Regular maintenance not only extends the life of your car but also ensures its value remains high, allowing you to keep more money in your pocket when it’s time to repay.

Another wise approach is to consider how Car Title Loans Port Arthur TX differ from traditional loans. Unlike other loan types that might require a credit check or lengthy application processes, these loans offer same-day funding and often require only the title of your vehicle as collateral. However, this convenience comes with an understanding that you must be disciplined in managing your repayments to avoid defaulting on the loan, which could result in repossession of your vehicle. Always stay on top of your repayment schedule and consider the implications of late or missed payments.

Building Financial Stability After Repayment

After successfully repaying your car title loan in Port Arthur TX, building financial stability is a crucial step to ensure long-term success. It involves creating and adhering to a budget to manage your expenses effectively. Start by tracking your income and expenses to understand your cash flow. Allocate money for necessities like rent or mortgage, utilities, food, and transportation. Then, set aside funds for savings and investments. This discipline will help you avoid taking on new debts and build a buffer for unexpected costs.

Additionally, improving your credit score should be a priority. Lenders consider your credit history when assessing loan eligibility and interest rates. Consistently making on-time payments demonstrates responsible borrowing habits. Regularly review your credit report for errors or discrepancies and dispute them promptly. Over time, these positive actions will enhance your credit profile, making it easier to access future loans at better terms.

Repaying a car title loan in Port Arthur, TX, can be a strategic step towards financial stability. By understanding these loans and employing wise repayment strategies, you can navigate this process effectively. Once repaid, focus on building your financial foundation to avoid future debt traps. Remember, responsible borrowing and timely repayment are key to maintaining control over your finances in the long term.