Car title loans Richmond TX offer quick cash with vehicle value as collateral, but strict terms and risks include repossession and credit damage if defaulted on. Lenders may provide flexible options like term restructuring or refinancing to help borrowers avoid severe consequences, depending on individual lender policies and financial hardship proof.

“Car title loans in Richmond, TX, offer a quick financial solution for those needing cash. However, defaulting on these loans can have significant consequences. This article explores the intricacies of car title loans Richmond TX and what happens when you fail to meet repayment terms. We delve into the legal repercussions, potential repossession risks, and available options for repaying delinquent loans, providing a comprehensive guide for borrowers facing financial challenges.”

- Understanding Car Title Loans in Richmond TX

- Consequences of Defaulting on Loan Agreements

- Repaying Delinquent Car Title Loans: Options Explained

Understanding Car Title Loans in Richmond TX

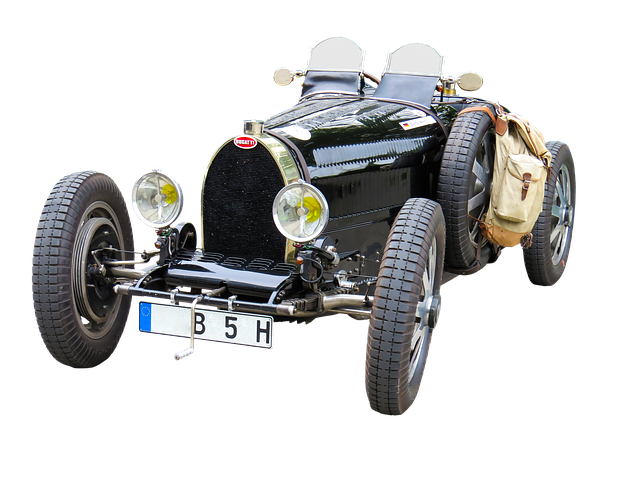

Car title loans Richmond TX have gained popularity as a quick solution for individuals seeking financial relief. These loans are secured by the value of your vehicle, allowing lenders to offer competitive interest rates and flexible repayment terms. In this arrangement, you hand over the car title temporarily until the loan is repaid. The process is designed to be straightforward, with many lenders promoting online applications for added convenience.

To establish loan eligibility, prospective borrowers must meet certain criteria. Lenders typically consider factors such as income, employment status, and vehicle condition. Understanding these requirements beforehand can help you determine if a car title loan in Richmond TX is the right choice. This alternative financing option offers a potential solution for those in need of immediate funds, but it’s essential to weigh the benefits and risks before committing to any loan agreement.

Consequences of Defaulting on Loan Agreements

When you take out a car title loan in Richmond, TX, it’s important to understand that failing to meet the agreed-upon terms can have significant consequences. If you default on your loan agreement, the lender has the legal right to repossess your vehicle, which serves as collateral for the loan. This process is often swift and can lead to financial strain and stress for borrowers.

In addition to repossession, defaulting on a car title loan may result in various fees and penalties, further increasing the overall cost of borrowing. Lenders may charge late fees, collection costs, and interest rates can skyrocket, making it challenging to regain financial stability. For those with semi truck loans or looking for quick funding, defaulting is not a viable option, as it can lead to the loss of valuable assets and a negative impact on their credit score, hindering future borrowing opportunities.

Repaying Delinquent Car Title Loans: Options Explained

If you find yourself unable to make payments on your car title loan in Richmond TX, don’t panic. There are several options available for repaying delinquent car title loans, allowing you to regain control and avoid repossession. The first step is to contact your lender directly and explain your situation. Many lenders are willing to work with borrowers who are facing financial difficulties, offering various repayment plans or extensions to help them catch up.

One common option is to restructure the loan terms, which may involve paying a higher monthly amount for a shorter period. Alternatively, some lenders provide the opportunity to refinance the loan, allowing you to borrow additional funds to settle the delinquency and potentially lower your interest rate. It’s important to remember that these options are subject to lender policies and may require proper documentation or proof of financial hardship. A credit check might be conducted to assess your current financial standing, but having vehicle collateral ensures a higher chance of approval for loan modifications.

When considering car title loans Richmond TX, understanding both the benefits and potential consequences is paramount. If you default on your loan agreement, severe repercussions can ensue, including repossession of your vehicle and negative impacts to your credit score. However, there are options available to help you repay delinquent loans and avoid these pitfalls. Remember, responsible borrowing and clear communication with lenders are key to navigating the world of car title loans Richmond TX successfully.