Waco car title loans provide quick cash but require understanding terms and conditions. Avoid excessive interest rates and aggressive tactics. Collect documents, know regulations, and document interactions when issues arise. File formal complaints with state regulatory bodies to protect borrower rights. Take legal action if overcharged or mistreated by lenders like Title Pawn or Semi Truck Loans. Stay informed about case progress through legal channels.

“Unraveling the complexities of Waco car title loans is crucial for borrowers seeking financial solutions. This article equips you with essential knowledge about your rights and potential red flags in the lending process. We guide you through the intricate steps of filing complaints against Waco title lenders, ensuring your voice is heard. From understanding loan practices to navigating legal avenues, this comprehensive resource empowers you to protect yourself. By following our step-by-step approach, you can take decisive action and assert your rights in the event of disputes involving Waco car title loans.”

- Understanding Waco Car Title Loans: Rights and Red Flags

- Navigating Complaint Procedures: Step-by-Step Guide

- Legal Recourse: Protecting Your Rights After Filing a Complaint

Understanding Waco Car Title Loans: Rights and Red Flags

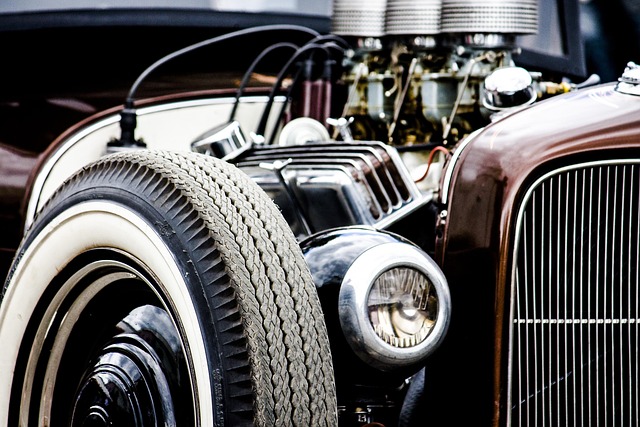

Waco car title loans are a type of short-term financing where borrowers use their vehicle’s title as collateral. This loan option is popular among individuals who need quick cash and may have limited credit options. While it offers a potential solution for urgent financial needs, it’s essential to understand your rights and be aware of red flags associated with these loans.

Before taking out a Waco car title loan, familiarize yourself with the terms and conditions. Ensure you comprehend the interest rates, repayment schedules, and potential penalties for early or late payments. Keep in mind that these loans are secured, meaning if you default, the lender can initiate a title transfer to take possession of your vehicle. Be cautious when dealing with lenders who charge excessive interest rates or require unrealistic terms. Red flags may include loan extensions with additional fees, opaque fee structures, or aggressive collection practices. Always prioritize responsible borrowing and explore alternative options whenever possible.

Navigating Complaint Procedures: Step-by-Step Guide

Navigating Complaint Procedures: Step-by-Step Guide

When considering Waco car title loans or any form of secured lending, such as semi truck loans, it’s crucial to be aware of your rights and the complaint process if you encounter issues. Here’s a straightforward step-by-step guide to help you file complaints effectively. Begin by gathering all necessary documentation related to your loan agreement. This includes copies of contracts, communications with the lender, and any evidence supporting your complaint. Next, research your state’s financial regulations and consumer protection laws. Many states have specific procedures for filing complaints against lenders, ensuring that your concerns are addressed appropriately.

Once you’ve reviewed these guidelines, contact the lender directly to express your issue. Document all conversations, sending written summaries with relevant details. If resolution isn’t achieved, proceed to file a formal complaint with the state regulatory body overseeing vehicle equity and secured loans. This step-by-step approach ensures that your voice is heard while protecting your rights as a borrower.

Legal Recourse: Protecting Your Rights After Filing a Complaint

When you’ve taken the step to file a complaint against a Waco car title lender, understanding your legal recourse is crucial. This process isn’t just about seeking justice; it’s also about protecting your rights and ensuring that such lenders adhere to fair practices. After filing a complaint, keep yourself informed about the progress of your case. Legal channels may take time, but they’re designed to uphold the law and provide remedies if violations are found.

Remember, while Waco car title loans can offer quick cash solutions, they come with specific regulations aimed at protecting borrowers. If you believe you’ve been mistreated or overcharged by a lender offering services like a Title Pawn, Cash Advance, or even Semi Truck Loans, don’t hesitate to pursue legal action. Your complaint could be the catalyst for change, ensuring that these lenders operate transparently and ethically in the future.

Filing a complaint against a Waco car title lender is a crucial step in protecting your rights and ensuring fair lending practices. By understanding the red flags, navigating the complaint procedures outlined in this guide, and knowing your legal recourse, you can stand up for yourself and make sure you aren’t taken advantage of by these types of loans. Remember, knowledge is power when it comes to Waco car title loans.