South Texas car title loans provide quick cash for individuals with limited credit history, using vehicle equity as collateral. Timely repayments improve credit score while defaults can damage it. Lenders assess vehicle value and condition for loan eligibility. Short-term durations and high interest rates require prudent management to avoid debt traps.

South Texas car title loans have gained popularity as a quick source of cash. But how do these loans impact your credit? This article delves into the intricacies of South Texas car title loans, exploring their workings and effects on your credit score. We’ll weigh the potential benefits and risks, providing insights to help you make informed decisions regarding this loan type.

Understanding South Texas Car Title Loans

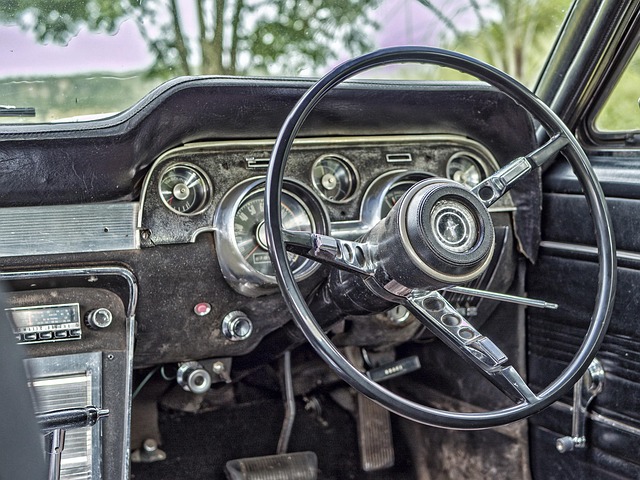

South Texas car title loans are a type of secured lending where borrowers use their vehicles, specifically their car or truck, as collateral. This unique loan option is designed for individuals who need quick access to cash and may not have the best credit history. Unlike traditional loans, these titles allow lenders to retain ownership of the vehicle until the debt is repaid. This means that should you fail to meet the repayment terms, the lender has the right to repossess your vehicle.

One key advantage of South Texas car title loans is that they often come with flexible interest rates and repayment plans tailored to individual needs. Borrowers can potentially keep their vehicle throughout the loan period, providing them with a sense of security and continued use of their asset. This alternative financing method has gained popularity for its accessibility, especially for those seeking immediate financial support without the strict credit requirements typically associated with bank loans.

Impact on Your Credit Score

South Texas car title loans can significantly impact your credit score, both positively and negatively, depending on how you manage them. When you apply for a car title loan, lenders will conduct a thorough vehicle inspection to assess its value and condition. This process is crucial as it determines your loan eligibility and the amount you can borrow based on your vehicle’s worth. A higher vehicle valuation could mean more loan funds at your disposal, but it also increases the risk for the lender if you default.

Your credit score can be influenced by timely loan repayments, which can enhance your creditworthiness. Conversely, late or missed payments can severely damage your credit history and score. Lenders often report these activities to credit bureaus, reflecting on your credit file. Therefore, it’s essential to understand the loan terms, including interest rates and repayment schedules, to ensure you meet your obligations and maintain a positive financial standing.

Potential Benefits and Risks

South Texas car title loans can offer a unique solution for individuals seeking quick access to cash. One potential benefit is their accessibility; compared to traditional loan options, these loans often have fewer stringent requirements, making them suitable for those with bad credit or limited financial history. This alternative financing method allows borrowers to use their vehicle’s equity as collateral, providing a means to obtain funds without the rigorous credit checks associated with secured loans or conventional bank loans.

However, there are risks to consider. These loans are typically short-term and often come with higher interest rates, potentially leading to a cycle of debt if not managed properly. The loan payoff might be less favorable for borrowers in the long run, especially if they cannot repay the loan on time. It’s crucial to understand that while South Texas car title loans can provide a quick financial fix, they may not be suitable for everyone and could have significant implications if not used as intended.

South Texas car title loans can provide a quick financial solution, but understanding their impact on your credit score is crucial. While these loans offer accessibility, they may negatively affect your credit if not managed responsibly. By weighing the potential benefits and risks, borrowers in South Texas can make informed decisions to maintain or improve their credit health. Remember, responsible borrowing is key to navigating these types of financial tools effectively.