San Antonio title loans offer quick cash but are risky with high-interest rates, hidden fees, and aggressive repayment terms. These secured loans use vehicle titles as collateral, but default can lead to repossession. Borrowers should understand loan requirements, compare offers, and consider alternatives like Dallas title loans or professional advice to avoid debt cycles and asset loss. Regulatory measures protect borrowers in San Antonio by setting clear guidelines on loan terms.

In the competitive financial landscape of San Antonio, San Antonio title loans have emerged as a quick solution for borrowers seeking cash. However, navigating this type of loan can be treacherous if not approached with caution. This comprehensive guide delves into the intricacies of San Antonio title loans, highlighting common pitfalls and risks to help borrowers make informed decisions. By understanding regulatory measures and adopting consumer-friendly tips, individuals can safeguard themselves from exploitative practices associated with these loans.

- Understanding San Antonio Title Loans: A Comprehensive Guide

- Common Pitfalls and Risks to Avoid With These Loans

- Safeguarding Borrowers: Regulatory Measures and Consumer Tips

Understanding San Antonio Title Loans: A Comprehensive Guide

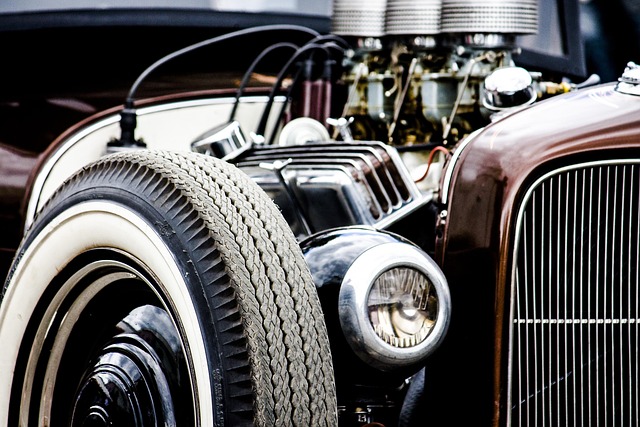

San Antonio title loans have gained popularity as a quick financial solution for borrowers in need. At their core, San Antonio title loans are secured loans where individuals use their vehicle’s title as collateral. This innovative financing option allows lenders to offer same-day funding, making it an attractive choice for those facing unexpected expenses or seeking emergency cash. The process typically involves applying online, providing vehicle information and documentation, and receiving the loan amount within hours.

While San Antonio title loans can be a lifesaver in dire circumstances, understanding the pitfalls is crucial. Unlike traditional loans, these titles come with stringent terms and high-interest rates. Borrowers must be prepared for potential hidden fees and aggressive repayment schedules, often demanding full repayment within 30 days. Additionally, failing to repay on time can result in significant penalties, including vehicle repossession. It’s essential to carefully consider one’s financial situation before delving into San Antonio title loans, exploring alternatives like Dallas title loans if possible, or seeking professional advice to navigate these complex financial arrangements.

Common Pitfalls and Risks to Avoid With These Loans

When considering San Antonio title loans, borrowers must be aware of several common pitfalls and risks to protect themselves from financial harm. One significant issue is the potential for a cycle of debt. These short-term loans often come with high-interest rates, and if not repaid on time, they can lead to additional fees and rollovers, making it challenging to break free from the loan’s grasp. It’s crucial to understand the Loan Requirements and Loan Eligibility criteria to avoid this trap and ensure you have a clear path to repayment.

Another risk is the potential loss of your asset—the title to your vehicle. If you default on the loan, the lender may repossess your car or truck, leaving you without transportation. This is especially concerning for those reliant on their vehicles for daily commuting or work purposes. It’s essential to thoroughly research and understand the terms and conditions of San Antonio title loans to make informed decisions and safeguard your assets.

Safeguarding Borrowers: Regulatory Measures and Consumer Tips

In an effort to safeguard borrowers from the potential pitfalls of San Antonio title loans, regulatory measures have been put in place to ensure fair lending practices. These regulations aim to protect consumers by setting clear guidelines on loan terms, interest rates, and repayment conditions. Lenders are required to conduct thorough vehicle valuations, ensuring that the collateralized value accurately reflects the market price, thus preventing borrowers from overextending themselves.

Consumers considering San Antonio title loans should be aware of their rights and responsibilities. Educating oneself about the process, comparing loan offers from different lenders, and understanding the implications of late payments or default are essential tips for avoiding financial traps. Additionally, exploring options like loan refinancing can provide flexibility and potentially lower interest rates, making it a valuable strategy for managing debt associated with secured loans.

San Antonio title loans can provide a much-needed financial boost, but borrowers must navigate this option carefully. By understanding the common pitfalls and risks associated with these loans, such as high-interest rates and potential vehicle repossession, individuals can make informed decisions. Regulatory measures and consumer education play a crucial role in safeguarding borrowers. Always thoroughly research lenders and consider alternative options before embracing San Antonio title loans, ensuring you receive the best terms for your unique situation.