Car title loans provide quick funding for individuals with bad credit, using their vehicle equity as collateral. The simple application process involves proving ownership, filling out forms, and identifying oneself. Once approved, lenders deposit funds within a day. Refinancing options may help manage repayment. Before applying, ensure you meet basic criteria, gather necessary documents, and choose a reputable lender. Fill out the application, providing vehicle and personal details; the lender will verify and inspect the vehicle. Upon approval, review the agreement and complete the title transfer for instant access to funds, but be aware of high-interest rates and potential risks.

Are you struggling with bad credit and need a loan quickly? Discover how car title loans can provide an alternative financing option. This comprehensive guide breaks down the intricate details of applying for a car title loan, specifically tailored for borrowers with low credit scores. We’ll walk you through each step, from assessing your vehicle’s value to finalizing the agreement. Learn about the potential benefits and considerations, ensuring an informed decision during this challenging financial period.

- Understanding Car Title Loans for Bad Credit Borrowers

- The Step-by-Step Application Process

- Benefits and Considerations for This Option

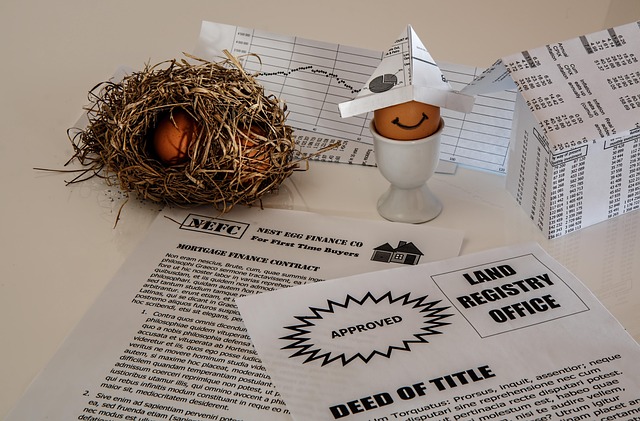

Understanding Car Title Loans for Bad Credit Borrowers

Car title loans are a unique financing option designed for individuals with bad credit who may struggle to secure traditional loan approvals. This alternative lending method allows borrowers to use their vehicle’s equity as collateral, providing access to funds quickly and conveniently. Unlike other loan types, a car title loan does not strictly rely on credit scores or extensive financial history checks, making it more accessible to those with less-than-perfect credit.

The car title loan application process involves several straightforward steps. Borrowers typically need to provide proof of vehicle ownership, fill out an application form, and present valid identification. Once approved, lenders offer quick funding through direct deposit into the borrower’s bank account. This streamlines the borrowing experience, ensuring that funds are readily available for emergency expenses or other financial needs, often within a single business day. Loan refinancing options may also be available to help borrowers manage their repayments over time, depending on their specific circumstances.

The Step-by-Step Application Process

Applying for a car title loan can be a straightforward process, especially for those with bad credit looking for quick funding. Here’s a step-by-step guide to help you navigate the application journey:

1. Assess Eligibility: Before applying, ensure you meet basic requirements such as being at least 18 years old and having a valid driver’s license. Bad credit borrowers are welcome to apply, but lenders will consider factors like vehicle value, income, and ability to repay.

2. Gather Documents: Collect essential documents, including your car’s title (free of any liens), proof of identity (like a government-issued ID or passport), and proof of insurance. The title transfer process is crucial for securing the loan, so ensure it’s readily available.

3. Choose a Lender: Research and select a reputable lender offering bad credit car title loans. Compare interest rates, terms, and fees to find the best option for your situation. Online lenders often provide same-day funding, making them a popular choice for those in urgent need of cash.

4. Complete the Application: Fill out the loan application form provided by your chosen lender. This typically involves detailing vehicle information, income, and employment history. Be transparent about your financial situation to increase your chances of approval.

5. Verification and Inspection: After submission, the lender will verify your details and may require an inspection of your vehicle to assess its value. This step is essential for determining the loan amount you can borrow, often based on the car’s market value.

6. Finalize Agreement and Receive Funds: If approved, review the loan agreement carefully. Once both parties agree, the title transfer process begins, and funds are released, usually through same-day funding.

Benefits and Considerations for This Option

For borrowers with bad credit, the car title loan application process offers a unique opportunity to access immediate financial support. This alternative lending method bypasses traditional credit checks and strict eligibility criteria often associated with bank loans. By leveraging vehicle equity, Houston Title Loans provide a swift solution for emergency expenses or short-term financial needs. The simplicity of the process is appealing; it requires minimal paperwork and can be completed swiftly, ensuring borrowers get the funds they need without lengthy delays.

However, considerations are essential. While car title loans can be beneficial in desperate situations, high-interest rates and potential risks should be understood. Borrowers must be prepared to make timely payments to avoid default and potential loss of their vehicle. It’s crucial to thoroughly review loan requirements and terms before committing, ensuring transparency and a clear path for repayment.

For borrowers with bad credit, a car title loan can offer a viable solution. By understanding the straightforward application process and weighing the benefits against potential considerations, individuals in this situation can access much-needed funds quickly. The car title loan application process is designed to be efficient, allowing those with limited financial history or low credit scores to still secure funding. With careful consideration, this option can prove beneficial for managing short-term financial needs.