Title loans for seniors offer quick cash secured against vehicle titles but carry high interest rates and repayment risks. Seniors should thoroughly evaluate lenders, understand terms, consider alternatives, and manage repayments comfortably to avoid adverse outcomes. Choose reputable lenders with transparent practices, flexible repayment plans tailored to seniors' capabilities, and compare rates for maximum advantages while maintaining financial stability.

“Exploring Title Loans? A Comprehensive Guide for Seniors. Unlocking access to immediate financial support, title loans offer a unique solution for elderly individuals. This article navigates the complex world of title loans, providing insights tailored to seniors. From understanding the fundamentals to evaluating lenders and maximizing benefits, we demystify this option. Learn how to make informed decisions regarding your financial future, ensuring safety and wisdom in borrowing. Discover the potential advantages and pitfalls of title loans specifically designed for seniors.”

- Understanding Title Loans: Basics for Seniors

- Evaluating Lenders: Safety and Terms for Elderly Borrowers

- Maximizing Benefits: How Seniors Can Use Title Loans Wisely

Understanding Title Loans: Basics for Seniors

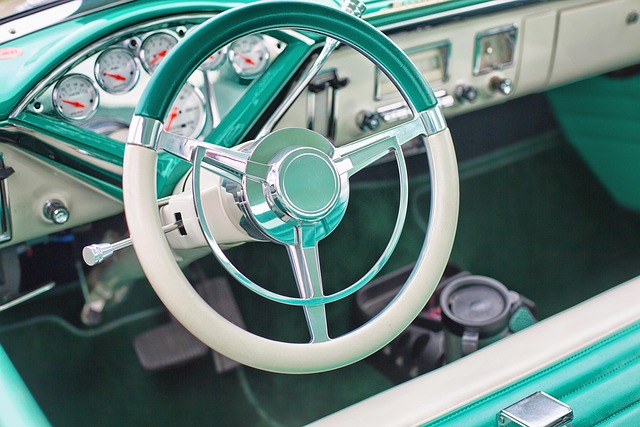

Title loans for seniors can be a quick solution to access fast cash when facing financial challenges. These loans are secured against an individual’s vehicle, allowing them to borrow money while keeping their car. The process involves using the vehicle’s title as collateral and typically requires proof of ownership and identification. Once approved, you’ll receive a direct deposit of the loan amount into your bank account, providing immediate access to funds.

While it might seem like an attractive option for fast cash, it’s crucial for seniors to understand the terms and conditions thoroughly. These loans often come with higher interest rates compared to traditional personal loans, and if you’re unable to repay, there’s a risk of losing your vehicle. It’s essential to consider your financial situation, evaluate alternative options, and ensure you can comfortably make the required payments to avoid potential consequences.

Evaluating Lenders: Safety and Terms for Elderly Borrowers

When considering a title loan as a senior borrower, evaluating lenders is paramount to ensuring safety and favorable terms. It’s crucial to verify the lender’s legitimacy and reputation by checking their licensing and affiliations with relevant regulatory bodies. Reputable lenders adhere to transparent practices, clearly outlining interest rates, repayment terms, and any associated fees.

Moreover, examine the loan terms carefully, focusing on the security requirements and the impact on your vehicle ownership. While quick funding is appealing, prioritize lenders offering flexible repayment plans that align with your financial capabilities. This ensures you maintain control over your vehicle and avoids potential pitfalls of short-term debt cycles. Opting for a lender that provides financial assistance tailored to seniors can be a game-changer, facilitating a smoother borrowing experience.

Maximizing Benefits: How Seniors Can Use Title Loans Wisely

Seniors considering a title loan should look to maximize its benefits while ensuring responsible borrowing. Firstly, appreciate that title loans can provide quick funding for unexpected expenses or urgent needs. This feature is especially valuable for seniors who might face medical emergencies or home repairs. Furthermore, these loans often offer flexible payments, allowing borrowers to manage their finances with more ease. However, it’s crucial to assess one’s ability to repay the loan without causing financial strain.

To make the most of a title loan, seniors should explore options that cater to their specific needs. Given that title loans for seniors can be tailored to suit various circumstances, understanding the terms and conditions is essential. Comparing rates, repayment periods, and fees from different lenders can help in choosing a suitable and affordable option. Additionally, being mindful of one’s credit history when applying for bad credit loans can lead to better interest rates and loan terms.

When considering a title loan, seniors can navigate this option with confidence by understanding their rights and benefits. By evaluating lenders carefully and using these loans strategically, individuals 60 years and older can access much-needed funds while maintaining financial security. Remember, choosing the right title loan provider is key to ensuring a positive experience that meets your unique needs.