Austin car title loans provide a flexible financial option for vehicle owners needing quick cash. Lenders assess vehicle value and repayment ability to determine loan amounts, with interest rates varying by lender. The process involves providing documents like registration and insurance, and a vehicle valuation based on make, model, year, and condition. Flexible payment plans are available, catering to various borrower needs.

In the vibrant city of Austin, Texas, exploring financial options like Austin car title loans can provide a safety net during unforeseen circumstances. This article delves into the world of secured lending, specifically focusing on how residents can leverage their vehicle ownership. We’ll explore the eligibility criteria for Austin car title loans, unraveling the common car models that meet these requirements and guiding you through the application process step-by-step.

- Understanding Austin Car Title Loans Requirements

- Common Car Models Eligible for Title Loans in Austin

- The Process: How to Apply for an Austin Car Title Loan

Understanding Austin Car Title Loans Requirements

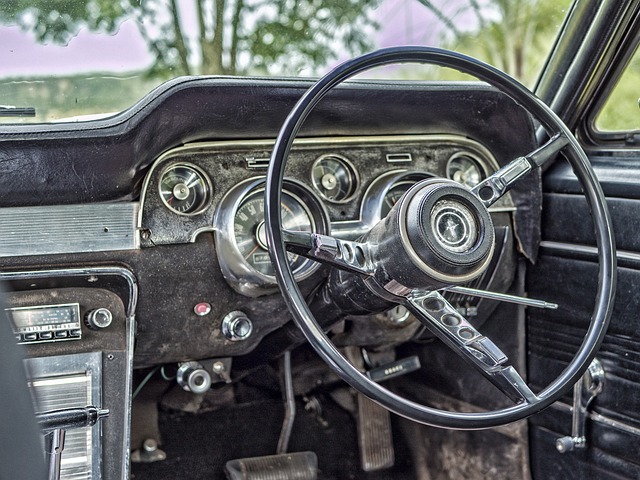

When considering an Austin car title loan, it’s crucial to understand the requirements set by lenders. Unlike traditional loans that rely on your credit score, car title loans assess your vehicle’s value and your ability to make payments. Lenders will evaluate your vehicle’s make, model, year, and overall condition to determine its worth, which directly impacts the loan amount you can secure. Additionally, they’ll require proof of income and identification to ensure responsible borrowing.

The application process is relatively straightforward. You’ll need to provide documentation such as your car’s registration, insurance, and a valid driver’s license. Lenders may also consider your credit history but with a lesser emphasis than other loan types. Interest rates vary among lenders and are typically calculated based on the loan amount and the agreed-upon repayment period. Payment plans can be tailored to fit your needs, offering flexibility in terms of duration and frequency.

Common Car Models Eligible for Title Loans in Austin

In Austin, car title loans are a popular financial solution for vehicle owners looking to access quick cash. When it comes to common car models eligible for these loans, there’s a wide range of options available due to the diverse automotive landscape in and around the city. Modern sedans, such as Honda Civics and Toyota Camrys, often qualify thanks to their reliability and high resale value. SUVs like Ford Escapos and Chevrolet Equinoxes are also popular choices given their increasing demand in the market.

Older models, while not as common, can still be considered for Austin car title loans. Classic cars or those with higher mileage might be eligible if they remain in good working condition. It’s important to note that lenders will assess the overall value and condition of your vehicle when determining eligibility. Additionally, payment plans for these loans are flexible, allowing borrowers to extend their loan terms if needed, which can provide some breathing room for unexpected expenses or delays in repayment.

The Process: How to Apply for an Austin Car Title Loan

Applying for an Austin car title loan is a straightforward process designed to help individuals access funds quickly using their vehicle’s equity. The first step involves gathering essential documents, such as your vehicle registration and proof of insurance, to ensure a smooth transaction. It’s crucial to have these in order before beginning the application.

Once prepared, you’ll need to contact a lender offering Austin car title loans. They will guide you through the process, which typically includes filling out an application form providing details about your vehicle and financial information. The next phase involves a quick vehicle valuation to determine the loan amount based on your car’s equity—this is where having good maintenance records can be beneficial. After approval, funds are usually deposited directly into your bank account, offering a convenient way to access emergency cash or fund unexpected expenses.

When considering an Austin car title loan, understanding the eligibility criteria and common vehicle models accepted is key. This article has outlined the basic requirements and highlighted various car makes and models that qualify, making it easier for Austin residents to navigate this financial option. By following a straightforward application process, you can access much-needed funds quickly, allowing you to keep your vehicle while leveraging its value. Remember, Austin car title loans can be a viable solution for short-term financial needs when managed responsibly.