Understanding title loan buyout options through cash advances or transfers allows borrowers to regain control and manage debt. Online applications simplify the process. Negotiating with lenders by reviewing agreements, showcasing reliable payment history, and researching local market values can lead to more favorable terms. Proactively initiating buyout conversations demonstrates responsibility and secures tailored repayment options.

Can you negotiate your title loan buyout terms? Many borrowers wonder if they have any leverage when it comes to paying off these high-interest loans. The good news is, understanding your options and employing effective negotiation strategies can lead to better terms. Learn how to navigate the process, recognize when to initiate a buyout conversation, and gain control over your financial future through informed decision-making regarding your title loan buyout.

- Understanding Title Loan Buyout Options

- Negotiation Strategies for Better Terms

- When and How to Initiate a Buyout Conversation

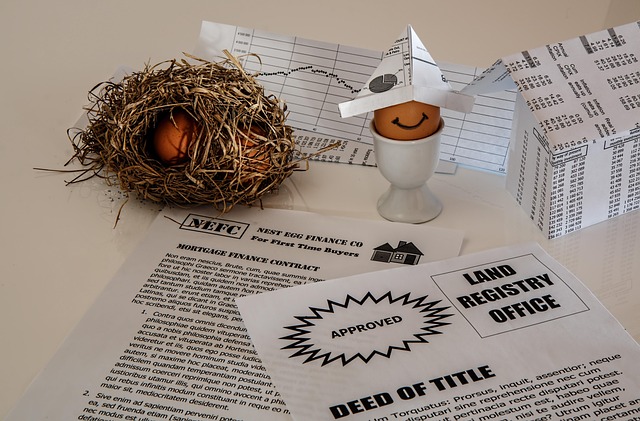

Understanding Title Loan Buyout Options

When considering a title loan buyout, understanding your options is crucial. This process involves repurchasing the outstanding balance on your existing title loan from the lender. The primary goal is to regain ownership of your asset and eliminate the financial burden associated with the loan. A title loan buyout can be negotiated in various ways, offering borrowers flexibility depending on their situation.

One common option is a cash advance, where you receive a lump sum payment to settle the loan. Alternatively, some lenders facilitate a title transfer, allowing you to transfer ownership of your asset to them and erase the debt. For convenience, many lenders now offer online applications for these transactions, making it easier to explore buyout possibilities.

Negotiation Strategies for Better Terms

When considering a title loan buyout, negotiating can be an effective strategy to secure better terms and conditions. Lenders often have some flexibility in their offers, especially if your loan is in good standing or you’re paying down the principal on time. Start by reviewing your loan agreement thoroughly to understand the current terms and any potential areas for negotiation. For instance, you might be able to discuss extending the repayment period, which can lower your monthly payments.

Presenting a strong case for why you deserve improved loan terms is crucial. This could include highlighting your history of timely payments, any increased financial stability since taking out the loan, or even offering additional collateral. In the context of Dallas title loans, understanding local market values and comparable loan offers can strengthen your position. Remember, while negotiating, remain respectful and professional throughout the process to increase the chances of a positive outcome that aligns with your loan requirements.

When and How to Initiate a Buyout Conversation

If you’ve taken out a title loan and are now facing financial challenges, knowing when and how to initiate a buyout conversation is crucial. The optimal time to start this discussion is when you realize your current repayment plan might not be sustainable. This could be due to an unexpected life event, job loss, or a sudden change in your financial situation. Don’t wait until default; proactive measures can help secure more favorable title loan buyout terms.

When reaching out to your lender, express your interest in exploring buyout options and be prepared to discuss your financial standing. Lenders often prefer to work with borrowers who are open to communication. During the conversation, consider proposing a direct deposit of funds as part of the buyout agreement. This demonstrates your commitment to repaying the loan. Additionally, you can inquire about different repayment options available, ensuring you find a plan that aligns with your current budget.

Knowing how to negotiate your title loan buyout terms can empower you to secure more favorable conditions. By understanding the market value of your vehicle, employing effective negotiation strategies, and timing your conversation appropriately, you can potentially reduce interest rates, extend repayment periods, or even cancel certain fees. Remember, while lenders are in business to make a profit, they may be open to negotiations if it means keeping a satisfied customer. Initiate a buyout conversation with confidence, knowing that you have the knowledge and strategies to secure the best possible outcome for your situation.