Low-income individuals seeking quick cash should leverage a title loan payment calculator to estimate monthly repayments based on loan amount, terms, and interest rates. This tool empowers borrowers to manage obligations effectively, especially with unique structures of motorcycle, car, or truck title loans. By understanding repayment impacts and employing financial strategies, borrowers can make informed decisions while preserving long-term stability.

In today’s financial landscape, understanding title loan payment calculators is crucial for low-income borrowers seeking short-term funding. This article demystifies complex calculations, breaking down how factors like interest rates and loan terms impact monthly payments. We delve into the intricacies of these loans, providing insights to empower individuals with knowledge. Additionally, we explore strategies tailored for low-income earners to navigate these loans effectively, ensuring informed decision-making and manageable repayment paths using title loan payment calculators.

- Understanding Title Loan Calculations for Borrowers

- Factors Influencing Monthly Payments Explained

- Strategies for Low-Income Individuals to Manage Loans

Understanding Title Loan Calculations for Borrowers

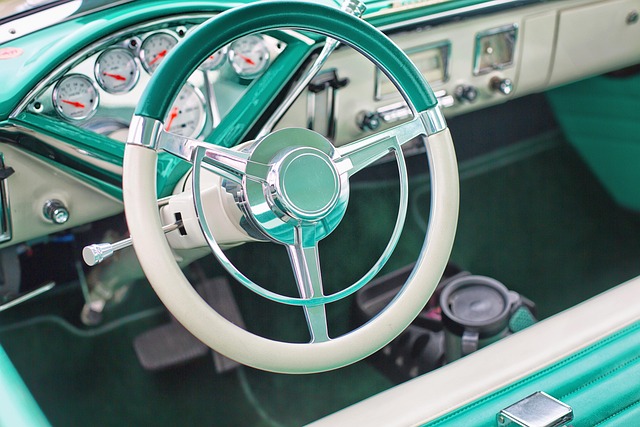

When considering a title loan payment calculator, it’s crucial to understand how these calculations work for borrowers. Unlike traditional loans, title loans use the value of your vehicle’s title as collateral. The online application process is straightforward, allowing you to access funds quickly. Interest rates play a significant role in determining your overall repayment cost, and they can vary depending on several factors, including the loan amount, term, and lender.

Motorcycle title loans, for instance, might have different terms and interest rate structures compared to car or truck title loans. A reliable title loan payment calculator helps borrowers estimate their monthly payments accurately. By inputting details like the loan amount and chosen term, you can get a clear picture of what your repayment schedule will look like. This tool is especially valuable for low-income borrowers who need quick access to cash but want to ensure they can manage their repayments effectively.

Factors Influencing Monthly Payments Explained

When considering a title loan, understanding how monthly payments are calculated is crucial for low-income borrowers looking to access short-term funding. Several factors influence the amount and frequency of these payments, with the most significant being the title loan payment calculator itself. This tool accounts for the loan requirements, including the principal amount borrowed, interest rates, and the agreed-upon repayment period. By inputting specific data, borrowers can gain a clear picture of their financial obligations.

The repayment options available also play a key role in determining monthly payments. Different lenders offer various terms, from shorter, high-interest periods to longer, more affordable ones. Interest rates, though often higher than traditional loans, are another critical variable. Borrowers should carefully review these rates and consider the potential impact on their overall repayment cost.

Strategies for Low-Income Individuals to Manage Loans

For low-income borrowers considering a title loan, managing repayment is key to avoiding financial strain. Utilizing a title loan payment calculator can provide much-needed clarity before taking out a loan. These tools allow individuals to input their expected income and loan amount to estimate manageable monthly payments. By doing so, they can assess if the loan fits within their budget, ensuring they allocate enough funds for necessities like food, housing, and utilities while still meeting loan obligations.

Additionally, low-income borrowers should explore strategies to boost their financial stability. Building an emergency fund, seeking financial counseling, or negotiating lower interest rates are viable options. Utilizing the vehicle equity as collateral can also provide access to capital without liquidating assets. Before pledging vehicle collateral, individuals should have a clear understanding of their vehicle’s vehicle valuation and the potential impact on their long-term financial health.

A title loan payment calculator is a valuable tool for low-income borrowers, offering transparency in repayment plans. By understanding the factors influencing monthly payments, individuals can make informed decisions and employ strategies to effectively manage their loans. Leveraging these tools and techniques ensures responsible borrowing, allowing low-income folks to access needed funds without overwhelming debt.