Texas title loan limits, regulated by the OCCC, protect consumers with maximum 75% loan-to-value ratios based on vehicle value. These caps vary by vehicle type, ensuring safe borrowing practices while offering quick funding without excessive interest or strict terms.

In the state of Texas, understanding title loan limits is crucial for borrowers seeking quick cash. This article guides you through the intricacies of Texas title loan limits and their implications. Learn how these caps influence your borrowing power and protect you from financial strain. Discover strategies to maximize your loan potential while adhering to safety measures, ensuring a responsible borrowing experience in Texas.

- Understanding Texas Title Loan Limits

- How These Limits Impact Borrowers

- Maximizing Your Loan While Staying Safe

Understanding Texas Title Loan Limits

In Texas, borrowers looking to secure a title loan should be aware of specific limits set by state regulations. These limits ensure fair lending practices and protect consumers from excessive borrowing. The Texas Office of Consumer Credit Commissioner (OCCC) oversees and enforces these guidelines, ensuring that lenders comply with caps on the amount borrowed based on the value of the borrower’s vehicle. This is where understanding Texas title loan limits becomes crucial for prospective borrowers.

One key aspect to consider is the maximum loan-to-value ratio, which typically ranges from 50% to 75%. This means lenders can lend up to 75% of the value of your vehicle as a title loan. Additionally, the interest rates and fees associated with these loans are regulated, offering borrowers flexible payments options while keeping costs transparent. Lenders must disclose all terms, including potential penalties for early repayment, ensuring borrowers have all the information needed to make informed decisions regarding their vehicle equity.

How These Limits Impact Borrowers

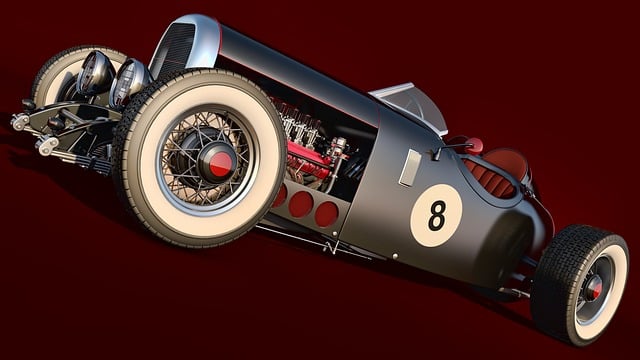

Understanding Texas title loan limits is crucial for borrowers looking to leverage their vehicle ownership. These limits, set by state regulations, directly impact how much cash you can access through a title loan. If you’re considering a truck title loan or any other type of vehicle-backed loan in Texas, knowing these caps will help inform your financial decisions.

The cap on Texas title loan amounts varies based on the type of vehicle and its value. For instance, the limit for traditional car or motorcycle titles is typically lower than for commercial vehicles or trucks. During the application process, lenders conduct a thorough vehicle inspection to determine its condition and value, which in turn affects how much you can borrow. This ensures responsible lending practices while also protecting borrowers from taking on more debt than they can handle.

Maximizing Your Loan While Staying Safe

Maximizing your loan amount while ensuring safety is a delicate balance borrowers in Texas often seek to achieve when considering a title pawn or vehicle collateral loan. Understanding the state’s Texas title loan limits is crucial in this regard. These limits are designed to protect lenders and borrowers alike, preventing excessive borrowing and promoting responsible lending practices.

By adhering to these limits, you can secure quick funding without putting your vehicle at undue risk. The process involves assessing your vehicle’s value, considering your repayment capacity, and ensuring the loan amount is within the legal boundaries set by Texas regulations. This approach allows borrowers to access immediate financial support while maintaining control over their assets and avoiding potential pitfalls associated with high-interest rates and strict repayment terms often associated with title loans.

In understanding Texas title loan limits, borrowers can make informed decisions that balance their financial needs with safety. By being aware of these restrictions, individuals can maximize their loan potential while avoiding excessive debt. Always remember, responsible borrowing is key to a positive financial experience, especially when dealing with Texas title loan limits.