The car title loan industry standards focus on consumer protection through transparent and fair practices. Compliance ensures lenders provide clear terms, fees, and repayment options, empowering borrowers to make informed decisions. These regulations also govern repossession processes, preventing abusive lending schemes and promoting ethical lending while offering borrower safety nets during crises.

The car title loan industry has come under scrutiny for its potential to trap borrowers in cycles of debt. However, robust car title loan industry standards and compliance rules play a pivotal role in preventing abuse. This article explores how these standards safeguard borrowers, ensuring fair lending practices while providing access to emergency funds. By examining the regulations in place, we uncover the critical balance between offering financial assistance and protecting consumers from predatory lending tactics.

- Car Title Loan Industry Standards: A Safeguard

- Preventing Abuse Through Compliance Rules

- The Role of Regulations in Protecting Borrowers

Car Title Loan Industry Standards: A Safeguard

Car Title Loan Industry Standards: A Safeguard

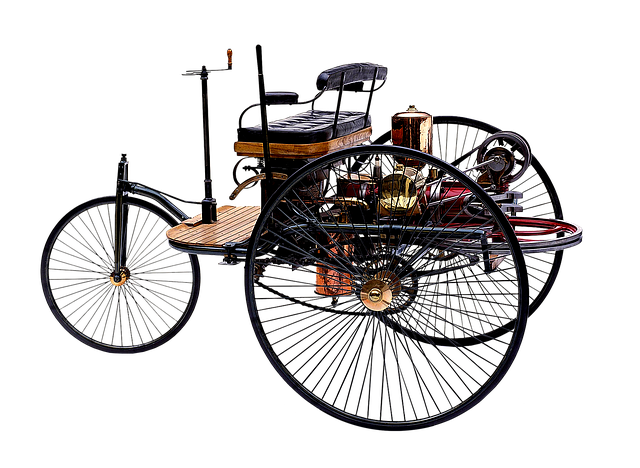

The car title loan industry is subject to stringent standards designed to protect consumers and prevent abuse. These standards, which include strict regulations on interest rates, repayment terms, and loan terms, are crucial in ensuring that borrowers are not taken advantage of by predatory lenders. Compliance with these industry standards helps maintain a level playing field, offering secure loans to individuals who need quick financial assistance without putting them at risk of accruing excessive debt.

By implementing clear and consistent industry standards, consumers can better understand their rights and obligations, enabling them to make informed decisions regarding their finances. Additionally, these standards facilitate transparent communication between lenders and borrowers, focusing on achievable payment plans and flexible repayment options such as extended terms or rollovers, which can help borrowers manage their debt more effectively.

Preventing Abuse Through Compliance Rules

The car title loan industry standards are designed with a robust compliance framework to safeguard consumers and prevent abusive lending practices. These rules mandate that lenders adhere to strict guidelines, ensuring fair treatment of borrowers. One key aspect is the requirement for transparent communication regarding interest rates, repayment options, and the entire loan lifecycle. By doing so, it empowers borrowers to make informed decisions without hidden costs or unfair terms.

Additionally, industry standards govern the process of title transfer and loan payoff. Lenders must follow legal procedures when repossessing a vehicle, providing borrowers with clear timelines and notices. This compliance ensures that the rights of both parties are respected, fostering trust and promoting a fair market environment. Such regulations play a pivotal role in protecting vulnerable individuals from predatory lending schemes.

The Role of Regulations in Protecting Borrowers

The car title loan industry standards play a pivotal role in safeguarding borrowers and promoting ethical lending practices. These comprehensive regulations are designed to ensure that lenders operate within a structured framework, minimizing potential abuses and protecting consumers’ rights. By adhering to these standards, lenders must maintain transparent interactions with borrowers, clearly outlining repayment terms and fees. This transparency empowers borrowers to make informed decisions, understanding the implications of their loans.

Compliance with industry standards also involves stringent verification processes for borrower eligibility, including income and vehicle assessment. This ensures that only those capable of repaying the loan receive funding, preventing individuals from falling into a cycle of debt. Moreover, these regulations provide safety nets, such as allowing borrowers to retain possession of their vehicles (Keep Your Vehicle), offering various repayment options (Repayment Options), and enabling them to access emergency funds during unexpected financial crises.

Car title loan industry standards and compliance regulations are vital tools in protecting borrowers from abusive lending practices. By adhering to these standards, lenders ensure transparency, fair terms, and responsible borrowing, fostering a safe and sustainable financial environment for all involved. Compliance with industry best practices is key to maintaining consumer trust and promoting ethical car title loan services.