In the digital age, individuals opt for alternative financing like title loans for rebuilt titles, using vehicles as collateral for quicker funds without strict bank requirements. To maximize loan value, maintain vehicle condition through repairs and details. Gather vehicle history records, schedule professional inspections, disclose prior accidents, and leverage same-day funding offered by lenders.

“Unleash the power of your rebuilt car’s potential with a revolutionary financing option—the Title Loan. This article guides you through the process of using your restored vehicle as collateral, offering a fresh perspective on auto loans. Discover the benefits of this unique approach, from increased access to capital for car owners to the ease of secure lending. Learn how to prepare your rebuilt title for collateralization and master the steps involved in navigating this successful loan strategy.”

- Understanding Title Loans and Their Benefits

- Preparing Your Rebuilt Car for Collateralization

- Navigating the Process: Steps to Success

Understanding Title Loans and Their Benefits

In today’s digital era, many individuals are exploring alternative financing options, and one such innovative approach is utilizing rebuilt cars as loan collateral. This method, often facilitated through a title loan for rebuilt title, offers a unique advantage to both lenders and borrowers. It provides a quicker and more accessible means of securing funds without the traditional stringent requirements of bank loans.

One of the key benefits is the flexibility it affords borrowers. With this type of loan, individuals can keep their vehicle as collateral, allowing them to retain ownership while accessing much-needed cash. This is particularly advantageous for those who rely on their vehicles for daily transportation or income generation. Moreover, many lenders offer payment plans, making it easier for borrowers to manage the repayment process without the added stress of a lump-sum payment.

Preparing Your Rebuilt Car for Collateralization

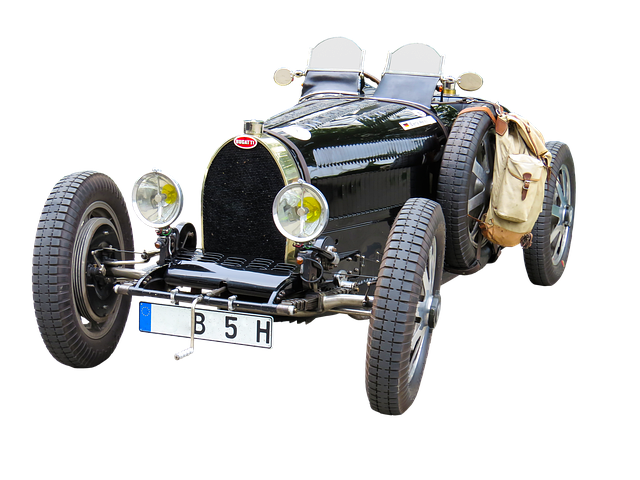

When preparing your rebuilt car for collateralization, ensuring its condition reflects its quality upgrade is paramount. Begin by undergoing any necessary repairs and maintenance checks to bring it up to standard. This includes fixing mechanical issues, polishing the exterior, and addressing any cosmetic imperfections. Remember, a well-maintained vehicle not only boosts its market value but also increases its appeal as loan collateral.

For instance, in cities like Houston where title loans are readily available, lenders prefer vehicles that exude a sense of investment. Consider detailing services to enhance its look and feel. Additionally, keep detailed records of all repairs, especially if you’re opting for a direct deposit without any credit check. This transparency builds trust with lenders, increasing your chances of securing favorable terms for your title loan.

Navigating the Process: Steps to Success

Navigating the Process: Steps to Success

When considering a title loan for rebuilt titles, understanding the process is key to a successful transaction. The journey begins with thorough preparation and documentation. Gather all necessary papers related to the vehicle’s history, including any repair records or estimates from licensed mechanics. It’s crucial to ensure that all work done on the car is legitimate and documented to satisfy lenders’ requirements.

Next, schedule a vehicle inspection. This step involves a professional assessment of your rebuilt car to determine its current condition, value, and potential as collateral. Many lenders offer same-day funding, but it’s essential to be transparent during the application process. Disclose any prior accidents or repairs to ensure a smooth evaluation and approval process for your title loan.

Using a rebuilt car as collateral for a title loan can be a viable option for those in need of quick cash. By understanding the process and preparing your vehicle properly, you can successfully navigate this alternative financing method. Remember that a rebuilt title doesn’t necessarily mean a less valuable asset; with proper documentation and a reliable lender, it can open doors to much-needed funds. Take a dive into this option, consider its benefits, and follow the steps outlined in this article to make an informed decision regarding your rebuilt car’s future.