A successful title loan payoff strategy involves swift repayment, budgeting, and two key tactics: making additional principal payments to reduce interest and simplifying schedules by prioritizing high-interest rates. This is crucial for escaping debt traps and reclaiming financial freedom in markets like Fort Worth and San Antonio.

Looking to conquer your title loan debt? This guide is your roadmap to financial freedom. We’ll walk you through understanding the complexities of title loans and their impact on your finances, then provide a step-by-step plan for creating an effective payoff strategy. Learn powerful strategies to accelerate repayment, save money, and break free from debt’s grasp. Unlock your financial future with our expert tips tailored for a successful title loan payoff strategy.

- Understanding Title Loans and Their Impact on Finances

- Creating a Comprehensive Payoff Plan: Step-by-Step Guide

- Strategies to Accelerate Loan Repayment and Save Money

Understanding Title Loans and Their Impact on Finances

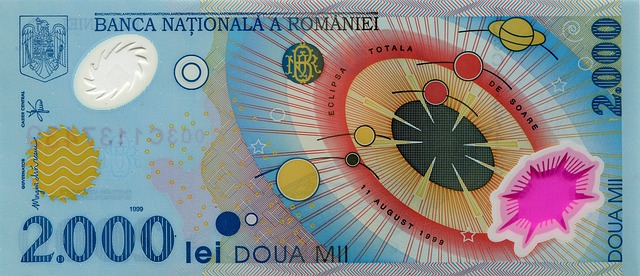

Title loans, often seen as a quick fix for financial emergencies, are secured loans using an individual’s vehicle title as collateral. While they provide access to cash in a short period, the impact on finances can be significant and long-lasting if not managed carefully. These loans typically come with high-interest rates and fees, making them a costly option for borrowers. The primary concern is that many individuals fall into a cycle of debt, struggling to repay both the principal and accumulating interest.

Understanding how these loans work is crucial when formulating a title loan payoff strategy. Unlike traditional loans with fixed repayment terms, title loans often have flexible but potentially harmful conditions, such as extended repayment periods or the option for loan extensions. This can lead to borrowers paying more in interest over time, especially if they are unable to repay promptly. A well-thought-out plan should aim to eliminate the debt swiftly, avoiding the pitfalls of a prolonged financial burden and potential loss of vehicle ownership through repossession.

Creating a Comprehensive Payoff Plan: Step-by-Step Guide

Creating a comprehensive Title loan payoff strategy is the first step towards financial freedom. It involves understanding your current financial situation and devising a plan to repay the loan efficiently. Start by evaluating your monthly income and fixed expenses, such as rent or mortgage, utilities, and insurance. This will give you a clear picture of how much disposable income you have available for loan repayment.

Next, prioritize your Title loan payments by considering interest rates and repayment terms. You might want to consider paying off high-interest loans first. Once you’ve determined the order of repayment, create a budget allocating a specific portion of your monthly income towards loan repayment. Ensure this allocation is realistic, allowing for unexpected expenses while still making progress toward complete payoff. Regularly review and adjust your budget as needed, especially after significant life events or changes in financial circumstances. For instance, if you receive a direct deposit from a new job, redirect a portion of these funds to accelerate your Title loan payoff strategy, effectively reducing the overall interest paid on Fort Worth Loans.

Strategies to Accelerate Loan Repayment and Save Money

When implementing a title loan payoff strategy, there are several effective strategies to accelerate repayment and save money. One proven method is to make additional principal payments beyond your regular monthly installments. Even small increases in these extra payments can significantly reduce the overall interest accrued over time. This approach not only cuts down on interest expenses but also shortens the lifespan of your loan, allowing you to reclaim your financial freedom more swiftly.

Another strategy involves prioritizing high-interest rates and consolidating multiple loans if possible. In San Antonio Loans or Fort Worth Loans markets, where interest rates can vary, it’s crucial to understand the impact of these rates on your repayment. By focusing on paying off higher-rate loans first, you can minimize the overall cost of borrowing. Additionally, combining multiple loans into a single, lower-interest loan can simplify your payment schedule and potentially save money in the long run.

Paying off a title loan requires a well-thought-out plan, combining thoughtful budgeting with strategic repayment methods. By understanding the impact of these loans on your finances and following a step-by-step guide for creating a comprehensive payoff plan, you can navigate this process effectively. Implementing strategies to accelerate repayment not only saves money on interest but also empowers you to regain control over your financial future. Remember, each step towards paying off your title loan is a victory in building a more secure financial foundation.