Military personnel and their spouses can access Title Loan Military Discounts for faster, flexible funding during financial stress. Eligibility requires demonstrating a marital bond, providing valid IDs, proof of residency, clear title to an asset (often a motorcycle), and meeting lender criteria. Repayment options, fee structures, and vehicle inspections should be understood to avoid hidden costs and maintain control over assets until full repayment. Specialized lenders in Fort Worth cater to this community's needs, offering solutions like Motorcycle Title Loans.

In today’s financial landscape, military service members and their spouses often seek accessible credit options. Title loan military discounts provide a unique advantage, offering reduced rates and streamlined processes for active-duty service members and eligible veterans’ spouses. This article guides you through understanding these discounts, clarifying eligibility criteria, and highlighting best practices to safeguard your loan—ensuring a secure and beneficial borrowing experience tailored to military families.

- Understanding Military Discounts on Title Loans

- Eligibility Criteria for Spouses

- Safeguarding Your Loan: Best Practices

Understanding Military Discounts on Title Loans

Military personnel often face unique financial challenges due to their service and deployment schedules. To ease these burdens, many lenders offer special title loan military discounts tailored to their needs. These discounts are a way to show appreciation for their service and provide them with access to quick funding when needed. When considering a title loan, understanding these discounts can be crucial in making an informed decision.

The title loan process for military members often includes simplified eligibility requirements and faster approval times. Lenders recognize the importance of timely support for active-duty service members and veterans, so they streamline the loan application process. Additionally, repayment options may be more flexible, taking into account the potential irregular income patterns common in military careers. These discounts and considerations can significantly benefit those who serve by providing a safety net during times of financial stress.

Eligibility Criteria for Spouses

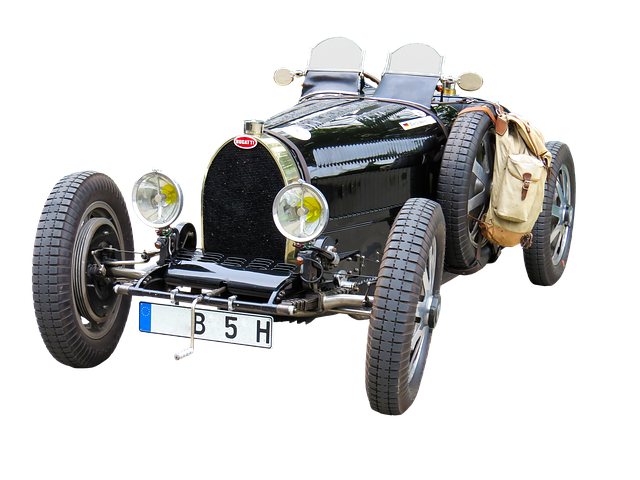

Spouses interested in taking advantage of title loan military discounts should be aware of the eligibility criteria set by lenders. Typically, to qualify for such benefits, couples must demonstrate a strong marital bond and meet certain financial requirements. Active-duty military personnel or their spouses can apply for these loans, ensuring they have a valid government ID, proof of residency, and a clear title to an asset, often their motorcycle. Lenders assess the value of the secured item to determine loan eligibility and offer quick funding options.

In Fort Worth Loans, where the military community is prominent, many financial institutions cater specifically to these needs. Spouses can explore alternatives like Motorcycle Title Loans, which use the vehicle’s title as collateral, providing access to immediate funds. This option is particularly appealing for those requiring fast cash to cover unexpected expenses or consolidate debt. By understanding the eligibility criteria and available options, spouses can make informed decisions regarding title loan military discounts, ensuring a safe and secure borrowing experience.

Safeguarding Your Loan: Best Practices

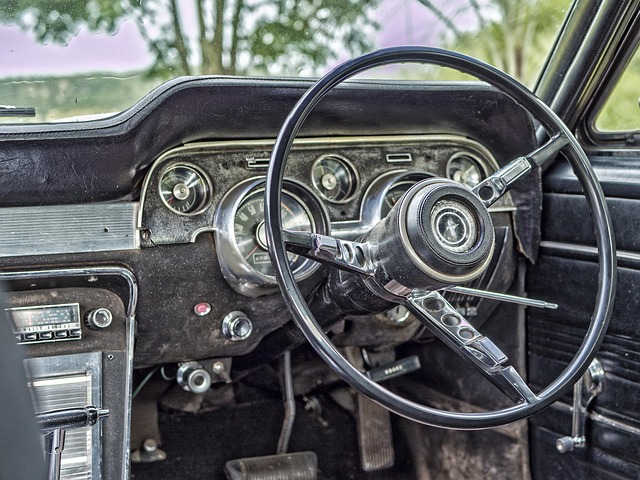

When utilizing Title Loan Military Discounts, safeguarding your loan is paramount to avoid financial strain and maintain peace of mind. One of the best practices is to thoroughly understand the repayment options offered by the lender. Different lenders have varying structures, so ensure you read the fine print and ask about flexible payment plans that align with your budget. Transparency is key; know exactly what fees and interest rates are associated with your loan.

Another essential practice is to insist on a thorough vehicle inspection before finalizing the title loan. This step protects both parties by ensuring the vehicle’s value aligns with the agreed-upon terms. Maintaining ownership of your vehicle throughout the process is crucial, hence the saying “keep your vehicle.” Refraining from relinquishing possession until the loan is fully repaid guarantees you retain control and prevents potential setbacks in case of unforeseen circumstances.

Military spouses now have access to a unique financial safety net thanks to title loan military discounts. By understanding eligibility criteria and practicing safe borrowing, spouses can leverage these discounts to secure loans with favorable terms. Remember, responsible borrowing is key to making the most of this opportunity without incurring long-term debt. With the right approach, title loan military discounts can be a game-changer for those serving our country and their families.