Texas regulations for title loans on older vehicles aim to protect borrowers by capping interest rates, preventing deceptive practices, and ensuring transparency. Borrowers should watch out for hidden fees, high-interest rates, and aggressive sales tactics, verifying lender legitimacy, document authenticity, and direct deposit for safety. Reputable lenders offer transparent terms, no-credit-check options, and focus on vehicle value rather than credit history. Always review fine print to avoid unfavorable conditions.

In the competitive market of Texas, securing a title loan on an older vehicle can be lucrative but also risky. With lax regulations specific to these loans, understanding the landscape is vital. This guide navigates Texas title loan regulations for older vehicles, highlighting common scams and essential steps to protect your investment. By familiarizing yourself with these details, you’ll be better equipped to avoid fraud and make informed decisions.

- Understanding Texas Title Loan Regulations for Older Vehicles

- Red Flags: Common Scams to Watch Out For

- Protecting Yourself: Steps to Secure Your Loan and Vehicle

Understanding Texas Title Loan Regulations for Older Vehicles

In Texas, regulations around title loans for older vehicles are designed to protect both lenders and borrowers. These laws outline specific requirements for loaning against vehicle titles, focusing on transparency and fair practices. The state has established guidelines that dictate how much a lender can charge in interest rates, ensuring they remain competitive and not exploitative. Moreover, the title loan process is regulated to prevent deceptive lending tactics, giving consumers greater peace of mind when considering emergency funds through this means.

Understanding these regulations is crucial for anyone exploring a Texas title loan for older vehicles. By familiarizing themselves with interest rate caps and transparent loan terms, borrowers can make informed decisions during what can be a stressful financial situation. This proactive approach not only helps them avoid predatory lending practices but also ensures they have a clear understanding of their obligations throughout the loan process.

Red Flags: Common Scams to Watch Out For

When considering a Texas title loan for older vehicles, it’s imperative to stay vigilant as this sector can be targeted by scammers. Some common red flags to watch out for include unusually high-interest rates and hidden fees that aren’t disclosed upfront. Scammers often try to rush borrowers into making decisions without giving them time to thoroughly review the title loan process and understand the terms. They might also offer seemingly appealing repayment plans that later prove impossible to meet, leading to default and vehicle repossession.

Another tactic is the use of fake or altered documents, especially during the title transfer process. These fraudsters may attempt to duplicate original papers or forge signatures to make a loan appear legitimate. Always verify the authenticity of documents and ensure you’re dealing with a reputable lender who adheres to legal loan requirements. Remember, a genuine lender will never pressure you into making hasty decisions or charge excessive fees without providing clear explanations.

Protecting Yourself: Steps to Secure Your Loan and Vehicle

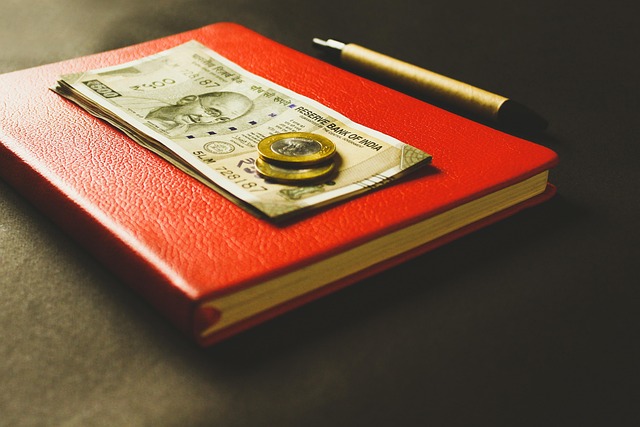

When considering a Texas title loan for older vehicles, protecting yourself is paramount to ensure your investment is secure. Start by verifying the legitimacy of the lender; ensure they are licensed and regulated, which helps mitigate risks associated with fraudulent activities. Reputable lenders will always provide clear terms and conditions, detailing interest rates, repayment schedules, and any fees involved, so be wary of deals that seem too good to be true.

Additionally, safeguard your vehicle’s documentation diligently. Keep the original title in a secure location and never leave it unsecured or accessible to anyone without your consent. Consider using direct deposit for loan proceeds; this reduces the risk of counterfeit transactions. Moreover, since many reputable lenders offer no-credit-check loans, focusing on your vehicle’s value rather than your credit history can be a smart move. Always read the fine print and ask questions to ensure you’re not locked into unfavorable terms, especially with bad credit loans.

When considering a Texas title loan for an older vehicle, staying informed about local regulations and remaining vigilant against common scams is essential. By understanding the red flags and taking proactive steps to secure your loan and vehicle, you can protect yourself from fraudulent practices. Always prioritize transparency, thoroughly review documents, and never hesitate to reach out to regulatory bodies if something feels amiss. Stay safe, stay informed, and make wise financial decisions when it comes to older vehicle title loans in Texas.