Title loan monthly payments offer clarity and simplicity for borrowers, with principal repayment and interest charges. The straightforward online application process involves personal info and vehicle title details. Approved lenders facilitate transparent transfers, helping individuals manage spending through fixed installments. Keeping your vehicle as collateral ensures asset possession, promoting effective budgeting and avoiding costly alternatives. Treating these loans as fixed costs prevents neglecting other essential expenses and savings goals. Transparent appraisal processes assist in accurate vehicle valuation, making title loan monthly payments valuable tools for managing finances.

“Streamline your finances and master budgeting with the power of title loan monthly payments. This comprehensive guide unravels the benefits and strategies behind using this unique approach for effective money management. From understanding fixed, predictable repayment schedules to leveraging extra cash flow, we’ll show you how title loans can simplify budgets, reduce stress, and empower financial control. By the end, you’ll be equipped with tools to make informed decisions.”

- Understanding Title Loan Monthly Payments

- Benefits of Using This Method for Budgeting

- Effective Strategies to Simplify Your Budget with Title Loans

Understanding Title Loan Monthly Payments

Understanding Title Loan Monthly Payments

When it comes to managing your finances, clarity is key. Title loan monthly payments are designed to be straightforward and structured, providing borrowers with a clear path to repay their loans. These payments typically consist of two main components: principal repayment and interest charges. The principal is the original amount borrowed, while interest rates—a crucial factor in any loan—reflect the cost of borrowing money over a set period.

By understanding these elements, borrowers can better navigate the online application process, which often involves submitting basic personal information and details about the asset being used as collateral (in this case, the vehicle title). Once approved, the lender facilitates the title transfer, locking in the terms of the loan. This transparent approach ensures that individuals have a clear grasp of their financial obligations, making it easier to budget and stay on track with monthly payments.

Benefits of Using This Method for Budgeting

Using Title Loan Monthly Payments for budgeting offers a straightforward and structured approach to managing your finances. It helps individuals gain control over their spending by breaking down larger debts into manageable, fixed installments. This method is particularly beneficial for those with unexpected expenses or urgent financial needs, as it provides quick access to funds without the stringent application processes often associated with traditional loans.

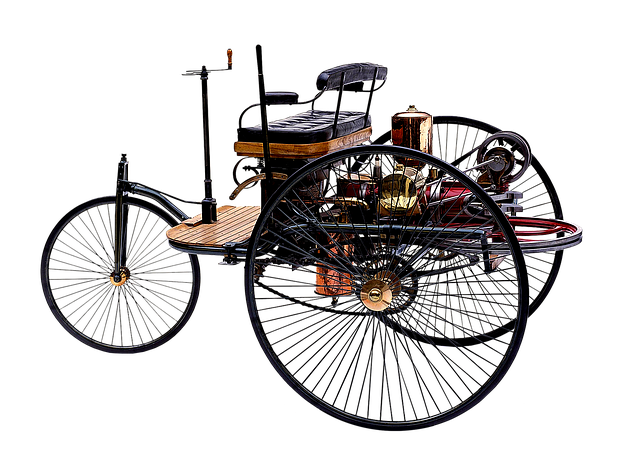

Additionally, keeping your vehicle, such as a semi truck, as collateral for a title loan can be advantageous. It ensures that you maintain possession of an asset that might otherwise be at risk due to unforeseen circumstances. The flexibility and accessibility of these short-term solutions allow individuals to budget effectively, repair their financial standing, and potentially avoid more costly alternatives in the future, like defaulting on bills or incurring high-interest debt.

Effective Strategies to Simplify Your Budget with Title Loans

Simplifying your monthly budget can be a challenging task, but incorporating a title loan payment into your financial strategy offers a practical solution. One effective approach is to allocate a dedicated portion of your income specifically for these loans’ consistent monthly payments. By treating this expense as a fixed cost, you gain better control over your budgeting. This method ensures that other essential bills and savings goals aren’t overlooked or delayed.

Additionally, understanding the value of your collateral, such as your vehicle, through accurate vehicle valuation is key. Many title loan services offer transparency in their appraisal process, allowing you to anticipate and budget for these payments more effectively. Whether you’re considering a personal loan or semi-truck loans, each has its unique financial implications, but with careful planning and consistent monthly repayments, it can serve as a valuable tool to manage your finances.

Title loan monthly payments offer a streamlined approach to budgeting, providing clarity and control over your finances. By understanding these payments and implementing effective strategies, you can simplify your budget, reduce stress, and gain a more comprehensive view of your monetary obligations. This method is particularly beneficial for those seeking an efficient way to manage unexpected expenses or long-term financial goals. Embrace the simplicity of structured repayment and take charge of your financial future.