Title loans for classic cars offer swift financing to car enthusiasts using their vehicle titles as collateral, bypassing strict credit checks. Ideal for restoration or daily driving costs, this option benefits those with less-than-perfect credit. Assessment considers scarcity, historical value, condition, and market demand; a professional appraisal ensures transparency. A straightforward process provides funding for classic car owners while preserving their unique vehicles.

Exploring the world of classic car ownership comes with unique challenges, especially when it’s time to secure funding. This article delves into the intricacies of title loans for classic cars, a popular choice among enthusiasts. We’ll guide you through understanding this financing option, revealing how value is assessed based on various factors. From initial evaluation to securing funds, we’ll simplify the process, empowering car owners to make informed decisions about their beloved classics.

- Understanding Title Loans for Classic Cars

- Assessing Value: Factors in Play

- The Process of Securing Funding

Understanding Title Loans for Classic Cars

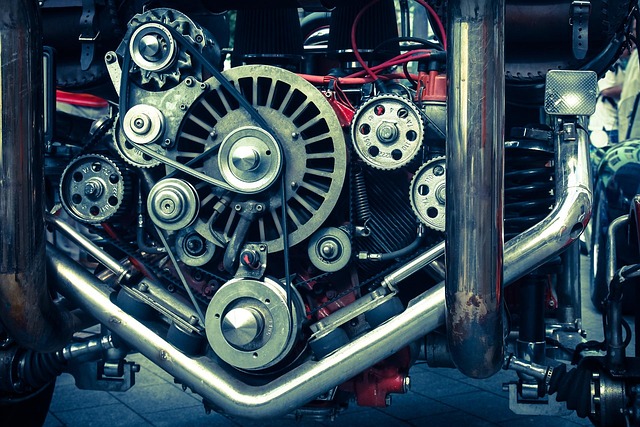

Title loans for classic cars have become a popular financing option among car enthusiasts who own and cherish vintage or rare vehicles. This type of loan is a secured lending arrangement where the borrower uses their car’s title as collateral. Unlike traditional bank loans, which often require extensive credit checks and strict repayment terms, title loans offer a more straightforward process with faster approval times. Borrowers can maintain possession of their classic cars while securing funding to cover various expenses, such as restoration projects, parts acquisition, or even daily driving costs.

The appeal lies in the accessibility it provides for car owners who may not qualify for conventional loans due to credit scores or other financial constraints. With a title loan, individuals can access a predetermined amount based on their vehicle’s estimated value, allowing them to make flexible payments over an agreed-upon period. This flexibility is especially beneficial for classic car owners, as maintenance and upkeep can be more expensive than for modern vehicles. As a result, title loans have emerged as a game-changer, enabling car enthusiasts to preserve and enjoy their beloved classics without the financial burden of traditional loan processes.

Assessing Value: Factors in Play

Assessing the value of a classic car for a title loan involves a multifaceted approach. Several key factors come into play when determining the worth of such vehicles. One of the primary considerations is the car’s historical significance and its place in automotive history. Classic cars, by definition, are often rare models produced in limited quantities over several decades ago. Their value can skyrocket due to their scarcity, especially if they’re in pristine or original condition.

Additionally, the vehicle’s ownership history, maintenance records, and overall condition contribute significantly to its assessed value. A well-maintained classic car with a clean title and comprehensive service logs will typically command a higher loan amount compared to one with a questionable past or significant repair needs. Other factors include the car’s current market demand, regional trends, and the potential for future appreciation, all of which can influence how much a lender is willing to offer through a Car Title Loan.

The Process of Securing Funding

Securing funding for a classic car through a title loan involves a straightforward process that many lenders streamline to cater to enthusiasts and owners alike. It begins with the applicant providing detailed information about their vehicle, including its make, model, year, and overall condition. This initial step is crucial as it sets the stage for the assessment of the car’s value. Once submitted, a professional appraiser or inspector will conduct a thorough vehicle inspection to verify these details and determine the market value of the classic car.

During this inspection, various factors come into play, such as the vehicle’s historical significance, rarity, restoration quality, and current condition, which collectively influence how much a lender is willing to offer in a Houston title loan. The inspector will assess any necessary repairs or maintenance, considering the cost of parts and labor, ensuring the car meets the required standards. This meticulous process guarantees that both parties have a clear understanding of the asset’s value, fostering trust and facilitating a secure financial transaction for classic car owners seeking funding.

When assessing value for a title loan on a classic car, several key factors come into play, ensuring a fair and accurate evaluation. By understanding the unique aspects of these vehicles and the lending process, owners can navigate the market effectively. From historical significance to restoration efforts, every detail contributes to determining the potential funding amount. Securing a title loan for classic cars involves a meticulous approach, allowing enthusiasts to preserve their passions while accessing much-needed capital.