Understanding state title loan laws is crucial for borrower safety. These laws protect against unfair practices by regulating interest rates, loan terms, and repayment options, ensuring transparency. Lenders must conduct vehicle inspections and assess eligibility based on credit history and income. Key protections include flexible payment plans and clear loan terms, preventing debt traps, even for specialized loans like truck title loans. Always read the fine print and stay informed about your rights under these regulations.

Staying safe in the world of title loans involves understanding and adhering to crucial regulations designed to protect borrowers. This comprehensive guide breaks down essential aspects of title loan laws, equipping you with knowledge to make informed decisions. From comprehending key provisions safeguarding your rights to navigating repayment terms and ensuring fair practices, these insights are vital for a secure lending experience. By staying informed, borrowers can navigate this financial landscape with confidence.

- Understanding Title Loan Regulations: A Comprehensive Guide

- Protecting Borrowers: Key Provisions to Know

- Navigating Repayment Terms: Ensuring Fair Practices

Understanding Title Loan Regulations: A Comprehensive Guide

Staying safe when considering a title loan involves understanding the regulations put in place to protect borrowers. Title loan laws vary by state, but they generally aim to ensure fair lending practices and transparent terms. These laws cover aspects like interest rates, loan terms, and repayment options, among others. Understanding these regulations is crucial for making informed decisions about borrowing money using your vehicle’s title as collateral.

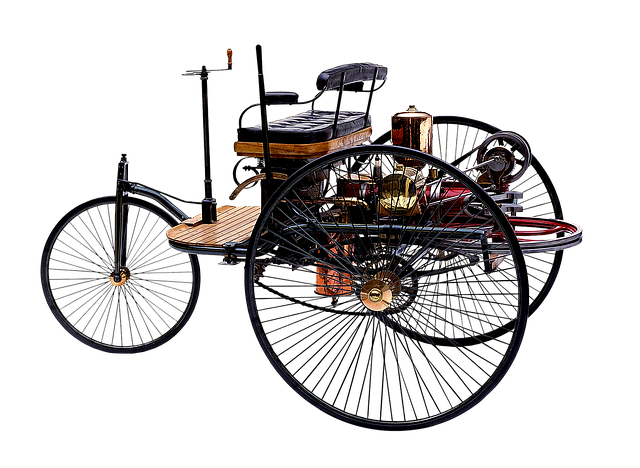

One key aspect regulated under title loan laws is the requirement for a thorough vehicle inspection. This ensures that the vehicle being used as collateral is of sufficient value to back the loan. Additionally, lenders must assess loan eligibility based on factors like credit history and income, ensuring borrowers can comfortably repay the loan. Even specific types of loans, such as semi truck loans, are subject to these regulations, guaranteeing that borrowers receive fair treatment regardless of their vehicle’s size or purpose.

Protecting Borrowers: Key Provisions to Know

Staying safe while considering a title loan involves understanding crucial protections designed to safeguard borrowers. Key provisions under title loan laws ensure transparency and fairness, mandating clear communication about interest rates, fees, and repayment terms. These regulations are in place to empower borrowers by giving them the knowledge to make informed decisions.

One of the most important aspects for borrowers is the availability of flexible payment plans. Title loan laws often allow borrowers to tailor their repayments to fit their financial capabilities, preventing a burden that could lead to default. This, coupled with clear loan terms, ensures that individuals taking out loans, including those considering truck title loans, are not trapped in cycles of debt.

Navigating Repayment Terms: Ensuring Fair Practices

When considering a title loan, understanding the repayment terms is crucial to ensuring fair practices and your financial well-being. Title loan laws are designed to protect borrowers by setting clear guidelines on how these loans should be structured and repaid. Lenders in Dallas or any other location must adhere to these regulations, which often include details about interest rates, loan duration, and repayment schedules. Familiarize yourself with the loan requirements and terms before signing any agreements.

One of the key aspects to focus on is debt consolidation options. If you’re considering a title loan for debt consolidation, ensure that the lender offers flexible repayment plans tailored to your needs. This allows you to manage your repayments effectively without falling into a cycle of high-interest debts. Stay informed about your rights under the title loan laws and always read the fine print to avoid any surprises.

Staying safe while availing of title loan services is achievable by understanding and adhering to the regulations set forth by state-level title loan laws. By familiarizing yourself with these laws, you can protect yourself as a borrower, ensuring fair practices and clear repayment terms. Armed with this knowledge, you’re better equipped to navigate the process securely, making informed decisions that align with your financial well-being.