Despite their popularity for quick cash, title loans have high interest rates, strict repayment terms and limited loan amounts. Individuals with bad credit can instead explore title loan alternatives like vehicle collateral loans which offer more flexible terms and easier access based on vehicle value, helping residents in cities like Fort Worth manage financial emergencies without giving up ownership.

Need cash fast but have bad credit? Traditional title loans may seem like the only option, but they come with high-interest rates and strict requirements. This article explores powerful title loan alternatives designed for individuals facing financial challenges. We’ll delve into understanding the basics of title loans and their drawbacks, while also uncovering effective credit repair options to improve future borrowing potential. Additionally, we’ll uncover other financial resources accessible for immediate needs, empowering you with diverse solutions.

- Understanding Title Loan Basics and Their Drawbacks

- Exploring Credit Repair Options for Better Future Loans

- Unlocking Access: Other Financial Resources for Immediate Needs

Understanding Title Loan Basics and Their Drawbacks

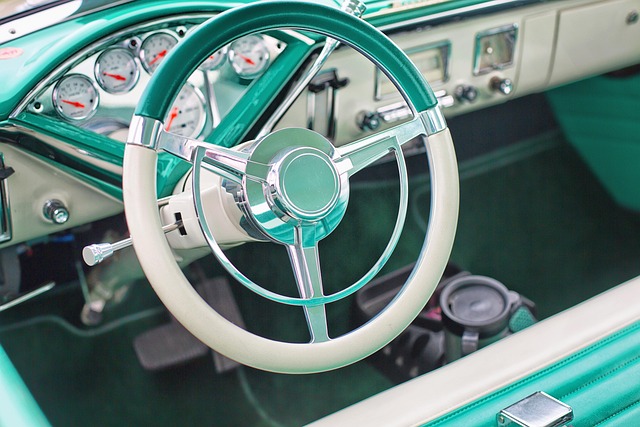

Title loans have gained popularity as a quick solution for individuals needing cash. This type of loan is secured by a person’s vehicle, allowing lenders to offer funds with seemingly relaxed credit requirements. However, beneath the surface, there are several drawbacks that make title loans a less-than-ideal choice, especially for those with bad credit.

For starters, these loans often come with extremely high-interest rates and fees, making them a costly option. The process of securing a title loan involves providing extensive personal information and, in some cases, facing strict repayment terms that can put an individual’s vehicle at risk of repossession if they fail to meet payments on time. Additionally, the loan amount is typically much lower than what traditional loans offer, and the approval process often requires a thorough vehicle valuation to determine the loan value—a factor that can be concerning for those seeking title loan alternatives.

Exploring Credit Repair Options for Better Future Loans

When considering title loan alternatives, repairing your credit score can significantly improve future lending options. Credit repair isn’t a quick fix; it involves understanding and managing your finances responsibly over time. One effective strategy is to pay down existing debts, which can lower debt-to-income ratios and boost creditworthiness. Additionally, maintaining timely payments on all accounts, including utility bills and rent, signals lenders that you’re financially responsible.

Exploring options like truck title loans or other secured lending products could also be part of your plan. While these still require collateral, such as vehicle ownership, they often come with more flexible loan terms compared to traditional personal loans. Over time, by demonstrating consistent repayment behavior, individuals can rebuild their credit and access better interest rates and loan options in the future.

Unlocking Access: Other Financial Resources for Immediate Needs

For individuals facing financial emergencies with limited options, exploring alternative solutions to traditional title loans is essential. Unlocking access to other financial resources can provide much-needed relief for those with poor credit or a lack of collateral. One such option gaining traction in cities like Fort Worth is leveraging vehicle ownership as security for short-term funding. This approach, often referred to as vehicle collateral loans, allows borrowers to tap into the equity of their vehicles without relinquishing complete ownership.

By using their vehicle’s value as guarantee, individuals can gain access to immediate cash and avoid the stringent requirements of title loans. These alternative financing methods cater specifically to those in need of quick funds for various purposes, from unexpected bills to urgent repairs. With a focus on vehicle ownership rather than complex credit checks, these solutions offer a more inclusive financial safety net, ensuring that residents of Fort Worth have access to resources tailored to their unique circumstances.

When faced with financial emergencies, individuals with bad credit often seek quick solutions like title loans. However, understanding the drawbacks and exploring alternative options is crucial for long-term financial health. Credit repair strategies and accessing other financial resources can help overcome immediate needs without falling into the cycle of high-interest debt. By considering these title loan alternatives, folks can chart a path towards financial stability and security.