Car title loan security measures involve rigorous document verification to confirm ownership, clear liens, assess vehicle value and creditworthiness. These measures enable access to capital for borrowers with bad credit and protect lenders from fraud, streamlining applications and fostering a transparent, competitive industry.

Car title loans, a popular alternative financing option, offer both convenience and quick access to cash. However, ensuring robust security measures is paramount for lenders and borrowers alike. This article delves into the critical aspect of car title loan security, focusing on document verification tools that safeguard transactions. By examining these measures, we highlight enhanced protection mechanisms, fostering trust within this financial sector. Understanding these security protocols is essential for both parties to make informed decisions in a transparent lending environment.

- Understanding Car Title Loan Security

- Document Verification: Key Component

- Enhanced Protection for Lenders and Borrowers

Understanding Car Title Loan Security

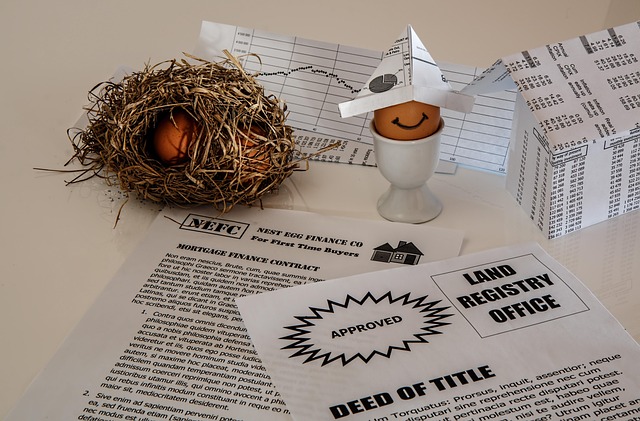

When considering a car title loan, understanding the security measures is key to ensuring both peace of mind and a safe financial transaction. Car title loan security measures are designed to protect both the lender and the borrower by establishing a clear legal framework for the agreement. These measures involve comprehensive document verification processes to confirm the authenticity and value of the collateral—the car’s title.

By utilizing advanced tools and techniques, lenders can verify the ownership history, ensure there are no outstanding liens or claims on the vehicle, and assess its current market value accurately. This is particularly important for borrowers with bad credit looking for a financial solution as it helps lenders mitigate risks associated with such loans. Secured loans, backed by car titles, offer a viable alternative to traditional unsecured loans, providing a means to access capital in situations where other loan options might be limited.

Document Verification: Key Component

Document verification is a critical aspect of car title loan security measures. Lenders utilize advanced tools to cross-reference and validate the authenticity of key documents presented by borrowers, such as identification cards, proof of income, and vehicle registration papers. This process ensures that all information provided aligns with official records, reducing the risk of fraudulent activities.

Accurate document verification not only safeguards lenders but also facilitates a smoother loan application process. By eliminating potential discrepancies early on, borrowers can focus on understanding their loan terms and making informed decisions. Moreover, it enables efficient handling of direct deposit for funds transfer, ensuring that borrowers receive their loans promptly without delays caused by incomplete or fake documentation.

Enhanced Protection for Lenders and Borrowers

In the realm of car title loans, implementing robust security measures is paramount for both lenders and borrowers. Advanced document verification tools play a pivotal role in enhancing protection, ensuring that all loan requirements are met with accuracy and transparency. These innovative solutions scrutinize crucial documents, verifying their authenticity to mitigate risks associated with fraudulent activities.

By leveraging these Car title loan security measures, lenders can safeguard their interests while offering competitive interest rates tailored to individual borrower needs. Moreover, the system facilitates seamless handling of loan extensions, providing flexibility when unexpected circumstances arise. This comprehensive approach fosters a fair and secure lending environment, fostering trust among participants in this modern financial landscape.

Car title loan security measures, particularly robust document verification tools, are pivotal in ensuring a safe and mutually beneficial lending process. By verifying critical documents, lenders can mitigate risks and offer enhanced protection to both parties. This not only safeguards the financial interests of the lender but also ensures borrowers receive fair terms, fostering a transparent environment for all car title loan transactions.