Car title loan default rates are a crucial metric for lenders and borrowers. High rates indicate risky lending practices or borrower instability, leading to regulatory scrutiny, market restrictions, and reputational damage. Lenders can mitigate defaults through improved risk assessment, transparent communication, flexible repayment options, and thorough vehicle inspections.

Car title loans, despite their appeal as quick cash solutions, carry significant risks with high default rates. This article delves into the factors driving these defaults and explores their profound implications on lender licensing. We examine how understanding default trends can inform regulatory strategies, highlight best practices to mitigate risk, and ultimately shape a more stable lending landscape. By focusing on the car title loan default rate, we aim to guide lenders in navigating this complex space.

- Understanding Car Title Loan Default Rates

- Licensing Implications of High Defaults

- Strategies to Mitigate Risk and Improve Licensing

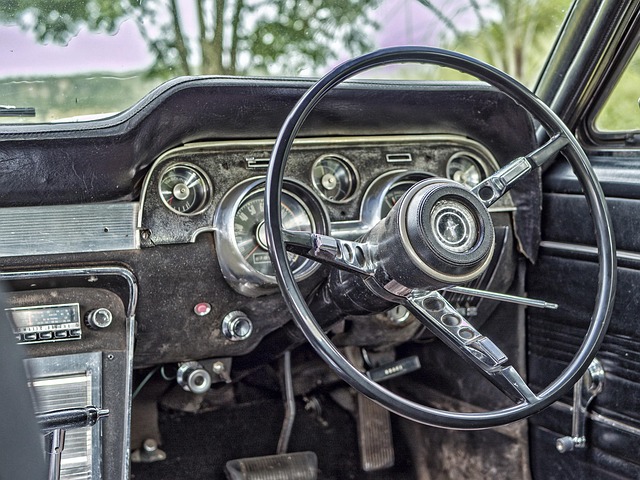

Understanding Car Title Loan Default Rates

Car title loan default rates reflect the percentage of borrowers who fail to repay their loans as agreed upon. These rates are a crucial indicator of a lender’s risk and financial health, especially in the alternative lending sector. Understanding these default rates is essential for both lenders and borrowers. For lenders, it helps assess the viability of their car title loan products and inform licensing decisions. Borrowers, on the other hand, need to grasp these rates to make informed choices about whether a car title loan offers them the necessary financial assistance without putting their vehicle at risk.

The default rate is calculated by dividing the number of loans that go into default by the total number of active car title loans. A low default rate suggests borrowers are more likely to keep their vehicles and repay their loans, indicating a responsible lending environment. Conversely, high default rates raise concerns about loan terms, interest rates, or the financial stability of borrowers, potentially leading to stricter licensing requirements for lenders. Quick approval processes, while appealing, may contribute to higher default rates if not balanced with clear repayment terms and borrower education.

Licensing Implications of High Defaults

When car title loan default rates climb, lenders face significant licensing implications. High default rates signal to regulatory bodies that a lender may be taking on excessive risk or targeting vulnerable borrowers who are unlikely to repay their loans. This can lead to stricter scrutiny of lending practices and potentially more stringent licensing requirements. Lenders with consistently high default rates may find it increasingly difficult to maintain or renew their licenses, hindering their ability to operate in the market.

Moreover, a rising default rate can negatively impact a lender’s reputation and creditworthiness. This can limit their access to capital markets, increase borrowing costs, and reduce loan eligibility for future borrowers. To mitigate these effects, lenders must review and adjust their risk assessment models, improve borrower screening processes, and offer flexible repayment options that better suit borrowers’ financial situations, such as extended terms or partial payments during difficult periods (No Credit Check).

Strategies to Mitigate Risk and Improve Licensing

To mitigate the risk associated with car title loan default rates, lenders can implement several strategies that enhance their licensing and operational resilience. One effective approach is to conduct thorough vehicle inspections before extending loans. This practice not only assesses the value of the collateral but also ensures the condition of the vehicle, thereby reducing the likelihood of defaults. By requiring well-maintained vehicles as security, lenders send a signal to borrowers about their commitment to responsible lending practices.

Additionally, promoting transparency and clear communication can help keep your vehicle secure loan processes. Educating borrowers about repayment terms, late fees, and potential consequences of default can foster trust and encourage timely payments. Lenders should also consider offering flexible repayment plans tailored to individual borrower needs, which could further reduce defaults and improve licensing standing by demonstrating a customer-centric approach.

Car title loan default rates significantly impact lender licensing, with high defaults leading to stricter regulatory scrutiny. Understanding these default rates and their causes is crucial for lenders to implement effective risk mitigation strategies. By adopting innovative approaches, such as enhanced customer screening, improved loan terms, and advanced data analytics, lenders can streamline their processes and minimize defaults. This, in turn, fosters a healthier lending environment and strengthens licensing requirements, ultimately benefiting both lenders and borrowers alike.