Exploring local title loan forgiveness programs provides safe havens for high-interest lending victims. These initiatives, found on government websites or through community orgs, offer tailored solutions like foreclosure prevention or debt freedom based on region and eligibility criteria. Utilizing community resources simplifies applications by providing insights into requirements and deadlines, ensuring successful securing of forgiveness for secured loans.

Struggling with a title loan? Discover nearby community-based title loan forgiveness programs offering much-needed relief. This guide explores local options for debt reduction, helping you navigate complex eligibility criteria and access supportive resources close by. Learn how to apply and gain control of your financial future through these innovative forgiveness initiatives. Find the help you need, right around the corner.

- Exploring Local Options for Title Loan Relief

- Understanding Eligibility Criteria for Forgiveness Programs

- Navigating Applications and Support Resources Nearby

Exploring Local Options for Title Loan Relief

When considering relief from your existing title loan, exploring local options is a strategic move. Many communities now have specialized programs designed to assist residents in navigating challenging financial situations. These initiatives often provide a safe haven for those trapped in cycles of high-interest lending, offering not just debt reduction but also a path to financial stability. Local government websites and community organizations are excellent resources to uncover these hidden gems.

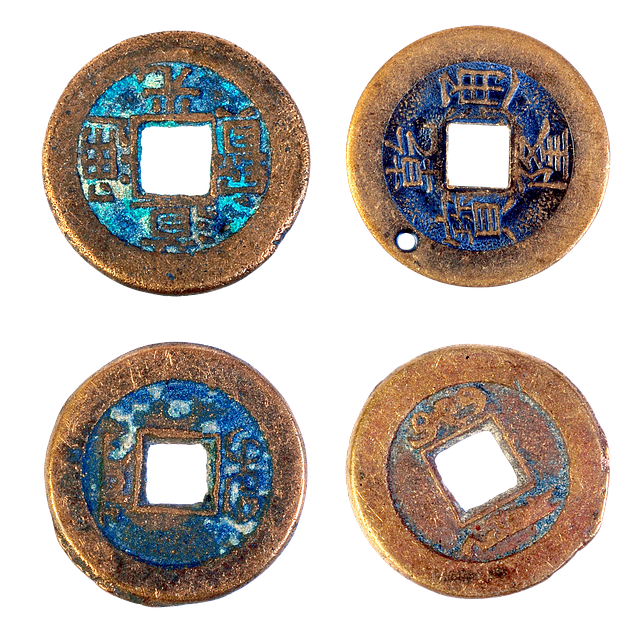

Title loan forgiveness programs vary across regions, catering to diverse economic landscapes. For instance, some areas may focus on helping homeowners avoid foreclosure through innovative Boat Title Loan relief measures. Other regions could offer tailored solutions for low-income individuals seeking freedom from debt. A thorough understanding of your area’s available options is key. Factors like vehicle valuation and credit checks might differ between programs, so it’s essential to research and compare before making a decision that aligns with your unique circumstances.

Understanding Eligibility Criteria for Forgiveness Programs

Many community-based initiatives offer title loan forgiveness programs as a way to support individuals and families facing financial hardships. However, understanding the eligibility criteria is essential before applying. These programs often have specific requirements that determine who qualifies for assistance. For instance, some may focus on low-income households or those with certain types of debt, like truck title loans.

Eligibility can depend on factors such as income levels, credit history, and the purpose of the loan. Programs might also prioritize individuals who have exhausted other financial resources or are facing unforeseen circumstances, such as job loss due to an emergency. Knowing these criteria allows borrowers to assess their eligibility and take the necessary steps to access available title loan forgiveness programs nearby.

Navigating Applications and Support Resources Nearby

Navigating Applications for title loan forgiveness programs nearby can be a daunting task, but with the right resources, it becomes more manageable. Start by researching local non-profit organizations and community centers that offer support and guidance on such initiatives. These entities often have detailed information about eligibility criteria, application procedures, and deadlines for various title loan forgiveness programs. They can help you understand the specific requirements for Dallas Title Loans or Motorcycle Title Loans, ensuring you meet all necessary conditions before submitting your application.

Local libraries and community forums are also valuable support resources where you can gather essential forms and learn from others’ experiences. Many communities have dedicated websites or social media groups that provide updates on available title loan forgiveness programs, making it easier to stay informed and access the assistance you need. Remember, seeking help early in the process can significantly impact your success in securing forgiveness for your secured loans.

If you’re seeking relief from a title loan, exploring community-based forgiveness programs can be a promising step. By understanding the eligibility criteria and navigating local support resources, you can find options tailored to your situation. Remember, these programs are designed to assist individuals facing financial challenges, offering a potential path to debt reduction and a fresh start. Dive into your local resources and discover how title loan forgiveness could bring peace of mind and new opportunities.