Car title loans for pensioners provide a convenient and accessible financial solution tailored to retirees' needs. Using their vehicles as collateral, these loans offer simpler qualifications with minimal paperwork, appealing to those with limited borrowing options. The online application process is seamless, allowing seniors to apply from home without long waits or piles of documents. Lower interest rates and flexible payoff periods make them an attractive choice for short-term funding or unexpected expenses, ensuring pensioners retain vehicle ownership.

For pensioners seeking quick and accessible financial solutions, online car title loans offer a convenient alternative. This article guides you through the process, focusing on how pensioners can leverage their vehicle’s equity for immediate funding. We explore the benefits of online car title loans, highlighting their speed, flexibility, and ease of application. By understanding this option, pensioners can make informed decisions, ensuring financial peace of mind.

- Understanding Car Title Loans for Pensioners

- Benefits of Online Car Title Loans

- Simplifying the Application Process

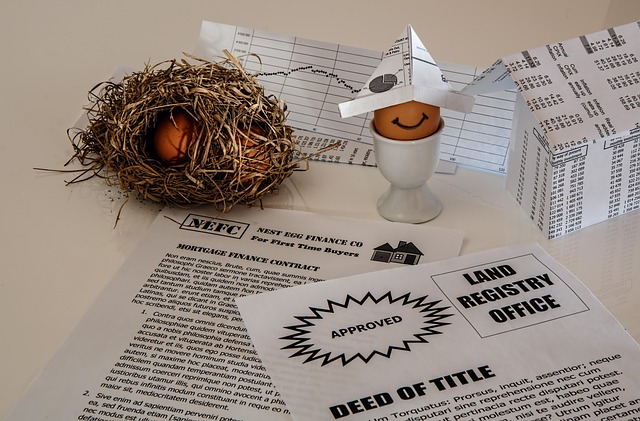

Understanding Car Title Loans for Pensioners

Car title loans for pensioners are a convenient financial solution tailored to meet the unique needs of those who have reached retirement age. These loans leverage a pensioner’s most valuable asset—their vehicle—as collateral, providing quick access to cash. Unlike traditional bank loans that often require complex eligibility criteria and extensive paperwork, car title loans offer simpler qualifications, focusing on the ownership and condition of the borrower’s motor vehicle. This makes them an attractive option for older adults who may have limited options when it comes to borrowing funds.

In a process known as a title transfer, pensioners can use their car title to secure a loan with minimal hassle. Once approved, lenders facilitate a quick exchange, allowing borrowers to retain possession of their vehicle while gaining immediate financial support. Dallas title loans, for instance, have gained popularity among the retirement community due to their accessibility and favorable terms. As secured loans, these car title loans offer lower interest rates compared to unsecured alternatives, making them an even more appealing choice for pensioners seeking short-term funding or a bridge to cover unexpected expenses.

Benefits of Online Car Title Loans

Online Car Title Loans offer a convenient and accessible solution for pensioners seeking financial support. This modern approach to borrowing eliminates the need for extensive paperwork and in-person visits, which is particularly beneficial for individuals with limited mobility or those who prefer a simpler process. The application can be completed entirely online, ensuring a quick approval process, a significant advantage over traditional loan options.

One of the key benefits is the potential for a shorter loan payoff period. Pensioners can access their funds faster, helping them manage unexpected expenses or take advantage of opportunities without the burden of long-term debt. Moreover, San Antonio loans, when structured appropriately, can provide much-needed cash flow while allowing individuals to retain ownership of their vehicles, making it an attractive option for those relying on their cars for daily transportation and mobility.

Simplifying the Application Process

Applying for a car title loan used to be a complex process, often requiring extensive paperwork and lengthy waiting times. However, with the rise of online platforms, this has changed dramatically for pensioners seeking financial support. Now, it’s easier than ever to access car title loans for pensioners through digital applications, allowing individuals to secure funding from the comfort of their homes. This modern approach streamlines the entire process, making it efficient and hassle-free.

The online application process is designed with simplicity in mind, focusing on accessibility and user-friendliness. Applicants no longer need to visit physical locations or deal with tedious forms. Instead, they can complete a digital form on their preferred device, providing essential details about themselves and their vehicles. This streamlined approach not only saves time but also caters to pensioners who may have limited mobility or familiarity with traditional loan application methods. Moreover, it includes options for those with bad credit loans, ensuring that everyone has the chance to explore financial support without the usual barriers.

Online car title loans can be a viable option for pensioners seeking quick access to cash. By understanding these loans, leveraging their benefits, and simplifying the application process, seniors can navigate this alternative financing with ease. Car title loans for pensioners offer a modern solution, providing both flexibility and accessibility during retirement.