Lenders in Fort Worth and Dallas conduct thorough title loan risk assessments, evaluating borrower credit history, income, repayment capabilities, and collateral value to offer competitive terms. This process is crucial for responsible lending and ensures borrowers with less-than-perfect credit gain access to emergency funds while protecting lenders from potential losses.

Title loan risk assessment is a critical component of ensuring responsible lending practices. This article delves into the intricate factors that shape approval decisions for title loans, providing a comprehensive guide for both lenders and borrowers. We explore how understanding creditworthiness plays a pivotal role in managing risks, while also highlighting strategies to mitigate potential hazards for all parties involved. By examining these key aspects, you’ll gain valuable insights into the significance of thorough title loan risk assessment.

- Understanding Title Loan Risk Assessment Factors

- The Role of Creditworthiness in Approval Decisions

- Mitigating Risks for Lenders and Borrowers Alike

Understanding Title Loan Risk Assessment Factors

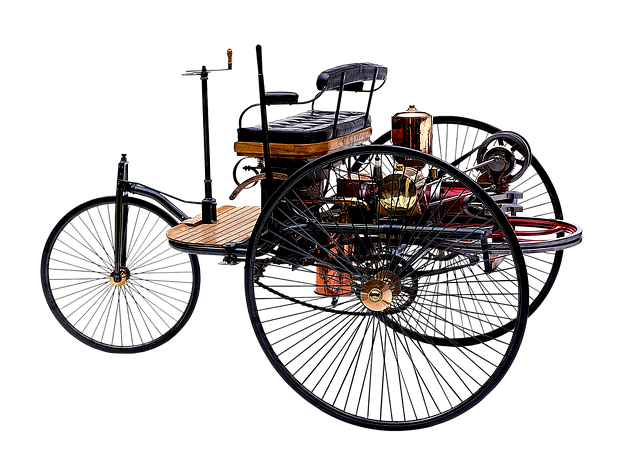

When evaluating a potential title loan risk assessment, several key factors come into play. Lenders consider the value and condition of the asset being used as collateral, typically the borrower’s vehicle. This involves detailed appraisals to determine market values and assess any potential repair costs. The age and overall condition of the vehicle are significant, as they directly impact its resale value. Additionally, lenders scrutinize the borrower’s credit history, income stability, and ability to make consistent payments. These factors collectively help predict repayment likelihood and mitigate risks associated with loan defaults.

The process is crucial for both Fort Worth Loans and Dallas Title Loans providers, ensuring responsible lending practices while offering much-needed financial assistance. By thoroughly assessing these risks, lenders can offer competitive terms and interest rates tailored to individual borrower profiles. This method benefits borrowers by providing access to emergency funds when needed and guiding them through a transparent loan process.

The Role of Creditworthiness in Approval Decisions

Creditworthiness plays a pivotal role in shaping approval decisions for title loans. Lenders conduct thorough risk assessments to evaluate an applicant’s ability to repay the loan, ensuring a balanced and sustainable lending environment. This assessment goes beyond just looking at credit scores; it delves into various factors that indicate financial health and responsibility.

For individuals with less-than-perfect credit or a history of bad credit loans, a title loan can offer a much-needed financial solution. Lenders consider the collateral provided by the applicant—typically their vehicle’s title—to mitigate risks associated with lending to those with limited credit history or poor creditworthiness. This approach allows lenders to extend loan terms and interest rates that are more suitable for borrowers’ needs, fostering a sense of trust and accessibility in the lending process.

Mitigating Risks for Lenders and Borrowers Alike

Risk assessment plays a pivotal role in ensuring both lenders and borrowers benefit from title loan approvals. By meticulously evaluating various factors, lenders can mitigate potential losses associated with loan defaults, which is crucial for their financial stability. This process involves analyzing the borrower’s credit history, income stability, and ability to repay, along with assessing the value of the collateral—in this case, the vehicle securing the loan. A comprehensive Title Loan Risk Assessment in San Antonio helps lenders make informed decisions, fostering a healthy lending environment.

For borrowers, this assessment is equally significant as it determines their eligibility for emergency funds when they need them most. It ensures that individuals can access much-needed financial support without burdening themselves with excessive risk. The accuracy of vehicle valuation during the assessment process is vital; an accurate appraisal protects both parties from potential disputes and ensures the loan amount aligns with the true value of the collateral, providing a secure transaction for San Antonio Loans.

Title loan risk assessment is a multifaceted process that combines an evaluation of creditworthiness, vehicle condition, and borrower financial stability. By understanding these factors, lenders can make informed decisions while mitigating potential risks. For borrowers, this means access to much-needed funds with terms tailored to their ability to repay. Ultimately, a robust title loan risk assessment benefits both parties, fostering a transparent and secure lending environment in today’s financial landscape.