Best-rated title loan companies with mobile apps offer quick funding against vehicle equity, ideal for emergencies. These user-friendly apps streamline applications and account management, but borrowers should compare interest rates, understand collateral value, and review transparent terms to avoid hidden costs, prioritizing fair lending practices in San Antonio.

In today’s fast-paced world, immediate financial support is often needed. Best-rated title loan companies now offer mobile apps, revolutionizing access to quick funding. This article explores the top-rated title loan apps, guiding you through their features and benefits. We’ll delve into the navigation of risks associated with these innovative services while highlighting why best-rated title lending apps are a game-changer for urgent financial needs.

- Exploring Top-Rated Title Loan Apps for Quick Funding

- Features to Look For in High-Rated Mobile Title Loans

- Navigating Risks and Benefits of Best-Rated Title Lending Apps

Exploring Top-Rated Title Loan Apps for Quick Funding

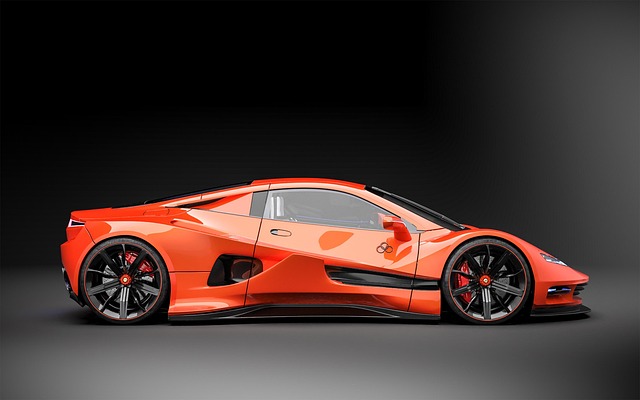

In today’s fast-paced world, quick funding is often a necessity, and best-rated title loan companies with mobile apps offer a convenient solution. These top-rated apps allow borrowers to access funds against the equity in their vehicles, providing a swift alternative to traditional banking options. By completing an online application and undergoing a simple vehicle inspection, users can secure loans within a short span, making them ideal for emergencies or unexpected expenses.

Exploring these apps ensures a transparent process with minimal hassle. Many reputable title loan companies now offer user-friendly interfaces, enabling borrowers to check their eligibility, receive offers, and manage their loans on the go. This digital transformation has revolutionized access to short-term funding, empowering individuals to make informed financial decisions without the need for extensive paperwork or waiting periods.

Features to Look For in High-Rated Mobile Title Loans

When considering a title loan through top-rated companies offering mobile apps, there are several key features to look for. First and foremost, a user-friendly interface is essential. The app should allow users to quickly apply for loans, upload necessary documents, and manage their account with ease. Features like real-time updates on application status, digital signing capabilities, and secure data transmission ensure a seamless experience.

Additionally, interest rates play a significant role in the overall cost of the loan. Compare rates offered by different best-rated title loan companies to find the most competitive options. Keep in mind that these rates often depend on factors such as the value of your vehicle collateral and your credit check results. A reputable app should provide transparent information about these aspects, allowing you to make informed decisions before securing a loan.

Navigating Risks and Benefits of Best-Rated Title Lending Apps

Navigating the world of best-rated title loan companies through their mobile apps can be a double-edged sword. While these digital platforms offer convenient access to immediate funding, they also come with risks that borrowers should be aware of. The convenience of applying for and managing car title loans in San Antonio via a smartphone app is undeniable. However, it’s crucial to understand the potential drawbacks before making a decision.

One significant benefit is the transparency these apps often provide. They clearly outline loan terms, interest rates, and fees, enabling borrowers to make informed choices. Moreover, the entire process—from applying to title transfer—can be completed remotely, saving time and effort. However, borrowers must remain vigilant about hidden costs or deceptive practices. Reputable best-rated title loan companies will prioritize fair lending practices, ensuring borrowers understand all aspects of their loans before finalizing any agreements.

When considering a best-rated title loan company offering mobile apps, it’s crucial to balance convenience with caution. By understanding key features, evaluating risks, and selecting a reputable lender, you can access quick funding while ensuring a secure borrowing experience. Remember, thorough research is key to making an informed decision when navigating the world of mobile title loans.