Texas has witnessed a surge in the online title loan sector, providing quick funding but sparking regulatory concerns over high-interest rates and collection methods. The state's evolving regulatory landscape imposes stringent licensing requirements, mandates vehicle inspections for collateral security, and prioritizes consumer protection. Enhanced online application processes offer borrowers increased transparency, while regulations facilitate clear communication of loan payoff options, mitigating the risk of predatory lending practices in the competitive Texas online title loans market. The Texas Office of Consumer Credit Commissioner actively enforces these rules, particularly targeting out-of-state operators.

“In recent times, Texas has witnessed a surge in enforcement actions against operators providing online title loans. This article delves into the evolving regulatory landscape of Texas online title loans, exploring the factors driving increased scrutiny. We analyze the current legal framework, recent legislative changes, and the reasons behind rising consumer complaints, including unfair lending practices and COVID-19’s impact on financial vulnerability. Furthermore, we discuss the implications for lenders and borrowers, offering insights into compliance consequences, best practices, and borrower rights.”

- Texas Online Title Loans: Regulatory Landscape

- – Overview of the online lending industry in Texas

- – Current legal framework and regulations for online title loans

Texas Online Title Loans: Regulatory Landscape

Texas online title loans have been a growing sector within the state’s financial landscape, offering quick and easily accessible funding to borrowers. However, this relatively new industry has also drawn the attention of regulators due to potential risks associated with high-interest rates and aggressive collection practices. The regulatory environment for Texas online title loans is evolving, with increased scrutiny from both state and federal authorities.

Key aspects of this landscape include stringent licensing requirements, mandatory vehicle inspections to ensure collateral value, and a focus on consumer protection. Borrowers now have better access to transparent terms and conditions through improved Online Application processes. Moreover, regulations encourage clear communication about loan payoff options, helping borrowers make informed decisions and avoid predatory lending practices.

– Overview of the online lending industry in Texas

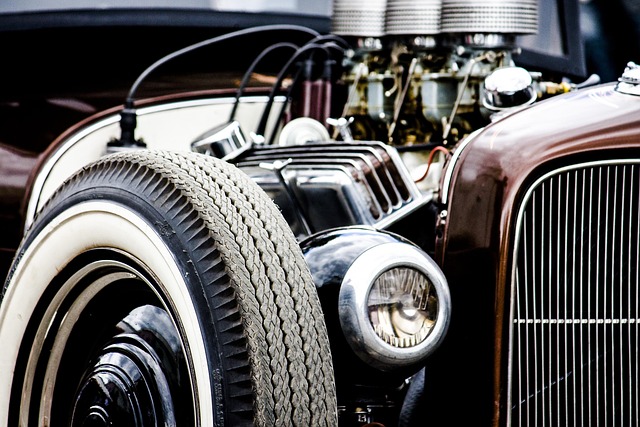

Texas, a state known for its robust economy and diverse financial landscape, has witnessed significant growth in the online lending sector, particularly when it comes to Texas online title loans. This type of lending has become increasingly popular among residents seeking quick cash solutions. The industry offers a range of services, including Fort Worth Loans, catering to various borrower needs. Online title loan operators provide short-term funding secured by an individual’s vehicle title, making it accessible to those with less-than-perfect credit.

Within Texas, the online lending market is highly competitive, with numerous platforms and lenders vying for customers. While this competition drives innovation, it also presents challenges in terms of regulation and consumer protection. Recent enforcement actions target specific operators, highlighting the state’s commitment to curbing abusive lending practices. These measures include strict oversight of Interest Rates and loan terms, ensuring borrowers receive fair treatment, especially when taking out Motorcycle Title Loans.

– Current legal framework and regulations for online title loans

In Texas, the legal framework surrounding online title loans is a complex web of regulations designed to protect consumers from predatory lending practices. The state has specific laws governing secured loans, including those backed by vehicles like cars or motorcycles. These regulations mandate that lenders provide clear and transparent terms, ensuring borrowers fully understand the loan’s conditions and potential consequences. An essential aspect of this framework is the requirement for an online application process, which must adhere to strict data security standards to safeguard sensitive financial information.

The current landscape sees a rise in enforcement actions against Texas online title loans operators, indicating a heightened focus on compliance. Lenders are expected to follow not only state laws but also federal guidelines related to consumer protection and fair lending practices. This includes verifying the legitimacy of borrowers’ identities and ensuring loans are extended based on the borrower’s ability to repay, thereby preventing unethical practices such as excessive interest rates or hidden fees, prevalent in some San Antonio loans operations. Additionally, the Texas Office of Consumer Credit Commissioner plays a vital role in monitoring and enforcing these regulations, especially regarding out-of-state lenders offering services within the state, emphasizing the need for robust compliance in the online title pawn industry.

As the regulatory landscape for Texas online title loans continues to evolve, increased enforcement actions underscore the growing importance of compliance. Lenders operating in this space must stay abreast of changing regulations and adapt their practices accordingly to avoid legal repercussions. By adhering to the evolving framework, lenders can ensure fair and transparent operations, fostering a sustainable and trusted environment for borrowers seeking short-term financial solutions.