Texas title loan no income verification borrowers share their real-life experiences, highlighting both benefits and challenges. Truckers and others appreciate quick access to cash via vehicle collateral, like Texas truck title loans, due to flexible payments and accessibility. However, they caution against potential pitfalls, emphasizing the need for responsible borrowing practices and thorough understanding. These loans offer an alternative financing method leveraging car equity, providing immediate funding without strict income verification or extensive paperwork.

“In the landscape of financial services, understanding real-life experiences is crucial. This article delves into the stories of Texas title loan borrowers who sought funding without providing income verification. Through their narratives, we explore the complexities and benefits of this unique loan option. From navigating challenging financial situations to unlocking access for all, these real-stories highlight the significance of Texas title loans as a viable alternative. Discover how individuals have successfully managed their finances in an often labyrinthine process.”

- Borrowers Share Their Real-Life Experiences

- Navigating Loan Options Without Income Verification

- Texas Title Loans: Unlocking Access for All

Borrowers Share Their Real-Life Experiences

In the world of Texas title loan no income verification borrowing, real-life stories offer a unique perspective. Many borrowers have shared their experiences with these alternative financing options, highlighting both the benefits and challenges they faced. One common theme among these narratives is the relief felt by those who needed quick access to cash but lacked traditional financial documentation.

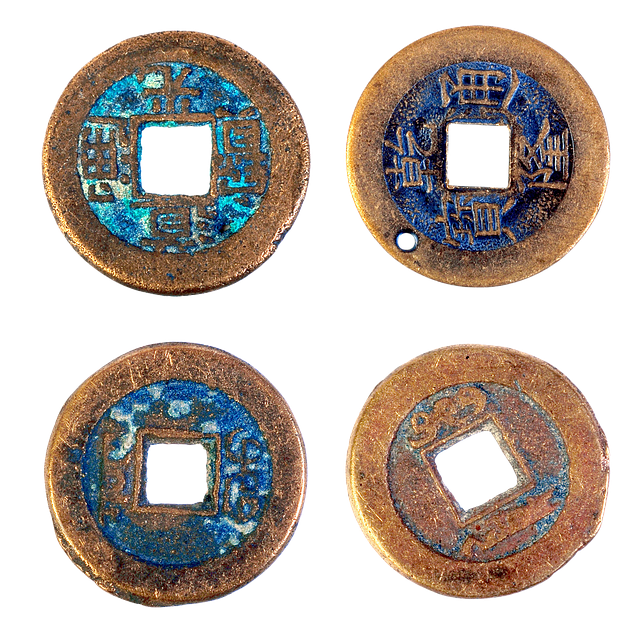

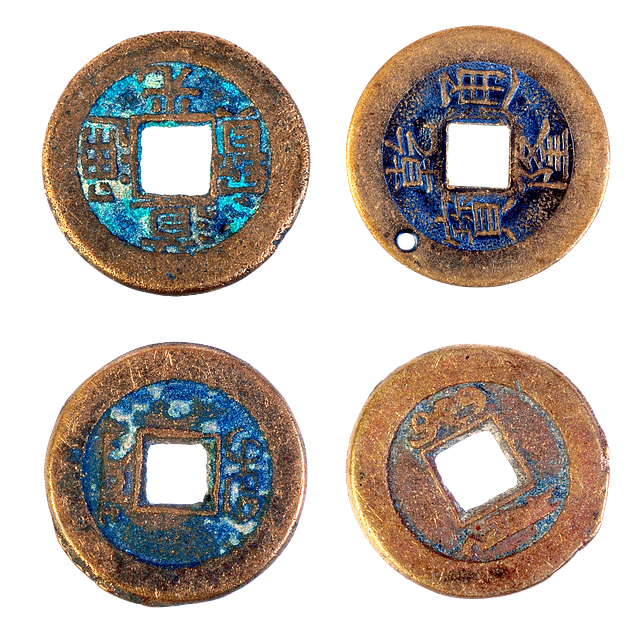

For instance, several truckers have relied on vehicle collateral, such as Texas truck title loans, to cover immediate expenses. They appreciate the flexible payments that align with their unpredictable work schedules. These borrowers vouch for the accessibility and speed of these loans, which can be a game-changer in times of financial emergency. However, they also caution against the potential pitfalls, emphasizing the importance of thorough understanding and responsible borrowing practices.

Navigating Loan Options Without Income Verification

Many individuals in Texas find themselves in situations where they need access to quick funding but are unable to provide traditional income verification. This is where Texas title loan no income verification options step in as a viable solution. These loans, secured against an individual’s vehicle, offer flexibility and accessibility for those who may not have the necessary paperwork or employment history to qualify for conventional loans.

Navigating this alternative financing landscape involves understanding the terms and conditions carefully. Lenders will typically require a clear car title, proof of vehicle ownership, and the ability to demonstrate consistent vehicle maintenance. Repayment options can vary, with some lenders offering flexible payment plans over an extended period, making it easier for borrowers to manage their debt. The process streamlines borrowing by utilizing the equity in one’s asset—in this case, the car—as collateral, providing a straightforward path to financial relief without the stringent verification processes of traditional loans.

Texas Title Loans: Unlocking Access for All

In Texas, where financial opportunities are as diverse as its landscapes, Texas Title Loans have emerged as a beacon of hope for many individuals seeking quick and accessible funding. These loans, often tailored to meet the unique needs of borrowers who may not have traditional employment or income verification, offer a streamlined solution for those in need of immediate financial assistance. By removing stringent income requirements, Texas Title Loans unlock doors for all, ensuring that even those with non-stable income streams can access much-needed capital.

The Texas Title Loan process is designed to be straightforward and efficient. Borrowers can apply online or through a local branch, providing details about their vehicle’s title and value. This approach not only simplifies the application but also enables individuals to secure loans without extensive paperwork or complex eligibility criteria. Furthermore, these loans often come with flexible terms and the option for loan extensions, providing borrowers with greater control over their repayment plans and the ability to manage unexpected financial burdens more effectively.

Real stories from Texas title loan no income verification borrowers highlight the power of accessible lending. By understanding their experiences, we can see how these loans provide a safety net for those in need, offering flexible options without the strictness of traditional income verification. Texas title loans have the potential to unlock financial stability for all, ensuring folks can access resources when it matters most.