Bankruptcy can lead to lenders seizing collateral like vehicles for title loans. While protections exist, they vary by region and debt type. Understanding loan eligibility, terms like "same-day funding," and assessing financial situations are crucial to avoid unforeseen consequences. Strategies include refinancing, tailored payment plans, temporary extensions, and open communication with lenders to navigate challenges and prevent bankruptcy.

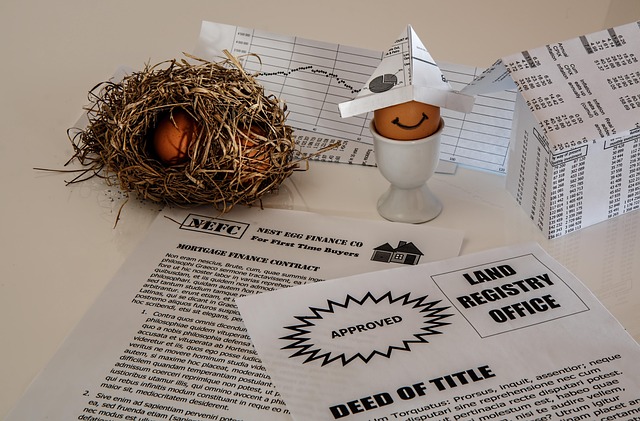

Title loans, a quick source of cash, can lead to significant financial strain if not managed wisely. Understanding the bankruptcy implications of these loans is crucial for maintaining assets. This article delves into the intricate process of title loan bankruptcy, exploring its impact on asset retention and highlighting legal protections available. We also provide actionable strategies to mitigate potential losses, equipping readers with knowledge to navigate this complex landscape successfully.

- Understanding Title Loan Bankruptcy Process

- Impact on Asset Retention: Legal Protections

- Strategies to Mitigate and Navigate Potential Losses

Understanding Title Loan Bankruptcy Process

When considering a title loan, it’s crucial to understand that bankruptcy can significantly impact your ability to retain assets. The process begins with a legal declaration that an individual or business is unable to repay debts. In the context of a title loan, this means the lender may seize and sell the collateral—typically a vehicle—to recover outstanding funds. Understanding the specifics of this process is essential for borrowers.

The bankruptcy code provides certain protections, but these vary based on jurisdiction and debt type. For instance, in some cases, individuals may be able to keep their vehicles if they meet specific criteria, such as having a valid need for transportation or demonstrating financial hardship. However, the burden of proof lies with the borrower, and the court will determine the outcome based on the presented facts. Key terms like “same-day funding” and “loan eligibility” without a robust understanding of one’s financial situation can lead to unforeseen consequences, especially if bankruptcy becomes a necessity later down the line.

Impact on Asset Retention: Legal Protections

When individuals face financial distress and consider bankruptcy, one area that significantly suffers is asset retention. In particular, those who have taken out title loans find themselves at a disadvantage due to the unique nature of these secured loans. During bankruptcy proceedings, the court may seize assets to fulfill debt obligations, and in the case of title loans, this can include the vehicle itself. This has profound implications for borrowers, potentially leaving them without their primary mode of transportation or other valuable possessions.

However, there are legal protections in place to safeguard certain assets, including those used as collateral for secured loans like title loans. In some instances, borrowers may be able to retain their vehicles by making arrangements such as loan refinancing or setting up payment plans that align with their post-bankruptcy financial standing. These strategies not only help preserve assets but also provide a measure of stability during a challenging period, allowing individuals to rebuild their financial health while adhering to bankruptcy regulations.

Strategies to Mitigate and Navigate Potential Losses

In light of potential Title loan bankruptcy implications, individuals facing financial distress should explore strategic avenues to mitigate and navigate these challenges. One effective approach is to prioritize open communication with lenders. By engaging in transparent discussions, borrowers can negotiate terms that may include extended loan periods, allowing for more time to resolve financial troubles without the immediate burden of repayment. Additionally, understanding one’s Loan Eligibility based on current financial standing is crucial; a thorough assessment can unveil options like restructuring or refinancing, which could prevent bankruptcy and preserve assets.

Another key strategy involves the comprehensive Vehicle Inspection process. Evaluating the value and condition of the vehicle securing the title loan provides a realistic perspective on potential losses. This assessment can inform decisions regarding loan modifications or even negotiation tactics with lenders. Moreover, considering a Loan Extension as a temporary solution can provide much-needed breathing room while exploring longer-term financial solutions, ensuring that bankruptcy remains a last resort.

Title loan bankruptcy implications can significantly impact asset retention, but with the right strategies, individuals can navigate these challenges effectively. Understanding the process, leveraging legal protections, and employing proactive measures can help mitigate potential losses. By staying informed and taking proactive steps, individuals can protect their assets while managing their financial obligations, ensuring a more stable future despite bankruptcy.