Donna Auto Title Loans offer quick funding using your vehicle's title as collateral, ideal for individuals with poor credit or no history. Approved funds are deposited directly into your bank account. To apply, ensure accurate vehicle details, understand repayment terms, prepare essential documents like proof of income and registration, and submit an online application.

“Looking to secure a loan in Donna using your vehicle’s title as collateral? Understandable, but be warned—mistakes can happen. In this guide, we’ll help you navigate the process with confidence by first demystifying Donna auto title loans and their benefits. We’ll then highlight common pitfalls to steer clear of during the application phase. Finally, discover practical strategies to increase your chances of approval and secure a fair loan.”

- Understanding Donna Auto Title Loans: Basics Explained

- Common Mistakes to Avoid When Applying

- Strategies for Securing a Loan With Confidence

Understanding Donna Auto Title Loans: Basics Explained

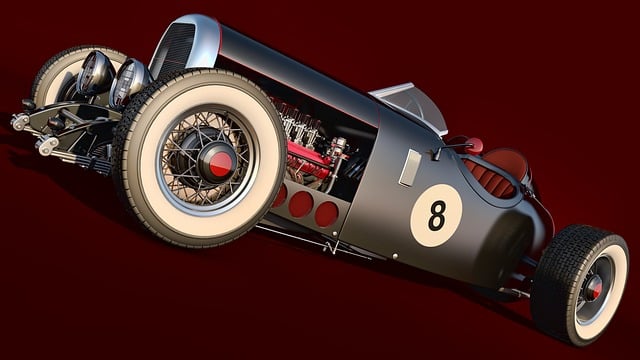

Donna Auto Title Loans, also known as secured loans using vehicle ownership, offer a way to access cash by leveraging the value of your motor vehicle. This type of loan is ideal for individuals who need quick funding and have a clear legal right to their vehicle’s title. The process involves borrowing money from a lender, using your car or motorcycle title as collateral. Once approved, you’ll receive funds directly into your bank account via direct deposit, providing convenient access to capital.

Understanding the basics of Donna Auto Title Loans is crucial for borrowers. Unlike traditional loans that rely on credit scores, these loans assess the value of your vehicle. Lenders verify your vehicle’s condition, make, model, year, and overall market value to determine loan eligibility. This straightforward approach allows individuals with less-than-perfect credit or no credit history to gain access to much-needed funds for various purposes, from emergencies to investments in business ventures.

Common Mistakes to Avoid When Applying

When applying for Donna auto title loans, it’s easy to make mistakes that could delay or even deny your application. One common error is failing to provide accurate and complete information about the vehicle being used as collateral. Always ensure all details like the make, model, year, and vehicle identification number (VIN) are correct and up-to-date. This transparency builds trust with lenders, increasing your chances of securing a loan quickly.

Another mistake to avoid is not understanding the purpose of these loans. Donna auto title loans are designed for short-term financial relief, often used for fast cash needs or debt consolidation. Applicants should clearly define their financial goals and ensure that taking out a Dallas title loan aligns with those objectives. Lenders will assess your ability to repay, so being honest about your income, expenses, and existing debts is crucial to avoid potential delays or rejections.

Strategies for Securing a Loan With Confidence

Securing a loan for your vehicle can be a straightforward process when you approach it with preparation and the right strategies in mind. When considering Donna auto title loans or even semi truck loans, understanding the requirements beforehand is key to success. Begin by gathering all necessary documents, such as proof of income, identification, and vehicle registration. This initial step ensures that you meet the basic eligibility criteria for any type of collateral loan, including those using your vehicle as security.

An often-overlooked advantage is submitting an online application. This modern approach saves time and provides convenience, allowing you to apply from the comfort of your home. The process is designed to be simple and efficient, making it easier to secure a loan without the hassle of traditional in-person visits. Additionally, having vehicle collateral significantly increases your chances of approval, as it offers lenders peace of mind regarding repayment.

When navigating the process of Donna auto title loans, being aware of common pitfalls can significantly enhance your experience. By understanding the fundamentals and implementing effective strategies, you can confidently secure a loan that meets your needs. Remember to stay informed, choose reputable lenders, and carefully review terms and conditions. With these tips in mind, you’re well-equipped to avoid common mistakes and make smart financial decisions regarding Donna auto title loans.