Texas online title loans usage varies with demographics and economic conditions. Young adults often seek them for emergencies, while higher-income earners use them for specific needs. During booms, inquiries rise, and downturns see approvals increase. Cars and motorcycles are popular collateral due to easy valuation. Online applications offer convenience and transparency, appealing to busy individuals. Financial institutions can tailor marketing to these diverse behaviors.

“Texas online title loans have seen significant growth, with data revealing intriguing trends in recent years. This article delves into the demographic factors driving demand, providing valuable insights on who is most likely to seek these loans. We explore time trends, uncovering monthly patterns that show peak loan uptake periods. Additionally, we analyze vehicle types commonly used as collateral security, offering a comprehensive look at the Texas online title loan landscape.”

- Analyzing Demographic Factors Influencing Loan Demand

- Time Trends: Monthly Uptake Patterns Unveiled

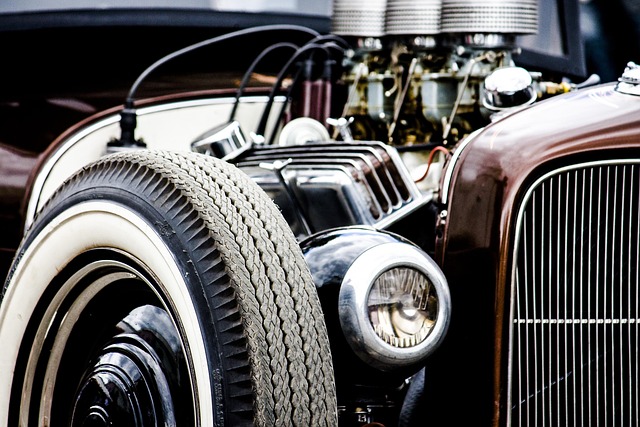

- Vehicle Types: Popular Choices for Collateral Security

Analyzing Demographic Factors Influencing Loan Demand

In the landscape of Texas online title loans, understanding demographic factors is key to deciphering loan uptake trends. Age, income levels, and geographic locations play a significant role in determining who seeks these financial services. Young adults, often facing unforeseen expenses or needing emergency funds, are increasingly turning to title loans as a quick solution. This trend highlights the need for accessible short-term financing options, especially among populations with limited traditional banking access.

Moreover, analyzing loan requirements and extension patterns reveals distinct behaviors across demographics. Higher-income earners may utilize these loans for specific, defined needs, while lower-income groups might rely on them as a regular source of emergency funds. Such insights are crucial for financial institutions to tailor marketing strategies and services, ensuring they meet the unique needs of Texas residents when it comes to online title loans.

Time Trends: Monthly Uptake Patterns Unveiled

The monthly uptake patterns of Texas online title loans offer a fascinating glimpse into consumer behavior and financial needs within the state. Data reveals consistent interest in this alternative financing option, with fluctuations tracking broader economic trends. During economic booms, there’s often a corresponding increase in loan inquiries, indicating that individuals seek to capitalize on their assets through titles loans for various purposes, including debt consolidation or funding unexpected expenses. Conversely, periods of economic downturn see a rise in loan approvals as Texans turn to this option for emergency financial support.

The stability and adaptability of Texas online title loans are underscored by consistent monthly demand. This financing method’s appeal lies in its accessibility; borrowers can leverage the value of their vehicles without the stringent requirements often associated with traditional loans. The process, streamlined by digital platforms, offers a swift solution for those needing quick cash, whether for debt consolidation or covering immediate financial obligations. The data highlights how vehicle valuation plays a pivotal role in loan approval rates, as consumers look to access liquidity securely and efficiently.

Vehicle Types: Popular Choices for Collateral Security

When it comes to securing Texas online title loans, vehicle types play a significant role in the loan approval process. The most popular choices for collateral security tend to be cars and motorcycles. These vehicles are easily valued through online car price guides and appraisal services, making them ideal for borrowers looking for quick approval without extensive credit checks. The simplicity of this process encourages more individuals to explore online title loans as a viable financial option.

The convenience of an online application further fuels the popularity of these types of loans. Borrowers can complete the entire process from the comfort of their homes, eliminating the need for in-person visits and saving them time. This accessibility is particularly appealing for those with busy schedules or limited mobility. Additionally, the transparent nature of online applications allows borrowers to understand the terms and conditions clearly, ensuring they make informed decisions regarding their financial needs.

Texas online title loans have emerged as a significant financial option, with data revealing notable trends in uptake. By analyzing demographic influences, monthly patterns, and vehicle preferences, we gain insights into the factors driving this market. These findings offer valuable knowledge for both lenders and borrowers, highlighting the appeal and accessibility of Texas online title loans within the digital lending landscape.