South Texas car title loans provide swift financial aid for local residents with urgent cash needs, leveraging vehicle titles as collateral for easy approval and quick access to funds, despite limited credit history. With flexible repayment options and potential refinancing benefits, these loans offer a convenient solution but should be explored cautiously to avoid intensifying financial strain.

In the vibrant landscape of South Texas, understanding accessible financial options is crucial for drivers seeking quick cash. This article delves into the world of South Texas car title loans, a popular choice for those in need. We’ll explore what these loans entail, who qualifies, and the advantages and drawbacks. By understanding South Texas car title loans, drivers can make informed decisions when facing financial challenges.

- Understanding South Texas Car Title Loans

- Eligibility Criteria for South Texas Drivers

- Benefits and Considerations of Car Title Loans in South Texas

Understanding South Texas Car Title Loans

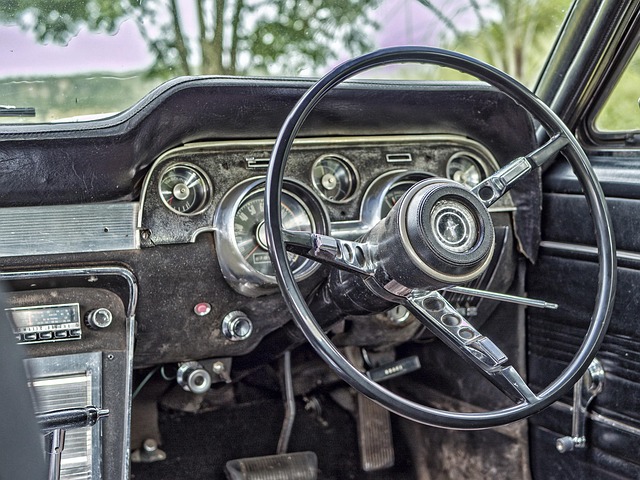

In South Texas, car title loans have emerged as a popular financial solution for many residents facing immediate cash needs. These short-term, high-interest loans are secured by an individual’s vehicle title, allowing lenders to offer quick access to funds with relatively less stringent requirements compared to traditional bank loans. This option is particularly attractive to those in need of emergency cash or who have limited credit history, as it does not require a perfect credit score for approval.

Understanding the process behind South Texas car title loans is crucial. Borrowers retain possession of their vehicles while providing the loan provider with the title as collateral. Once the loan is repaid, including interest and fees, the lender returns the title to the borrower. The key advantage lies in the flexibility they offer, especially for those who need a quick influx of cash without the extensive waiting periods associated with traditional loans. An online application process further streamlines the experience, making it easily accessible for South Texas residents who value convenience and swift financial aid.

Eligibility Criteria for South Texas Drivers

South Texas car title loans offer a unique opportunity for local drivers to gain access to quick funds using their vehicle as collateral. To be eligible for such loans, applicants must meet certain criteria. Firstly, they need to own a vehicle with a clear and valid registration, ensuring there are no outstanding liens or existing loans on the same asset. This process ensures lenders can easily verify ownership and assess the value of the collateral.

Additionally, South Texas drivers should be prepared to demonstrate their ability to repay the loan. Lenders typically require proof of income, such as pay stubs or tax returns, to ensure borrowers have a stable financial standing. While these loans are often marketed for debt consolidation, like Dallas Title Loans or Title Pawn options, it’s essential to consider other factors and explore all available solutions to avoid further financial strain.

Benefits and Considerations of Car Title Loans in South Texas

South Texas car title loans offer a unique financial solution for residents facing urgent cash needs. One of the primary benefits is their accessibility; unlike traditional bank loans, these loans don’t require perfect credit or extensive documentation. This makes them an attractive option for those with limited options due to bad credit history. The process is straightforward: drivers can use their vehicle’s title as collateral, allowing for quicker approval and access to funds, often within a single business day. This can be particularly useful during unexpected financial emergencies or when time is of the essence.

Additionally, South Texas car title loans provide flexibility in terms of repayment with options for direct deposit into borrowers’ accounts, making it easier to manage loan payments. Borrowers can also benefit from customizable repayment plans, ensuring they make manageable monthly payments without the stress of lump-sum repayments. Moreover, refinancing options are available for those who find themselves in a position to pay off their loan early, allowing them to save on interest costs. This aspect offers peace of mind and encourages responsible borrowing practices.

South Texas car title loans can provide a quick solution for drivers in need of cash. By understanding the eligibility criteria, benefits, and considerations outlined in this article, you’re better equipped to make an informed decision. Remember, these loans offer access to funds using your vehicle’s title as collateral, making them a viable option when traditional banking routes are limited. Always weigh the advantages and potential risks before proceeding, ensuring it aligns with your financial goals and circumstances.