Car title loan consumer advocacy groups fight against predatory practices, pushing for transparent terms, flexible repayment options, and education to protect borrowers from high-interest rates and debt traps. They lobby for regulations that ensure fair lending, vehicle inspections, and direct deposit services, empowering individuals to make safer financial choices.

The car title loan industry has come under increasing scrutiny from consumer advocates, who highlight its potential pitfalls for borrowers. With high-interest rates and strict repayment terms, many consumers find themselves in a cycle of debt. This article explores the impact of the industry on vulnerable individuals and the efforts of advocacy groups to protect borrowers’ rights. We delve into proposed consumer protection measures, aiming to provide clarity and safeguard against exploitative practices within the car title loan sector.

- Uncovering Car Title Loan Industry's Impact on Consumers

- Advocacy Groups: Protecting Borrowers' Rights and Interests

- Consumer Protection Measures: What Advocates Propose

Uncovering Car Title Loan Industry's Impact on Consumers

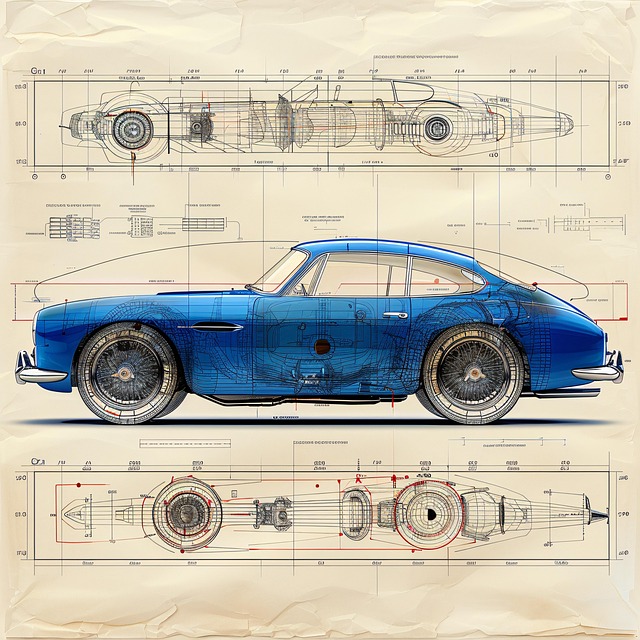

The car title loan industry has long been a subject of debate due to its impact on consumers. Advocates for consumer advocacy groups argue that these loans often trap borrowers in a cycle of debt, known as a “title transfer” or “title pawn.” With high-interest rates and stringent repayment terms, many consumers find themselves unable to repay the full amount borrowed, leading to the loss of their vehicles. This not only affects their financial stability but also has significant emotional repercussions, especially for those who rely on their cars as primary means of transportation.

These advocacy groups highlight the importance of transparency and fair lending practices within the industry. They advocate for better regulations that protect consumers from exploitative lenders, ensuring they understand the full implications of taking out a car title loan. By educating borrowers about potential risks and providing alternatives, such as financial counseling or emergency aid programs, these advocates strive to empower consumers to make informed decisions, thereby mitigating the negative effects often associated with Car Title Loans.

Advocacy Groups: Protecting Borrowers' Rights and Interests

Advocacy groups play a pivotal role in shaping public discourse around the car title loan industry by championing the rights and interests of borrowers. These consumer advocacy organizations aim to ensure fair lending practices, transparent communication, and equitable terms for individuals seeking short-term financial solutions through car title loans.

By advocating for robust consumer protection measures, such as thorough vehicle inspections before extending loans and flexible payment plans tailored to borrowers’ financial capabilities, these groups help safeguard consumers from predatory lending tactics. They also promote awareness about the potential risks associated with car title loans, empowering individuals to make informed decisions about their finances. Through lobbying efforts, public education campaigns, and direct intervention in controversial loan cases, advocacy groups strive to create a more balanced and favorable environment for borrowers navigating challenging financial situations.

Consumer Protection Measures: What Advocates Propose

Advocates for car title loan consumer protection emphasize the need for robust regulations to safeguard borrowers from predatory lending practices. They propose measures such as transparent and clear terms, including detailed disclosures about interest rates, fees, and repayment schedules. These advocates also urge lenders to provide accurate information about the potential consequences of defaulting on the loan, focusing on the long-term financial impact.

Moreover, they recommend that lenders offer flexible repayment options, especially for borrowers seeking debt consolidation or cash advances. Direct Deposit services could be made more accessible, ensuring borrowers receive their funds securely and promptly. Such protections aim to empower consumers, enabling them to make informed decisions while mitigating the risks associated with car title loans.

The car title loan industry has faced scrutiny for its potential negative impact on consumers. However, dedicated advocacy groups are working tirelessly to protect borrowers’ rights and interests through robust consumer protection measures. By proposing clear guidelines and transparent practices, these advocates aim to ensure that individuals in need of quick funding have access to safe and fair lending options. Their efforts underscore the importance of responsible lending and highlight the ongoing need for regulatory oversight within the car title loan sector.