Car title loans Sherman TX provide quick financial aid using a borrower's vehicle as collateral, offering faster access than traditional bank loans and suitable for individuals with less-than-perfect credit. These loans have manageable repayment terms and competitive interest rates, ideal for emergencies or debt consolidation. However, responsible repayment is crucial to avoid late payment consequences and potential legal issues. Understanding loan requirements and negotiation strategies is key. Alternatives like Dallas title loans exist but require thorough research.

In today’s financial landscape, Car title loans Sherman TX offer a unique solution for quick cash needs. Understanding this alternative financing option is crucial before borrowing. This article breaks down the basics of car title loans, clarifies eligibility criteria, and provides repayment strategies for borrowers in Sherman, TX. By navigating these aspects responsibly, individuals can make informed decisions regarding their financial future.

- Understanding Car Title Loans: Basics and Benefits

- Eligibility Criteria: Who Qualifies for Sherman TX Car Title Loans?

- Repayment Options and Strategies for Borrowers

Understanding Car Title Loans: Basics and Benefits

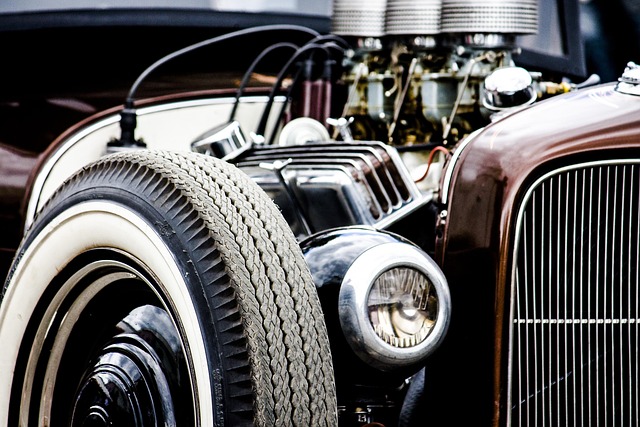

Car title loans Sherman TX have gained popularity as a quick solution for individuals seeking financial assistance. This type of loan is secured by the borrower’s vehicle, typically a car or truck, with the lender holding the title until the loan is repaid. The process involves assessing the vehicle’s value and offering a loan amount based on that assessment, often providing faster access to funds compared to traditional bank loans. One significant advantage is that even those with less-than-perfect credit can qualify, as the focus is primarily on the vehicle’s equity rather than the borrower’s financial history.

The benefits extend further, especially for those in need of quick cash for emergencies or debt consolidation. Car title loans Sherman TX offer manageable repayment terms, allowing borrowers to pay back the loan over a period that suits their financial capabilities, often with competitive interest rates. Moreover, it can be a strategic move for individuals looking to consolidate high-interest debt, providing relief from multiple lenders and potentially lowering overall monthly payments. However, it’s crucial to approach this option responsibly, understanding the loan requirements and potential consequences if not repaid on time.

Eligibility Criteria: Who Qualifies for Sherman TX Car Title Loans?

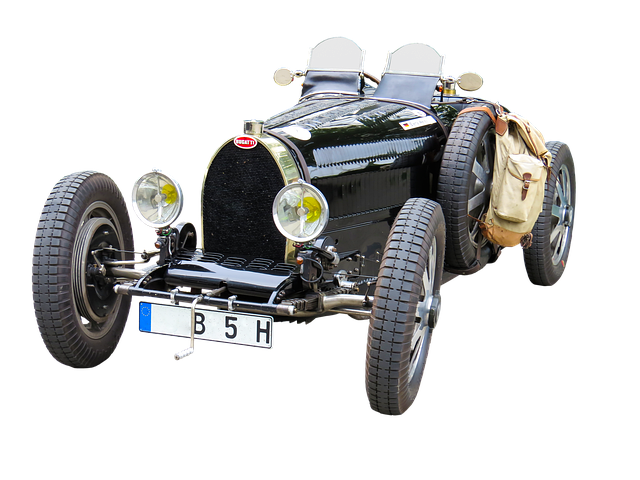

Car title loans Sherman TX are designed for individuals who need quick financial assistance and have a clear vehicle ownership. To qualify, borrowers must meet specific eligibility criteria. Typically, lenders require proof of income to ensure repayment capability, a valid driver’s license or state ID, and a clear vehicle title in their name. The vehicle itself should have adequate equity to secure the loan amount.

While these loans offer fast cash solutions, it’s crucial to understand the loan terms. Borrowers agree to hand over the car title as collateral until the debt is repaid, often with interest. Repayment periods vary but usually range from 30 days to a year, and borrowers can expect competitive interest rates compared to traditional short-term loans. Ensuring you meet these eligibility standards and thoroughly understand the terms will help make informed decisions regarding car title loans Sherman TX.

Repayment Options and Strategies for Borrowers

When considering Car title loans Sherman TX, borrowers must be aware of their repayment options and strategies to ensure a responsible borrowing experience. These loans are secured by your vehicle’s title, meaning your car acts as collateral. This provides lenders with a level of security but also places an obligation on you to repay the loan according to agreed-upon terms. Repayment plans can vary significantly, from short-term loans with higher interest rates to longer-term agreements with more manageable monthly payments.

Borrowers should explore different repayment strategies, such as making early payments to reduce interest accrual or negotiating terms that align with their financial capabilities. It’s crucial to understand the loan agreement, including the interest rate, repayment schedule, and any additional fees. Maintaining open communication with lenders can help manage expectations and avoid defaulting on the loan, which could result in a title transfer or other legal consequences. For those seeking alternatives to traditional loans, exploring Dallas title loans or considering options beyond vehicle collateral may be beneficial, but thorough research is always advised.

Car title loans Sherman TX can be a viable option for those in need of quick cash, but it’s crucial to approach this decision responsibly. By understanding the basics, eligibility requirements, and repayment strategies, borrowers can make informed choices. Before proceeding, assess your financial situation and ensure you meet the criteria to avoid potential pitfalls. Car title loans offer benefits, but proper planning and knowledge are essential for a positive borrowing experience.