Benbrook auto title loans offer swift financial aid by leveraging vehicle equity, catering to diverse car models with fair assessments. Same-day funding provides emergency solutions, but responsible borrowing is crucial to avoid long-term strain and significant risks like high-interest rates and repossession.

“Benbrook auto title loans offer a unique financial solution for those seeking quick access to capital. This type of loan, secured by your vehicle’s title, provides a streamlined alternative to traditional lending. In this article, we explore the benefits and risks associated with Benbrook auto title loans. By understanding how these loans can stabilize your financial situation or present potential challenges, you’ll be better equipped to make informed decisions regarding your financial health.”

- Understanding Benbrook Auto Title Loans: Unlocking Access to Capital

- Benefits: How These Loans Can Stabilize Your Financial Situation

- Risks and Considerations: Navigating Potential Challenges

Understanding Benbrook Auto Title Loans: Unlocking Access to Capital

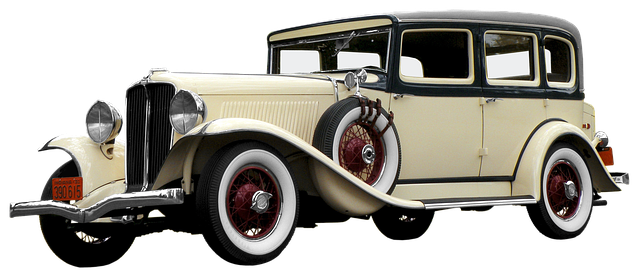

Benbrook auto title loans offer a unique financial solution for individuals seeking quick access to capital. This type of loan utilizes the equity in your vehicle, specifically its title, as collateral. By leveraging this asset, lenders can provide funds relatively faster than traditional loan methods. The process involves applying for a loan, where your vehicle’s title is reviewed and assessed for value. Upon approval, known as loan approval, you receive the borrowed amount, which can be used for various purposes, including covering unexpected expenses or emergency funds.

Unlike motorcycle title loans, which have specific requirements for the vehicle type, Benbrook auto title loans are more inclusive, catering to a broader range of car models and conditions. This accessibility makes it an attractive option for many looking to bridge financial gaps. While there are benefits, it’s crucial to approach any loan responsibly, ensuring you can meet the repayment terms without causing long-term financial strain.

Benefits: How These Loans Can Stabilize Your Financial Situation

Benbrook auto title loans offer a unique advantage for individuals seeking quick financial support. One of the primary benefits is their ability to provide stable and accessible funding, especially in times of unexpected expenses or emergencies. When you apply for a Benbrook auto title loan, the process is designed to be efficient, ensuring fast cash delivery within the same day of approval. This rapid funding can be a game-changer when immediate financial relief is required.

These loans are secured by your vehicle’s title, which means you keep full control over your asset while accessing much-needed capital. The loan approval process is straightforward and involves assessing the value of your vehicle, ensuring a fair agreement. This option stabilizes your financial situation by offering a manageable repayment plan tailored to your budget, allowing for greater peace of mind during challenging times.

Risks and Considerations: Navigating Potential Challenges

When considering Benbrook auto title loans, it’s crucial to weigh both the benefits and potential risks. These types of loans use your vehicle ownership as collateral, a factor that significantly impacts your financial health. While this can provide access to capital quickly, there are significant challenges to bear in mind. Should you be unable to repay the loan, you risk losing your vehicle through repossession. This not only ends your reliance on the vehicle for transportation but also disrupts your daily routine and financial stability.

In terms of Houston title loans or any similar arrangement, it’s essential to carefully evaluate your financial situation before committing. Assessing your ability to manage the loan repayments without compromising other essential expenses is paramount. It’s worth noting that high-interest rates are a common feature of such loans, adding to the overall cost and increasing the risk for borrowers. Specifically, Benbrook auto title loans may not be suitable for everyone, especially those with shaky financial ground or inconsistent income streams.

Benbrook auto title loans offer a unique financial solution, providing access to capital quickly and conveniently. While they present benefits like stability for borrowers in need, it’s crucial to approach them with caution. Understanding both advantages and risks is essential to making an informed decision about these loans. By weighing the potential impact on your financial health, you can navigate this option wisely, ensuring a positive outcome that aligns with your long-term financial goals.