Title loan risk assessment in Houston involves evaluating borrower financial health, vehicle collateral, debt-to-income ratios, employment history, and vehicle condition through detailed inspections. Lenders assess ownership status, existing loans, mechanical state, and minimum requirements to secure the loan. Comprehensive assessments protect both parties, ensure responsible lending, and offer borrowers competitive rates, flexible plans, and potential for improved loan conditions.

Looking to secure a title loan but unsure about what to expect? Understanding the title loan risk assessment process is crucial. This in-depth guide breaks down the factors lenders consider during their evaluation, from vehicle condition to your credit history. Learn how mitigating risks can enhance your loan terms and ensure a smoother borrowing experience. Get ready to navigate the process with confidence.

- Understanding Title Loan Risk Assessment Process

- Factors Considered During a Title Loan Check

- Mitigating Risks for Better Loan Terms

Understanding Title Loan Risk Assessment Process

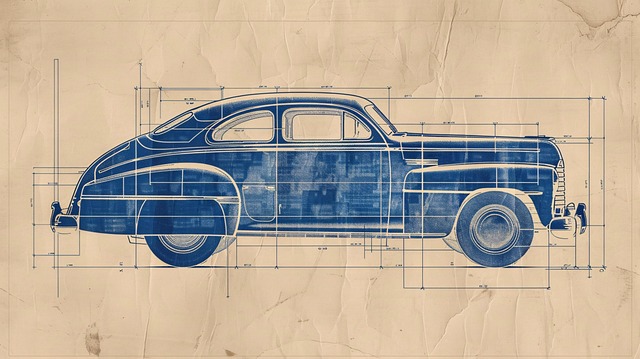

The process of assessing risk in a title loan is a crucial step that both lenders and borrowers should understand. It involves a thorough evaluation of various factors related to the borrower’s financial health and the collateral being offered—in this case, the vehicle ownership. This assessment goes beyond just examining one’s credit score; it delves into analyzing the overall debt-to-income ratio, employment history, and, most importantly, the condition and value of the vehicle in question, as determined through a meticulous vehicle inspection.

In the context of Houston Title Loans, borrowers can expect this risk assessment to be comprehensive. Lenders will appraise the vehicle’s ownership status, condition, and current market value. The vehicle inspection typically includes checking for any existing loans or liens on the car, evaluating its mechanical and cosmetic state, and ensuring it meets the minimum requirements set by the lender. This meticulous process is designed to safeguard both parties, ensuring that the loan is secure and that borrowers are committed to repaying their debts while maintaining clear vehicle ownership.

Factors Considered During a Title Loan Check

When conducting a title loan risk check, several key factors are carefully evaluated to determine the borrower’s eligibility and assess potential risks. These assessments go beyond basic credit scores and financial history. Lenders consider various elements, including the loan payoff terms and conditions, to ensure borrowers can make timely repayments. The lender will also examine the vehicle equity, evaluating the market value of the vehicle against the loan amount requested. This step is crucial in gauging the collateral’s viability and potential loss if the borrower defaults.

Additionally, the lender may look into factors such as the borrower’s employment history and income stability to predict repayment capabilities. They also assess the overall financial health of the borrower by reviewing existing debts and obligations. These comprehensive title loan risk assessments are designed to protect both the lender and the borrower, ensuring that loans are granted responsibly and with a higher likelihood of successful repayment.

Mitigating Risks for Better Loan Terms

A comprehensive title loan risk assessment is a critical step in securing better loan terms. Lenders utilize this process to evaluate the potential risks associated with lending against your vehicle, ensuring both parties are protected. By analyzing various factors, lenders can offer more competitive rates and flexible repayment plans. This benefits borrowers by providing them with access to quick funds while keeping their collateral safe.

During a title loan risk check, lenders consider your vehicle’s value, your ability to repay the loan, and any existing liens or outstanding issues on the title. By addressing these risks upfront, you position yourself for favorable loan conditions, such as longer repayment periods, lower interest rates, and even the option of loan refinancing if your financial situation improves. It’s a proactive step that encourages responsible borrowing, ensuring you keep your vehicle while accessing much-needed funds.

A thorough title loan risk assessment is key to securing favorable loan terms. By understanding the factors that impact this process, borrowers can proactively mitigate risks and make informed decisions. Navigating the complexities of a title loan check empowers folks to access needed funds while minimizing potential pitfalls. In light of these insights, remember that an educated borrower is better equipped to manage their financial obligations and avoid surprises.