Title loans for business expenses provide quick capital access using vehicle titles as collateral, ideal for emergency funding. With higher interest rates and risks, choosing reputable lenders with clear processes, fair practices, and flexible repayment options is crucial. These loans are suitable for businesses with less-than-perfect credit, helping fund essential areas like inventory or equipment upgrades. A well-planned payoff strategy ensures effective navigation of unexpected costs and supports business growth.

In today’s dynamic business landscape, accessing flexible financing options is paramount for growth. Among alternative lending methods, title loans stand out as a powerful tool for entrepreneurs seeking quick and secure funding for unexpected business expenses. This article delves into the intricacies of understanding and utilizing title loans for business needs, highlighting the importance of choosing reputable providers to ensure a smooth and successful borrowing experience.

- Understanding Title Loans for Business Expenses

- Choosing Reputable Providers for Business Financing

- Leveraging Title Loans: Strategies for Smart Business Spending

Understanding Title Loans for Business Expenses

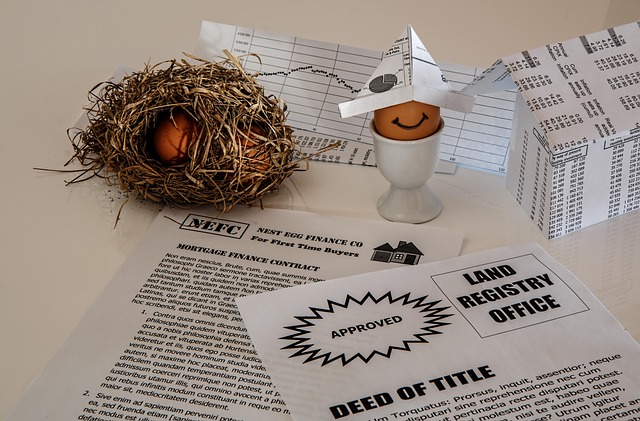

Title loans for business expenses are a financial tool that offers businesses a quick and convenient way to access capital. This type of loan uses the value of a business’s assets, such as real estate or equipment, as collateral. The process involves a lender evaluating the asset’s worth and providing a loan amount based on its equity, with repayment typically structured over a shorter period compared to traditional loans.

For businesses in need of emergency funds or facing unexpected cash flow issues, San Antonio Loans can be a viable option. This type of financing is particularly useful for small and medium-sized enterprises (SMEs) that may not have access to conventional banking services or require immediate funding for expansion, inventory purchases, or covering operational costs. It’s important to remember that while these loans offer rapid access to capital, they carry higher interest rates and potential risks due to the collateralized nature of the loan.

Choosing Reputable Providers for Business Financing

When seeking a title loan for business expenses, selecting reputable providers is paramount to ensure a smooth and beneficial borrowing experience. It’s crucial to look beyond the attractive interest rates and focus on lenders with strong reputations in the industry. Check their credentials, licensing, and customer reviews to gauge their reliability and transparency. Reputable providers will have clear and concise loan requirements, easy application processes, and fair practices for loan approval and eligibility determination.

A trustworthy lender should be able to explain the entire process openly, highlighting any potential fees or charges upfront. They should also offer flexible repayment options tailored to business needs. Prioritize companies that value long-term customer relationships over quick, short-term gains. This ensures not only a safer loan but also a supportive partnership for your business’s financial journey.

Leveraging Title Loans: Strategies for Smart Business Spending

Leveraging a title loan for business expenses can be a strategic financial decision for entrepreneurs looking to access immediate capital. These loans use your vehicle’s title as collateral, offering a quick and convenient funding solution. Unlike traditional bank loans, which may have stringent requirements and lengthy approval processes, Fort Worth loans provide an alternative for those with less-than-perfect credit.

When considering a title loan, business owners should develop a clear strategy for spending. Prioritizing essential expenses like inventory acquisition, marketing campaigns, or equipment upgrades can maximize the benefits of these short-term loans. Even options like boat title loans, while niche, can be utilized for specific business needs, such as funding a sailing adventure to promote your brand. A well-planned payoff strategy ensures that these loans serve as effective tools for navigating unexpected costs and driving business growth.

When considering a title loan for business expenses, it’s crucial to select trusted providers who offer transparent terms and competitive rates. By understanding the intricacies of these loans and strategically leveraging them, businesses can access much-needed capital to navigate challenging financial landscapes. Remember that smart spending and careful planning are key to making the most of a title loan, ensuring your business thrives rather than struggles.