The Title Loan Payment Calculator helps borrowers in San Antonio by offering transparent and precise financial insights for title loans, considering vehicle valuation, interest rates, and loan terms to accurately calculate monthly payments. It saves time, allows comparisons, and aids strategic repayment decisions, empowering users to make informed choices without hidden surprises.

A Title loan payment calculator is an indispensable tool for anyone considering a title loan as part of their financial planning. This article breaks down the complexities of understanding title loan payments, highlighting the benefits of using a dedicated calculator. We’ll explore key features and tools these calculators offer, empowering you to make informed decisions about short-term lending options. Discover how a simple calculation can significantly impact your financial trajectory.

- Understanding Title Loan Payments: A Primer

- The Benefits of Using a Payment Calculator

- Key Features and Tools in a Title Loan Calculator

Understanding Title Loan Payments: A Primer

Understanding Title Loan Payments: A Primer

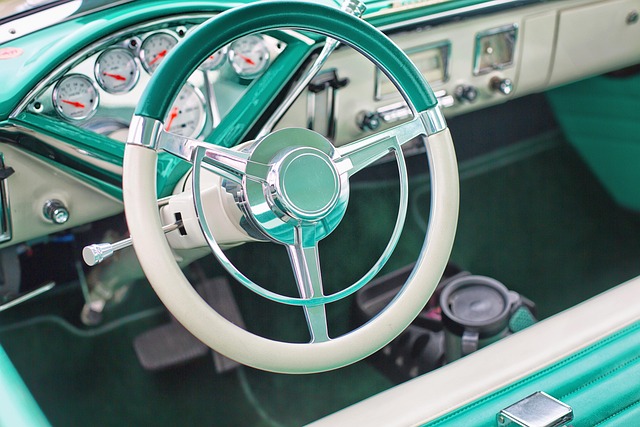

When considering a title loan payment calculator, it’s essential to grasp the basics of how these loans work and what goes into calculating your payments. Unlike traditional loans, title loans are secured by the ownership of a vehicle, typically a car or truck. This means that you’re pledging your vehicle as collateral for the loan amount. The primary factor influencing your monthly payments is the total loan value, which is determined by evaluating your vehicle’s worth based on its make, model, year, and overall condition.

The title loan payment calculator also takes into account the length of your repayment period, usually ranging from 12 to 48 months in Fort Worth loans. Flexible payments are a key feature, allowing borrowers to spread out the cost over a longer term. This can make these loans more manageable for those who need quick access to cash but might struggle with shorter repayment periods. However, it’s crucial to remember that interest rates vary and can significantly impact the overall cost of borrowing.

The Benefits of Using a Payment Calculator

Using a Title loan payment calculator offers several benefits to anyone considering a title pawn or loan extension. Firstly, it provides a clear and precise understanding of the financial commitment involved. By inputting specific details about the vehicle valuation and proposed loan terms, borrowers can instantly see how much they will pay each month, including interest rates and fees. This transparency empowers them to make informed decisions without hidden surprises.

Additionally, these calculators save time and effort in navigating complex loan structures. They allow users to quickly compare different scenarios – like varying loan amounts or repayment periods – to identify the best option aligned with their financial planning goals. Whether it’s paying off the title pawn faster or stretching out payments for better manageability, a calculator serves as a valuable tool throughout the entire process.

Key Features and Tools in a Title Loan Calculator

A Title Loan Payment Calculator is a powerful online tool designed to simplify and demystify the process of financial planning for borrowers considering San Antonio loans. This calculator offers several key features that make it an invaluable resource for anyone looking to understand their loan obligations better. It allows users to input specific details about the loan, such as the principal amount, interest rate, and loan term, enabling precise calculations of monthly payments. By providing a clear breakdown of these payments, borrowers gain a deeper understanding of their financial commitments, helping them make informed decisions regarding debt consolidation or managing secured loans.

Moreover, some advanced calculators may include features like amortization schedules, which detail how much of each payment goes towards interest and principal reduction. This feature is particularly useful for those seeking to pay off their loans faster or explore various repayment scenarios. With these tools, borrowers can easily compare different loan offers and choose the one that best aligns with their financial goals, ensuring they make strategic decisions without hidden surprises.

A Title loan payment calculator is an invaluable tool for anyone considering this type of loan. By offering clear insights into potential repayment plans, it empowers borrowers to make informed financial decisions. With its ability to factor in varying interest rates and loan terms, this calculator ensures you understand the full scope of your payments, enabling better long-term financial planning.