Killeen title loans offer swift financial aid secured by your vehicle's title, skipping credit checks. Legitimacy and comparison are key; verify lenders through licensing, compare rates, and understand vehicle inspection implications. Evaluate lending processes, transparency, customer support, and flexible repayment options for an informed decision.

“In Killeen, TX, understanding your options is key when considering a title loan. This financial tool can offer quick cash, but choosing the right provider is crucial for a positive experience. This guide breaks down the process of comparing title loan providers in Killeen, focusing on essential factors like interest rates, lending terms, and customer service. By following these steps, you’ll navigate the market efficiently, securing the best possible deal for your Killeen title loans.”

- Understanding Killeen Title Loans: Basics and Benefits

- Evaluating Lenders: Key Factors to Consider in Killeen

- Secure Lending Process: Steps to Compare Providers Effortlessly

Understanding Killeen Title Loans: Basics and Benefits

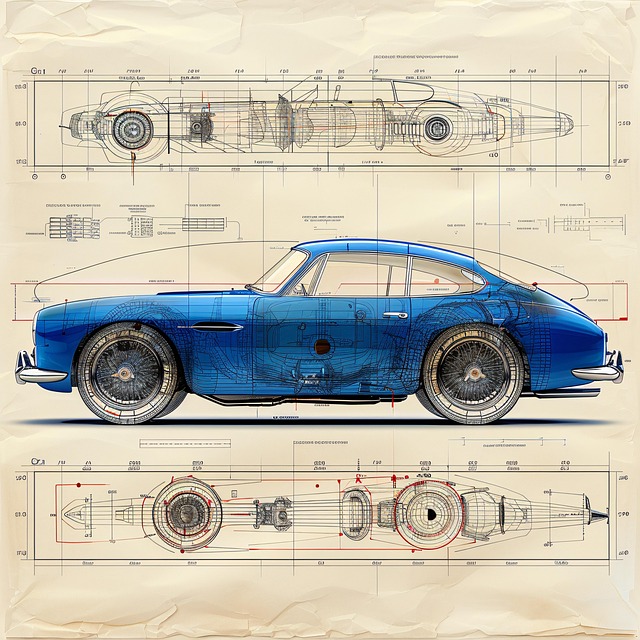

In Killeen TX, Killeen title loans offer a unique and beneficial financial solution for individuals seeking quick access to cash. This type of loan is secured by the title of your vehicle, allowing lenders to provide approvals based on your vehicle’s value rather than strictly your credit score. The process is designed to be efficient, often resulting in quick approval, making it an attractive option for those needing emergency funds fast.

Unlike traditional loans that may require extensive paperwork and a lengthy application process, Killeen title loans streamline the experience. Borrowers can use their vehicle’s title as collateral, enabling them to obtain funds without the rigorous credit checks commonly associated with other loan types. Furthermore, these loans offer flexibility in terms of repayment, and some providers even allow for loan refinancing, making it an adaptable solution to meet various financial needs.

Evaluating Lenders: Key Factors to Consider in Killeen

When evaluating lenders for Killeen title loans, several key factors come into play to ensure you make an informed decision. First and foremost, check the lender’s legitimacy and reputation by verifying their licensing and insurance. Reputable lenders adhere to state regulations, providing transparency in their terms and conditions. This is crucial for protecting your rights as a borrower.

Additionally, compare interest rates offered, keeping in mind that lower isn’t always better. Consider fees associated with the loan, such as administration or documentation charges. Some providers may offer flexible repayment plans or discounts based on your vehicle’s condition, like those specializing in boat title loans within Killeen. Ensure you understand the terms regarding vehicle inspection, as this step is essential for assessing your collateral value accurately.

Secure Lending Process: Steps to Compare Providers Effortlessly

When comparing Killeen title loans providers, understanding the lending process is key to making an informed decision. The most secure lending practices ensure your information and property rights are protected throughout the loan period. Start by evaluating each provider’s application process – many offer online forms for convenience. Compare the steps involved, document requirements, and timeframes for approval. A reputable lender will provide clear terms and conditions regarding interest rates, repayment schedules, and any additional fees.

Next, assess their customer support channels. Look for providers with transparent communication practices, offering phone, email, or live chat options. Efficient and responsive customer service is crucial during the loan term, especially when navigating payment plans or seeking clarification on charges. Additionally, verify if they offer flexible repayment options, such as direct deposit or personalized payment plans, catering to your financial comfort and stability.

When exploring Killeen title loans, understanding the key factors that differentiate lenders is crucial. By carefully evaluating each provider based on their interest rates, loan terms, and customer service, you can make an informed decision that aligns with your financial needs. Remember, a secure lending process involves transparent communication and straightforward terms, ensuring a stress-free experience as you access the funds you require.