Emergency Title Loans Texas provide a quick cash solution for self-employed individuals with limited credit options, offering online/local applications evaluating income and property ownership. Though bypassing traditional credit checks, these loans carry high-interest rates and repossession risks if defaulted, making them a last resort for urgent needs like unexpected bills or medical emergencies. Reputable lenders identified through research offer transparent terms, enabling access to funds within hours.

“In times of financial crisis, self-employed individuals in Texas may find themselves seeking immediate liquidity. Emergency Title Loans Texas offer a unique solution for those needing swift funding. This article explores the intricacies of these loans, focusing on their requirements, benefits tailored to self-employed borrowers, and an in-depth look at the application process. Discover how these short-term loans can provide a lifeline during unexpected events while understanding potential risks associated with this form of financing.”

- Understanding Emergency Title Loans Texas Requirements

- Benefits and Risks for Self-Employed Borrowers

- Navigating the Application Process for Quick Funding

Understanding Emergency Title Loans Texas Requirements

When considering Emergency Title Loans Texas for self-employed borrowers, understanding the requirements is key to securing a financial solution. These loans are designed to provide quick access to cash during unforeseen circumstances, offering a practical option for those with limited credit options. The process involves several steps, ensuring transparency and fairness. Lenders will evaluate your income, employment history, and property ownership to determine eligibility.

One of the significant advantages is that these loans often cater to individuals with bad credit or no credit history. The title loan process is straightforward; you can typically apply online or through a local lender. It’s a fast-paced financial solution, allowing borrowers to access funds within hours after meeting the necessary requirements. This option proves invaluable when facing unexpected bills, medical emergencies, or other urgent financial needs.

Benefits and Risks for Self-Employed Borrowers

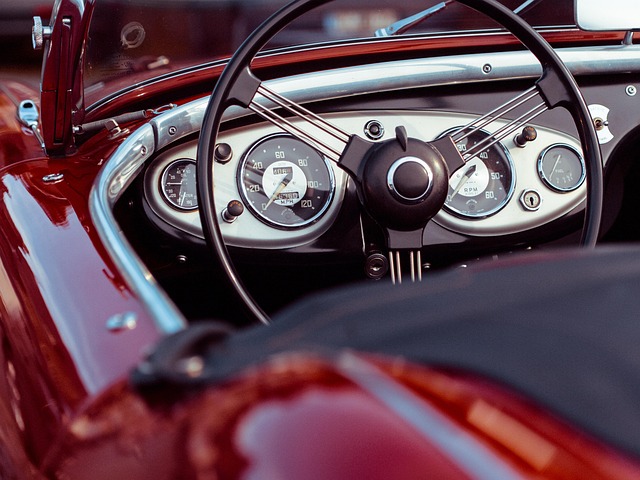

Emergency title loans Texas offer a unique opportunity for self-employed borrowers to access much-needed capital during financial emergencies. One significant advantage is the flexibility they provide, allowing individuals to use their vehicle’s equity as collateral. This option is particularly appealing to freelancers or business owners who may not have a stable employment history or traditional credit profiles, as it requires no hard credit checks. With just a few simple steps and qualifying documentation, self-employed borrowers can secure a cash advance quickly, making it an attractive solution for fast cash needs.

However, there are risks associated with these loans. The primary concern is the potential for high-interest rates and fees, which can quickly compound into substantial debt if not managed carefully. Additionally, borrowers must be prepared to make timely payments or risk losing their vehicle title. It’s essential to understand the loan requirements and terms thoroughly to avoid defaulting on the loan, as this could lead to legal repercussions and further financial strain. While emergency title loans Texas can provide a short-term fix, they should be considered a last resort due to the potential for long-term financial consequences.

Navigating the Application Process for Quick Funding

Navigating the application process for emergency title loans Texas can be a straightforward way to gain quick funding when facing financial emergencies. Self-employed borrowers often find traditional loan options limited, but this alternative offers a faster and more accessible route. The first step is to identify reputable lenders who specialize in title loans within Texas. Online research and checking reviews are essential to ensure the legitimacy and transparency of the lender.

Once you’ve found a suitable lender, the application process typically involves providing personal and financial information. This includes proof of identity, income verification, and vehicle details. The loan terms for emergency title loans Texas vary based on the amount borrowed and your ability to repay. Lenders will explain the terms clearly, ensuring you understand the repayment schedule and any associated fees. The title loan process is designed to be efficient, allowing self-employed individuals to access funds in a matter of hours, providing much-needed relief during challenging times.

Emergency Title Loans Texas can offer a lifeline for self-employed borrowers facing financial emergencies. While these loans provide quick funding, it’s crucial to weigh both benefits and risks. By understanding the application process and state requirements, you can make an informed decision, ensuring the best possible outcome in your time of need.