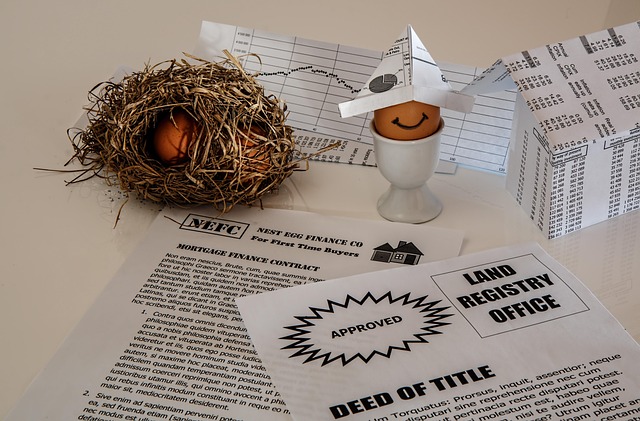

Texas Title Loan customer reviews are essential guides for borrowers seeking emergency funding, offering insights into interest rates, repayment terms, and customer service. By reading real experiences, individuals with bad credit can make informed decisions, navigate the market wisely, and select lenders that meet their unique needs during financial strain, ensuring positive impacts on their financial health.

In the competitive landscape of financial services, understanding consumer experiences is vital. Texas title loan customer reviews offer a wealth of insights for those considering short-term lending options. This article delves into how these reviews can guide decisions, uncovering valuable feedback on lenders’ performance. By weighing the pros and cons highlighted in customer narratives, borrowers can make informed choices, ensuring they navigate Texas title loan options with confidence and clarity.

- Uncovering Insights: Texas Title Loan Customer Reviews

- Weighing Pros and Cons: The Role of Reviews in Decision-Making

- Making Informed Choices: Navigating Texas Title Loan Options

Uncovering Insights: Texas Title Loan Customer Reviews

Texas Title Loan customer reviews offer a goldmine of insights for potential borrowers. These authentic accounts provide a transparent view of what it’s like to secure a loan, from application to repayment. By reading real-life experiences, individuals can uncover valuable lessons and make informed decisions when considering emergency funding options, such as boat title loans or other vehicle-backed financing.

These reviews shed light on various aspects crucial for borrowers, including the lending process, interest rates, and customer service. For instance, a satisfied customer might highlight an efficient Vehicle Inspection process, while another may focus on competitive interest rates. Uncovering these insights empowers individuals to navigate the market wisely and select lenders that align with their needs during times of financial strain.

Weighing Pros and Cons: The Role of Reviews in Decision-Making

When considering a Texas title loan, one of the most valuable resources available to guide your decision are customer reviews. These firsthand accounts offer a unique perspective by highlighting both the positive and negative experiences of individuals who have interacted with various lenders. Weighing these pros and cons is crucial in navigating the complex landscape of short-term financing options, especially for those with bad credit seeking quick approval.

Title loan customer reviews Texas can provide insights into aspects such as interest rates, repayment terms, customer service, and overall satisfaction. Prospective borrowers can learn about the transparency of lenders, their handling of secure loans, and how quickly they can secure funds. By carefully evaluating these reviews, you can make an informed choice that aligns with your financial needs, ensuring a more positive experience in your quest for a title loan.

Making Informed Choices: Navigating Texas Title Loan Options

When considering a Texas title loan, navigating the vast array of options can be daunting. This is where title loan customer reviews Texas come into play as a powerful tool for making informed choices. These reviews provide insights into the reliability and services offered by different lenders, helping borrowers understand what to expect. By reading real experiences from fellow customers, you can evaluate aspects like interest rates, loan terms, and the overall borrower experience.

Whether you’re looking for debt consolidation, considering Houston title loans or exploring options for truck title loans, customer reviews offer a unique perspective. They allow you to compare lenders side by side, identifying those with consistent positive feedback for their fair practices and transparent terms. This guidance is invaluable when making a decision that can impact your financial health.

Texas title loan customer reviews serve as a powerful tool for individuals seeking financial solutions. By weighing the insights and experiences shared in these reviews, borrowers can make informed decisions when navigating Texas title loan options. Understanding both the pros and cons outlined by real customers enables individuals to choose lenders that align with their needs, ensuring a positive borrowing experience. Leverage these reviews to guide your choices and avoid potential pitfalls, ultimately leading to smarter financial decisions.