Applying for car title loans in Lockhart, TX requires understanding lender criteria like vehicle ownership and repayment ability. Loan amounts are determined by your vehicle's value, with shorter terms and higher rates. Reputable lenders offer flexible options, even for bad credit. Compare loan offers strategically to secure favorable rates. Gather necessary documents and complete an accurate application for a clear, structured process.

“Unlocking Financial Freedom with Car Title Loans Lockhart TX: A Comprehensive Guide

Are you exploring car title loan options in Lockhart, Texas? This guide offers invaluable insights for securing the best rates on your next car title loan. From understanding local requirements to comparing offers and completing the application process step-by-step, we empower you with knowledge.

Dive into the world of Car Title Loans Lockhart TX and take control of your financial needs today.”

- Understanding Lockhart TX Car Title Loans Requirements

- Comparing Loan Offers for The Best Rates in Lockhart

- Securing Your Car Title Loan: A Step-by-Step Guide

Understanding Lockhart TX Car Title Loans Requirements

Applying for a car title loan in Lockhart, TX involves understanding certain requirements set by lenders to ensure responsible borrowing. These loans are secured against your vehicle’s title, meaning you need to own the vehicle outright or have substantial equity in it. Lenders will assess your vehicle’s value and its condition to determine the loan amount they’re willing to offer. Another crucial factor is your ability to repay. Unlike traditional loans, car title loans Lockhart TX often have shorter terms and higher interest rates, so having a steady income stream or a clear plan for repayment is essential.

When considering this option, keep in mind the various repayment options. Many lenders offer flexible payments tailored to borrowers’ needs, making it easier to manage expenses. Even those with bad credit loans can find suitable solutions as lenders focus more on the equity in your vehicle than your credit score. Understanding these requirements and exploring your repayment options will help you make an informed decision when applying for a car title loan in Lockhart, TX.

Comparing Loan Offers for The Best Rates in Lockhart

When exploring Car Title Loans Lockhart TX, comparing loan offers is an astute strategy to secure the best rates. This process involves meticulous research and evaluation of various lenders operating in the region. Start by identifying reputable institutions that specialize in car title loans. Online platforms and local directories can be excellent resources for this. Once you have a list, compare key factors such as interest rates, loan terms, and repayment conditions.

Many lenders in Lockhart TX offer competitive rates, but it’s crucial to understand the associated fees and charges. Some may advertise low-interest rates but include hidden costs that inflate the overall expense of the loan. Look for transparent lending practices and ensure you can comfortably manage the repayments without compromising your financial stability. Additionally, consider options like Houston Title Loans if traditional banking options or No Credit Check loans aren’t feasible, as these alternatives might provide more flexibility in certain situations.

Securing Your Car Title Loan: A Step-by-Step Guide

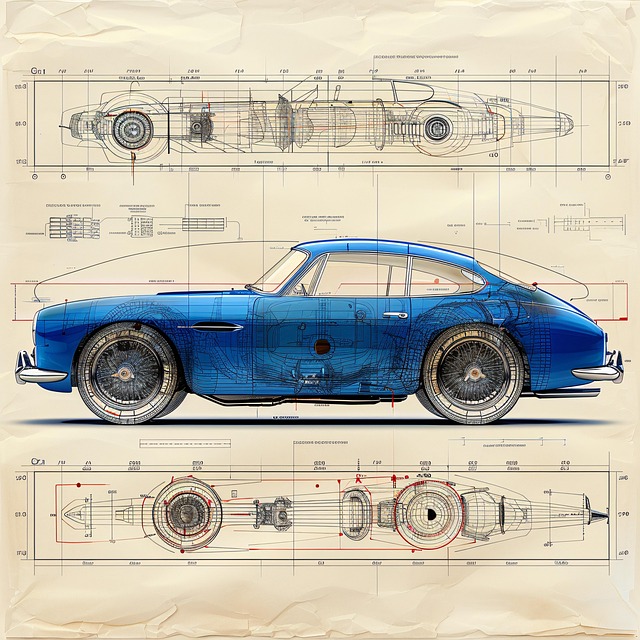

When considering a Car Title Loans Lockhart TX, understanding the process is key to securing fast cash and maintaining your vehicle. Here’s a step-by-step guide to help you navigate this option:

1. Assess Your Eligibility: Before applying, ensure you meet basic requirements like having a valid driver’s license, a clear car title in your name, and proof of insurance. The lender will also verify your income to determine if you can afford the flexible payments.

2. Choose a Reputable Lender: Not all lenders are created equal. Research and select a company that offers transparent terms and competitive interest rates. Compare different options to find the best fit for your needs, focusing on the Title Loan Process and ensuring they provide a smooth and secure transaction.

3. Provide Required Documents: Gather essential papers such as your car title, government-issued ID, income proof, and insurance documents. These are crucial for verifying your identity and ownership of the vehicle during the fast cash process.

4. Complete the Application: Fill out the loan application form accurately and honestly. Provide detailed information about your vehicle’s make, model, year, and condition. A clear and accurate application speeds up the approval process.

5. Sign the Agreement: After approval, review the loan agreement carefully. Understand the interest rates, repayment schedule, and any associated fees. Once you’re satisfied with the terms, sign the agreement to finalize your Car Title Loans Lockhart TX.

When considering car title loans in Lockhart, TX, understanding the process and comparing offers are key to securing the best rates. By thoroughly reviewing the requirements and following a step-by-step guide for application, you can ensure a smooth loan acquisition experience. Remember, your vehicle’s value is the foundation of this short-term funding solution, so take time to compare lenders and choose a reputable option that meets your financial needs.