A Car title loan voluntary surrender involves returning your vehicle to repay debt, requiring negotiations with lenders. Understand loan terms, retain ownership, and explore alternatives like refinancing or bad credit lenders. Clear communication, budget planning, and realistic goals aid in securing favorable terms, potentially leading to same-day funding.

Negotiating terms before a car title loan voluntary surrender is a crucial step in ensuring a fair and favorable outcome. This article guides you through the process, from understanding the concept of a car title loan voluntary surrender to preparing for negotiations and agreeing on terms. By mastering these strategies, you’ll be well-equipped to navigate this challenging situation, protecting your rights while achieving the best possible terms.

- Understanding Car Title Loan Voluntary Surrender

- Preparing for Negotiation: Rights and Options

- Strategies for Successful Term Agreeing

Understanding Car Title Loan Voluntary Surrender

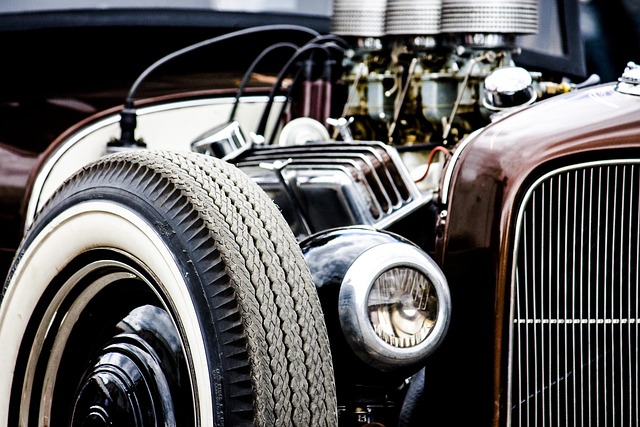

When considering a Car Title Loan Voluntary Surrender, it’s crucial to grasp the implications and process involved. This option allows borrowers to give back their vehicle to the lender in exchange for clearing outstanding loan debt. It’s not a default, but rather a strategic move to resolve financial obligations tied to a secured car title loan. The title loan process for voluntary surrender typically involves negotiating terms with the lender, ensuring you understand the final repayment amount and conditions.

During negotiations, it’s beneficial to explore loan eligibility criteria and discuss keeping your vehicle as an alternative solution. Lenders might offer more favorable terms or repayment plans if you opt to retain ownership. Understanding these options can help you make an informed decision while navigating the car title loan voluntary surrender process effectively.

Preparing for Negotiation: Rights and Options

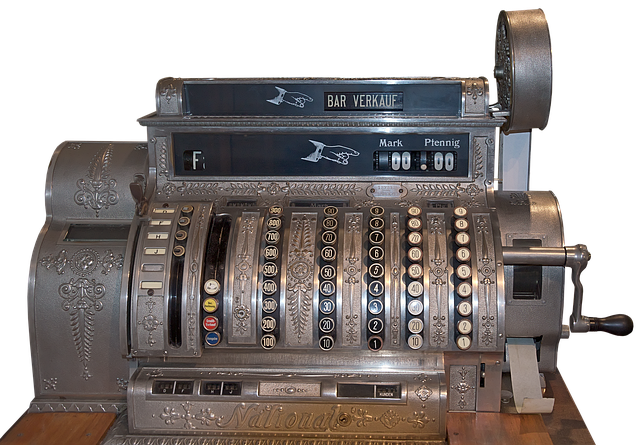

Before entering into negotiations for a Car title loan voluntary surrender, it’s crucial to understand your rights and available options. This preparation is key to ensuring a fair and beneficial outcome during the process. Familiarize yourself with the terms and conditions of your loan agreement, as these will dictate what you can expect in terms of repayment, penalties, and potential consequences for defaulting.

Know that when you’re considering a voluntary surrender, you still hold some power. You can negotiate interest rates, extension periods, or even the amount of the outstanding balance. Exploring alternatives like refinancing or negotiating with lenders who specialize in bad credit loans using your vehicle equity as collateral could also be viable options. This proactive approach allows you to make informed decisions and navigate the negotiation process with confidence.

Strategies for Successful Term Agreeing

When negotiating terms for a Car title loan voluntary surrender, clarity and communication are key. Begin by thoroughly understanding your financial situation to set realistic goals. Know exactly what you can afford in monthly payments and interest rates, factoring in potential hidden fees. This knowledge will empower you during discussions with lenders, ensuring you get the best possible deal.

Consider offering a clear repayment plan that aligns with your budget. Be open to negotiating loan requirements, such as extending the loan term to lower monthly payments or discussing reduced interest rates. Remember, the goal is to find a solution that allows you to regain control of your vehicle while managing your debt effectively. This collaborative approach benefits both parties and could lead to same-day funding if both sides are agreeable.

When considering a car title loan voluntary surrender, being prepared and understanding your rights is crucial. By familiarizing yourself with the process, knowing your options, and employing effective negotiation strategies, you can achieve a mutually beneficial agreement. Remember, clear communication and a thorough understanding of the terms are key to navigating this financial decision successfully.