Car title loans Cedar Hill TX offer immediate financial aid secured by your vehicle, ideal for unexpected costs like medical emergencies or home repairs. After providing proof of ownership and vehicle details, approved borrowers receive funds within 24 hours, repaying the loan with interest over a set period, risking vehicle loss for missed payments.

Car title loans Cedar Hill TX offer a reliable solution for unexpected expenses, providing fast access to cash using your vehicle’s title as collateral. In times of financial strain, these loans can bridge gaps, covering urgent costs without traditional credit checks. Understanding this process is key to leveraging its benefits. This article guides you through accessing car title loans Cedar Hill TX effectively, highlighting the advantages and steps involved, ensuring a smooth experience during challenging times.

- Understanding Car Title Loans Cedar Hill TX

- Benefits for Unexpected Expenses

- How to Access These Loans Effectively

Understanding Car Title Loans Cedar Hill TX

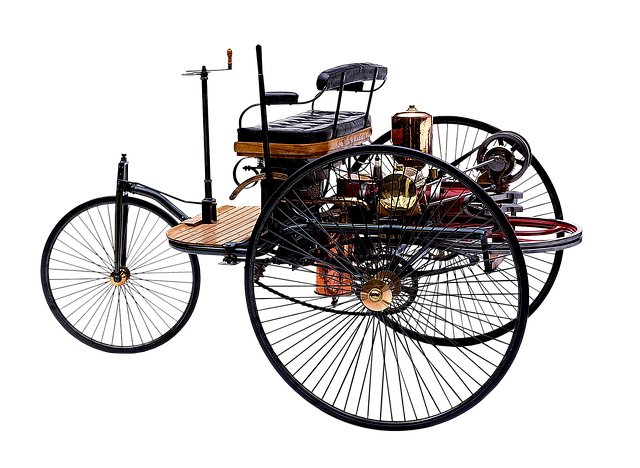

Car title loans Cedar Hill TX are a type of secured loan that uses your vehicle’s ownership as collateral. This means lenders offer emergency funding to borrowers based on the value of their car. Unlike traditional loans, which often require strict credit checks and lengthy application processes, car title loans provide a quicker alternative for those in need of immediate financial assistance. The process involves providing the lender with your vehicle’s registration and proof of insurance, after which they’ll assess its worth to determine the loan amount.

This type of loan is ideal for individuals facing unexpected expenses like medical emergencies, home repairs, or urgent travel needs. With a car title loan, borrowers can access funds relatively fast, often within 24 hours of approval. The vehicle remains in the borrower’s possession during the loan period, and once the debt is repaid, the title is returned. It’s crucial to understand the terms and conditions of such loans to ensure they’re suitable for your financial situation, especially as secured loans carry the risk of losing your vehicle if payments are missed.

Benefits for Unexpected Expenses

When faced with unexpected expenses, Car Title Loans Cedar Hill TX offer a swift and practical solution. These loans are designed to provide financial assistance during urgent times, ensuring individuals can cover immediate costs without delay. The process is straightforward; borrowers use their vehicle’s title as collateral, allowing them to access a loan amount based on the car’s value. This alternative financing option is particularly beneficial for those in need of quick cash and who may not qualify for traditional bank loans or credit cards.

By opting for Car Title Loans Cedar Hill TX, individuals can benefit from flexible payment plans, tailored to their financial comfort zones. Unlike other loan types, these loans do not impose strict repayment terms, making them ideal for managing unforeseen events like medical emergencies, home repairs, or urgent travel needs. With San Antonio Loans readily available, borrowers can focus on regaining stability and finding solutions rather than worrying about immediate debt repayment.

How to Access These Loans Effectively

Accessing Car Title Loans Cedar Hill TX is a straightforward process designed to help individuals navigate unexpected expenses with ease. The first step involves assessing your loan eligibility, which typically requires having a valid driver’s license and proof of vehicle ownership. Lenders will evaluate your vehicle’s equity, focusing on its make, model, year, and overall condition. This assessment determines the loan amount you can secure based on your vehicle’s value.

Once you’ve established your eligibility, you can apply for a car title loan in Cedar Hill TX either online or through a local lender. The application process is generally quick and requires providing personal information, details about your vehicle, and verifying your income. Upon approval, lenders will guide you through the next steps, which include signing the necessary documents and handing over your vehicle’s title as collateral until the loan is repaid. This ensures a secure transaction for both parties, allowing individuals to access much-needed funds quickly during times of unexpected expenses, such as medical emergencies or sudden repairs, while considering Dallas Title Loans as an option.

Car title loans Cedar Hill TX offer a reliable solution for unexpected financial burdens, providing quick access to cash without the usual stringent requirements. By leveraging the equity in your vehicle, these loans provide a hassle-free way to cover urgent expenses and can be easily repaid over time. Understanding how car title loans work and effectively accessing them can help individuals navigate through challenging financial situations with confidence and peace of mind.