Online title loan applications provide a swift, convenient, and accessible way for individuals to gain urgent funding by leveraging their vehicle's equity. The process involves digitizing and submitting vehicle and personal information, with lenders assessing the collateral's value to determine the loan amount. This modern approach streamlines documentation, caters to borrowers with less-than-perfect credit histories, and allows applicants to complete the application from home, eliminating extensive paperwork and physical office visits. After approval, funds are often transferred within a few business days, while borrowers retain ownership of their vehicles as collateral.

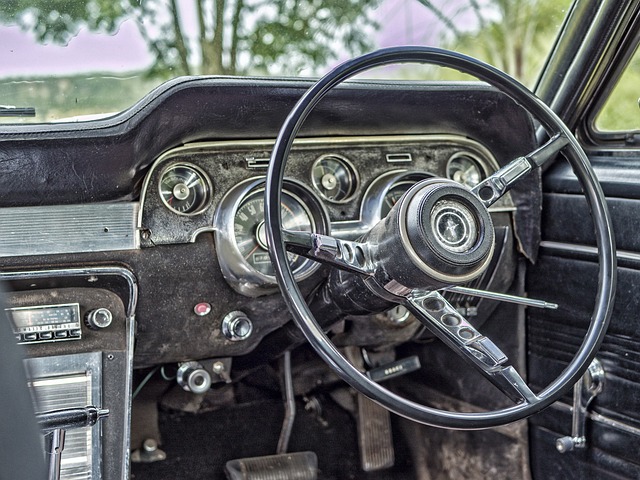

In today’s digital age, securing a loan for your beloved classic or older car model just got easier. Exploring the benefits of an online title loan application opens doors to swift funding without compromising on the value of your vehicle. This article delves into the process, highlighting the advantages and simplicity of using digital platforms for obtaining loans based on car titles. Understanding this option can empower car owners to access much-needed capital quickly and conveniently.

- Understanding Online Title Loan Applications

- Benefits of Using an Online Platform for Older Car Models

- The Process: Applying for a Title Loan Online

Understanding Online Title Loan Applications

Online title loan applications have become a popular and convenient way for individuals to access quick funding by leveraging their vehicle equity. This process involves digitally submitting information about your vehicle, its make, model, year, and current condition, along with personal details. The lender then assesses the value of your vehicle collateral to determine the loan amount you may qualify for.

Unlike traditional loan applications that require extensive paperwork, online title loans streamline the process, making it accessible for many older car owners. By using an online platform, you can apply from the comfort of your home, saving time and effort. Additionally, loan refinancing options are available for those who wish to pay off their existing loan and secure a new one with potentially better terms, utilizing their vehicle collateral as security.

Benefits of Using an Online Platform for Older Car Models

Applying for a loan through an online platform offers several advantages when it comes to financing your older car model. One of the key benefits is accessibility; with just a few clicks, you can complete the entire application process from the comfort of your home. This is especially convenient for those who might have limited mobility or live in remote areas, making traditional loan applications less feasible. Online platforms also streamline the documentation process, requiring only digital copies of necessary papers, which further saves time and effort.

Additionally, these platforms often cater to a wide range of borrowers, including those with less-than-perfect credit histories. Many online lenders specialize in providing bad credit loans, such as semi-truck loans, without the stringent credit checks that traditional banks might enforce. This makes it possible for more individuals to gain access to much-needed funds, ensuring they can keep their older vehicles running smoothly and avoid costly repairs out of pocket.

The Process: Applying for a Title Loan Online

Applying for an online title loan is a straightforward process that can be completed from the comfort of your home. It’s as simple as providing your vehicle’s details, such as its make, model, and year, along with some personal information like your name, address, and contact details. Once submitted, these details are evaluated to assess the vehicle’s value, which determines the loan amount offered. The beauty of this method lies in its efficiency; no need for extensive paperwork or lengthy visits to physical offices.

The online application process is designed to be user-friendly, ensuring a smooth experience for borrowers. After applying, you’ll be contacted by a lender who will guide you through the next steps, which may include verifying your information and negotiating terms. Should an agreement be reached, the funds can often be transferred into your account within a few business days, while you keep your vehicle as collateral throughout the loan period. This streamlined approach to borrowing offers both convenience and flexibility, especially for those with less-than-new vehicles, allowing them to access much-needed funds without compromising their vehicle ownership.

Online title loan applications offer a convenient and efficient way to secure funding for older car models, providing an alternative financing option for vehicle owners. By streamlining the process, these digital platforms make it faster and easier to access capital, catering to the needs of those with less-modern vehicles that traditional lenders might overlook. This modern approach to borrowing ensures that car owners can maintain their transportation while navigating financial challenges, making online title loan applications a practical choice in today’s digital era.