Pharr title loans provide quick cash using vehicle titles as collateral, but they carry risks. High-interest rates, strict repayment terms, and potential debt cycles are drawbacks. Borrowers should carefully compare Pharr lenders' eligibility criteria and terms to protect their financial health. Exploring alternatives like Houston title loans and considering responsible debt consolidation strategies is advisable.

“Uncovering the intricacies of Pharr title loans is essential for prospective borrowers navigating this financial instrument. This article provides a comprehensive overview, delving into the mechanics and potential risks associated with these loans. From understanding the collateral-based nature to recognizing pitfalls like high-interest rates and repayment penalties, you’ll gain insights to make informed decisions. Additionally, we offer strategies to mitigate harm, ensuring safe loan utilization in the competitive Pharr title loans market.”

- Understanding Pharr Title Loans: A Comprehensive Overview

- Potential Risks and Pitfalls: What Borrowers Need to Know

- Mitigating Harm: Strategies for Safe Loan Utilization

Understanding Pharr Title Loans: A Comprehensive Overview

Pharr title loans are a type of secured lending option where borrowers use their vehicle’s title as collateral for a loan. This innovative financial solution allows individuals to access cash quickly, often with less stringent requirements compared to traditional bank loans. However, it’s crucial to understand that this convenience comes with inherent risks. Borrowers must be fully aware of the terms and conditions before pledging their vehicle’s title.

Unlike Dallas Title Loans or Car Title Loans, where lenders primarily assess the value of the vehicle, Pharr title loans focus on the borrower’s ability to repay. While this may seem less restrictive, it means borrowers are taking on a personal responsibility that could impact their financial stability if they default. The process involves signing over the vehicle’s title to the lender until the loan is repaid, which can extend for several years. This should prompt careful consideration, especially when comparing Pharr title loans with other short-term financing options.

Potential Risks and Pitfalls: What Borrowers Need to Know

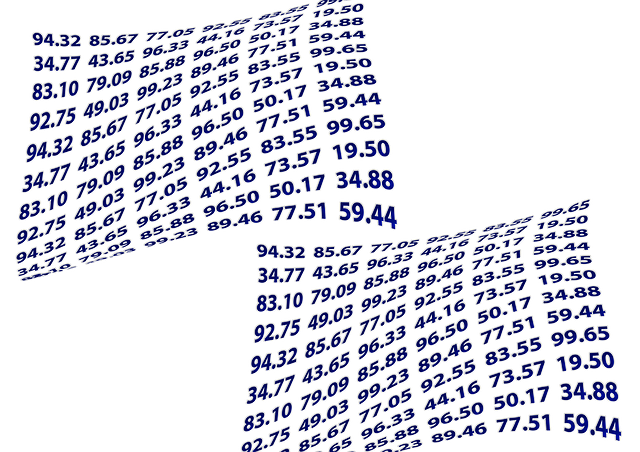

When considering Pharr title loans, borrowers must be fully aware of potential risks and pitfalls to make an informed decision. While these short-term loans can offer quick access to cash, they often come with high-interest rates and stringent repayment terms. Lenders in Pharr, like elsewhere, are legally allowed to charge significant fees, which can quickly add up if borrowers fail to repay the loan on time. This can lead to a cycle of debt, where individuals end up paying more in interest than the original loan amount.

Moreover, loan eligibility criteria vary among lenders. In Fort Worth loans, for instance, requirements like a clear vehicle title, steady income, and valid identification are common. However, some less reputable lenders might have absurd demands or hide hidden clauses that can later cause problems. It’s crucial to compare loan requirements and terms from different providers to choose the most suitable option without compromising your financial health.

Mitigating Harm: Strategies for Safe Loan Utilization

When considering Pharr title loans, it’s crucial to approach them with a strategic mindset to mitigate potential harm and ensure financial safety. These loans, secured by the title of your vehicle, can be a convenient solution for immediate cash needs. However, like any borrowing option, they come with risks, especially for borrowers with bad credit or those seeking debt consolidation. To safeguard yourself, it’s essential to understand the loan terms, including interest rates and repayment periods. Transparency about these factors enables informed decision-making.

One strategy for safe loan utilization is to compare offers from various lenders, not just focusing on Pharr title loans but also exploring alternatives like Houston title loans or bad credit loans that might offer more favorable conditions. Debt consolidation could be another viable option if managed responsibly. By understanding your financial goals and choosing a suitable loan type, you can effectively navigate the process, minimizing risks and ensuring a positive outcome.

When considering Pharr title loans, it’s crucial to balance the potential benefits with the risks outlined in this article. By understanding the intricacies of these loans and implementing safe utilization strategies, borrowers can make informed decisions while minimizing the associated dangers. Remember, knowledge is power when navigating financial commitments.